These instructions are the final conclusion to the post

UPS/FedEx Brokerage Fees – avoid scam

- You ordered some goods from US into Canada by UPS and they are on the way

- Going to import some goods from US into Canada by UPS

- Already received your package and did not pay anything to the driver. It means that UPS will send you brokerage fees invoice several weeks/months later, or send information right to collection agency

- Driver showed you collect-on-delivery (C.O.D.) invoice which was ~half of the item’s price and you refused to pay at the door

There are two conditions necessary for the procedure of self clearance at Canada customs:

- Your shipment’s value for duty is less than $1600 CAD

- You have one of the local CBSA (Canada customs) offices nearby. You may find the list of offices across Canada here: Directory of CBSA Offices where Courier Low Value Shipments Program clearances are performed.

Here is the procedure of self clearing (confirmed by CBSA main office and proven many times in practice):

- Wait while your package comes to the local UPS warehouse (where you live). You will see status in the shipment’s tracking information on UPS website. If you don’t track, so just wait for the first delivery attempt and refuse to pay at the door

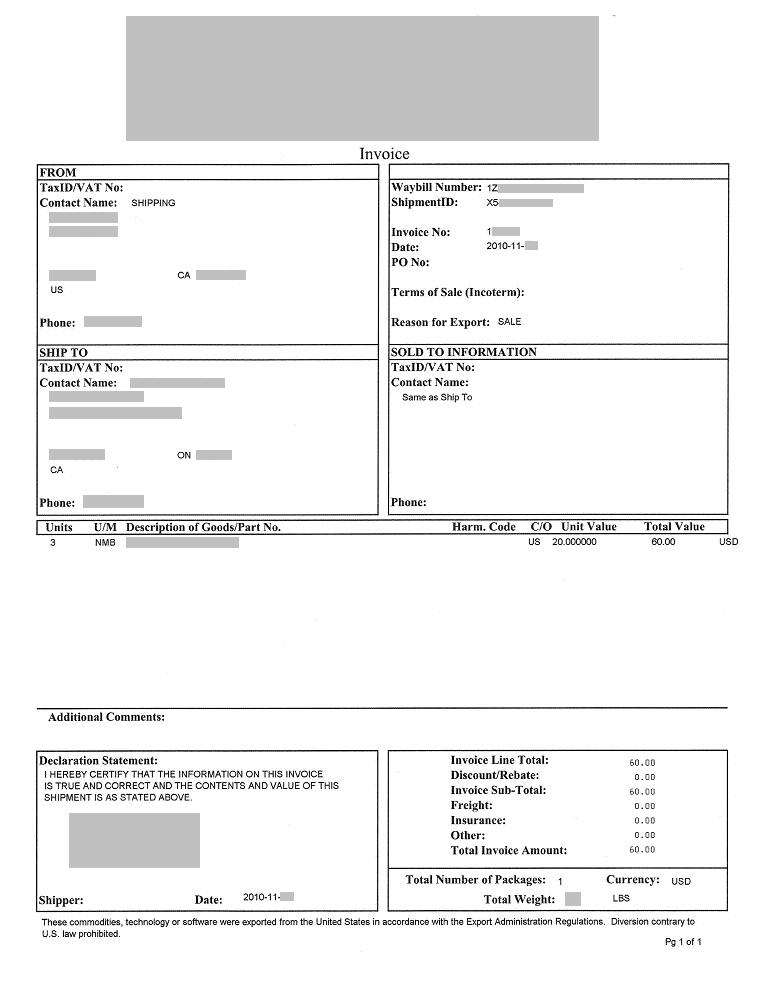

- Call UPS at toll free number 1-800-742-5877, press “3” to be connected to the billing department (or other prompt by the system), and ask customer service representative to send you shipment’s invoice. Some of the representatives call it commercial invoice. Just ask for “commercial invoice” associated with your tracking number. They can send it by e-mail or fax. Please make sure they got your address correctly – ask to spell it back. They will send it right away in .zip archive to your e-mail. Shipment’s invoice has the Unique Shipment Identifier Number needed by CBSA as well. This is how it looks like (click on image to enlarge):

- Find out what is the address of your local UPS warehouse where your package is being held. Call and ask UPS if you can’t figure out. CBSA may ask for this information during self clear. For GTA (if you see “Concord” in the tracking information) the address as of Nov. 2010 is:

UPS Center

2900 Steels ave. W,

Concord, ON, L4K 3S2

phone: 800-742-5877

- Take your shipment’s invoice, address of UPS warehouse, money to pay taxes and photo ID to the nearest CBSA office. Please take the reply from main CBSA office with instructions about self clear process for the case if officers in your local office are not aware with the proper procedure. You may find their reply at UPS/FedEx Brokerage Fees – avoid scam – section almost at the bottom of the post, just between solid grey lines. Last time I visited CBSA office in Brampton at the following address:

CBSA Brampton: office 480

197 Country Court Blvd.,

Brampton, ON, L6W 4P3

office hours: 8:30 – 16:30, Mon – Fri

!! – recently address has been changed to:

5425 Dixie Rd.

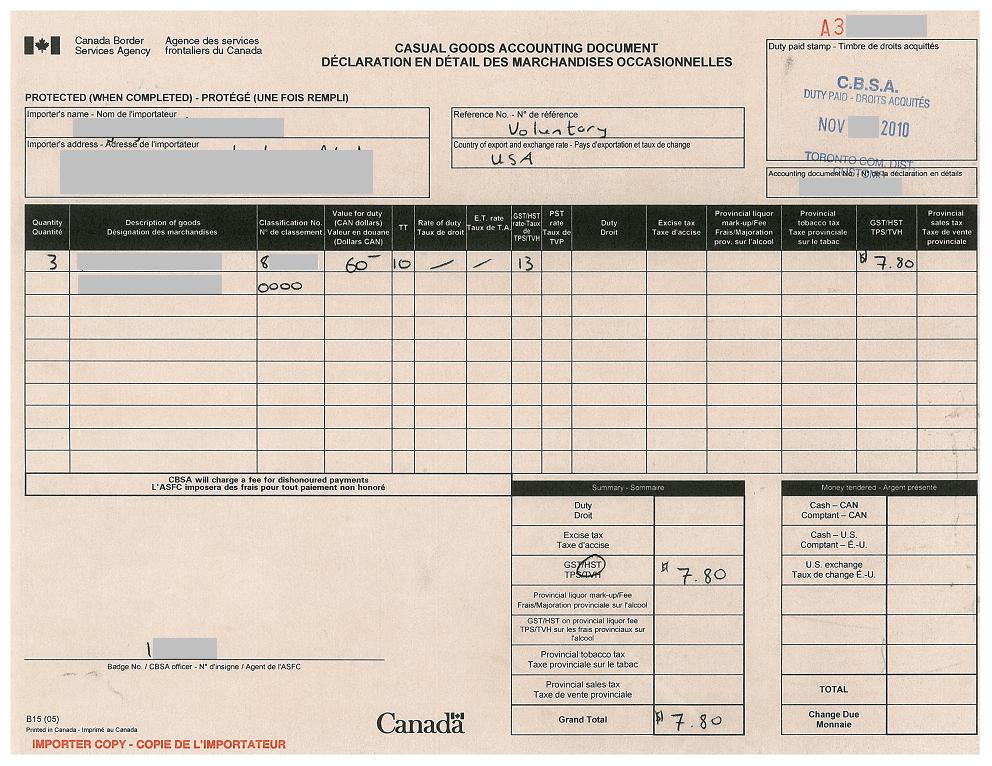

- Present your shipment’s invoice to customs officer and he will do clearance for you. After paying applicable taxes and duties to the cashier you will be provided with CBSA B15 form – Casual Goods Accounting Document, which confirms that you paid all the taxes to Canada customs. B15 form looks like this:

- Call UPS and ask how to provide them with B15 form (proof that you paid taxes) in order to waive brokerage fee invoice. They will give you fax number. Please make sure that you put your tracking number of the cover page. As of Nov 2010 CBSA B15 form should be sent here:

UPS Brokerage Department

fax number: 1-770-990-1724

- After that UPS Brokerage Department should process your B15 form and waive C.O.D. charges. It may take 1-5 days. You may also try to speed up the process by calling UPS and informing them that you already paid taxes to CBSA and sent receipt to the brokerage department. Ask UPS to schedule delivery.

You are done!

I have not done it with FedEx or other couriers, but procedure should be very similar.

I can’t stand UPS because of these b.s brokerage fees. 50 percent of my item cost, rediculous. These articles are incredible and I was quite excited to finally think I was going to get around the brokerage but I live in PEI. The CBSA offices here don’t offer the Courier Low Value Shipment Program and it’s not worth the travel to go to N.B or N.S to avoid the fee. Do the CBSA offices have the ability for me to clear brokerage even if they don’t offer that program…..and is there any other way to get around paying the brokerage fee if not?

Hi Trueler,

can you send me official because rep on the phone didn’t agree on the way to self-clear and i need them to change their mind to talk about doing self-clear at a place where they don’t have CLVS in place. Thanks

Thanks for update Colin!

Hey Trueler,

I went back to the CBSA this morning to try again. The Officer there, another one, who was awesome, explained that they were trying to figure out all day yesterday, and did after some research. The process was painless, and enjoyable. They have a very pleasant staff up there. Got my B15 and sent to UPS, they have dropped the balance, and I’m not waiting for my local warehouse to be notified so I can pick it up. Thanks for your help.

Colin

Hi HA,

I was told the same info once. Just try another one. Ask for supervisor if the representative refuses to give you commercial invoice. Just tell them that you need it for your records, don’t tell about self-clearance.

UPS gives incorrect information that it can be available only in 30 days.

Regards,

Trueler

I just called UPS and asked for the commercial invoice. They told me that they can’t give it out before 30 days and don’t provide it to the receiver of the shipments.

Thanks Trueler,

Your the best. I’ll be sure to let you know.

Colin

Hi Colin,

I have send the original reply from CBSA to your e-mail. It is pretty much the same as in the article. It is kind of “new” process because neither UPS nor local CBSA offices used it before. However, it is described in LVS documents and CBSA in Ottawa confirmed the process as well. So, it is the matter of time and importers’ effort when UPS and local CBSA offices will start to follow it.

Please let us know when you heard back from the officer who took your name and number and promised to research it.

Thanks!

Trueler

Hey there Treuler,

Can you email me the orig reply from CBSA, they don’t accept printout web pages here in Labrador. The officer here hasn’t ever heard of this process. Took my name and number so he can “research” it. Thanks

Colin

If customs office is not far from you, it is worth self clearing. It should not matter where it comes from: UK or US. It is the same HST depending on province you live in + UPS brokerage fees. The procedure should work as well.

Hi Trueler,

Thanks for the quick reply. It was a free standard UPS shipping offered by the website that I purchased from. I assume I will have to pay for the brokerage fees as the shipping status described by UPS is “Package data processed by brokerage. Waiting for clearance”.

Last time I was able to avoid the brokerage fee because I chose the UPS express which included a Free brokerage. But this time I will likely have to pay $27 according to the UPS brokerage rates listed on their web http://www.ups.com/content/ca/en/shipping/cost/zones/customs_clearance.html

So I am deciding if I should do the self clearing to avoid the $27 brokerage fee.

Hi Johnny,

Most likely all the fees are already included in the delivery price because it is air delivery I guess. Right?

Thanks,

Trueler

Hi Trueler,

My package is on its way from UK to Richmond BC, just wondering if the same procedures will work if the package is sent from UK?

Thanks

Hi Cayla,

It is up to customs. Sorry, I can’t guarantee this, because I did not inquire CBSA for this information. It is better to contact Canada Customs to make sure, or just try to self clear if customs office is not far from you.

Thank you.

Trueler

I was wondering if you can clear customs if your name is not on the package. My bf bought a gift for me and sent it to my addy, but he used his name intead of mine. He doesn’t live with me so his ID would have a different addy. Can I clear customs for this package, which has my bf’s name but my addy? Thanks a lot for this article!

I get what you are saying. Lucky for me they let it slide through to my local depot.

So keep my mouth shut until it arrives at my door and then say I “dispute COD charges”. Then call up ups and “self clear”. Sound right?

In Winnipeg it was much easier since it IS the port of entry. They would call me once it arrived. I would goto UPS depot and they would hand me the paperwork, I take to csba office on Wellington, pay tax. Drive back and get item. This living away from port of entry is a real pain.

Thank you Joseph! Your detailed experience is indeed helpful.

From my experience (and others), if you call UPS ahead of time, they just stop the shipment at the border until you let them process and “broker” it. So, my suggestion is to wait until shipment comes on its way from the port of entry to the local UPS warehouse.

Looks like in Joseph’s case UPS reps were aware of the proper self-clear procedure, and Joseph clearly insisted on his rights!

Thanks,

Trueler

My experience.

I ordered home theatre speakers from US. Shipping to Canada was only $30 UPS. I went for it.

I am VERY familiar with the UPS scam, I used to live in Winnipeg and popped over to Pembina, ND.

Now I am in Victoria, BC and have to figure out different ways to get my American fix.

Anyways, I was prepared for the UPS brokerage work. So I called mid – transit and explained I will be doing a ‘self clearing’.

The op said to call back when it hits Canada. So I did that. This op says the same story.

1. You have to self clear at point of entry (richmond, bc) (2 hr ferry $140, and a day shot)

I replied ‘sorry, that is untrue’ I will be contacting customs canada and clearing my own parcel. She put me on hold and then said ” Ok, you have to find a csba (canada customs office) and deal with them, like they are located in Ottawa only. Anyways I have 2 to choose from here the Airport or Downtown. I went to the Airport, they collected my HST 12%, $24 no duty. Even the customs agent knew about the UPS scam, he got stung once, only once.

Oh yeah, the UPS op told me that CSBA will be faxing the documents to UPS, that is untrue.

What happened, that pissed me off, but in the long run possibly saved me is that they ignored ALL my calls. Assigned a UPS broker, and prepared a bill for $81. This bill along with the parcel showed up at my house while I was at the csba office. Thankfully, no one was at my house, so it went back to the VICTORIA DEPOT located on 4254 Commerce circle.

Now I read on some website like this that UPS does NOT have a depot in Victoria and they contract deliveries to Vancouver Island thru Purolator so my parcel would be in Richmond, BC. Their Vancouver point of entry depot.

The problem would have arose if the CSBA agent wanted to inspect the parcel. Now would the Victoria agent call the Vancouver office and goto Richmond, BC to check? Maybe.

But I have learned that the easiest safest way is to call mid transit and tell them you will self clear, so they have it in their notes.

Then wait for the parcel to arrive, then refuse delivery due to a “COD dispute”. They will hold it the nearest depot, which is Victoria, plus there is no 5 day limit with a COD dispute.

Then call up UPS 1800 option 4, then 2 and tell you were always going to self clear and you want to hold parcel at depot until COD dispute is resolved. When I did the op told it could take 8 to 10 biz days. It took 1 day. Be sure they give you the fax number you can send the documents to! I was given a Fredericton Tele Services number. You basically want the RERATE department.

Then goto csba office with print out of email receipt you got when you bought online and tracking number. If you can get the agent put the tracking number in the REF box in the top right corner of B15 form. If not write it in yourself.

Then fax the B15 form to UPS with A TRACKING NUMBER. I called 24hrs later to make sure they got it. That was on FRI JAN14, by today JAN17 it was rerated from $81 to $0.00 and waiting for pick up at depot (they even would have delivered it too).

I hope I was clear in this post.

Key words to remember when talking to UPS are:

“SELF CLEAR”

“COD Dispute”

“RERATE”

UPS WANTED $81.00

CSBA Wanted $24.00

I PAID $24.00

SAVED $57

Another tip be sure to ONLY pay Canadian taxes on the item cost. NOT on shipping charges. Csba agents know this, but sometimes look at total number at bottom of invoice and once the B15 is printed it is tuff to have them redo it. So I always highlight and total the Item prices. They can charge you tax on US tax, so beware where you buy from. They don’t do that for States that allow tax rebates like North Dakota does with Manitoba.

Canuck Power!

You are welcome René.

Thanks a lot for sharing your experience!

Trueler

UPDATE: Kelowna International Airport WORKED!!

I met with the fine gentlemen at the CBSA office at the Kelowna International Airport, and they were able to complete the whole process in under 15 minutes! (I know this, because I was able to park for free… you pay for more than 15 minutes of parking there)

If anyone needs to self-clear a package, and you are quite some distance from an “offical” border office, you may want to phone up or visit any other international point of entry to see if they can do the job as well. It worked for me here at the Kelowna International Airport, and it may work for you as well, YMMV.

Suffice it to say, however, the service I received at each office was light-years apart. The Osoyoos office was arrogant, condescending and downright hostile, whereas Keith and Don at the Kelowna Airport were very friendly, understanding and patient. They allowed me to explain the situation, took the time to explain why Osoyoos may have never heard of the correct method, and even gave additional suggestions on how to better reduce cross-border *shipping* fees (what you pay the seller, not the brokerage fees) — there are informal depots just into the U.S. side of the border that can hold a package for a few days (and a few dollars), allowing a very expensive International shipment to end up being a relatively inexpensive domestic shipment. While I won’t be doing that for books and other small items, I might just do that with the next pair of servers I purchase.

Trueler, I want to thank you for this invaluable resource, and your assistance in helping me overcome my difficulties.

Hi René,

When you talk to CBSA guys, please refer not to “some website”, but to the official reply from CBSA with instructions how to self clear. All offices and courier companies must follow it. I have forwarded that original reply to your e-mail address if you think it may be helpful.

Regards,

Trueler

NEWS FLASH:

I just managed to get in contact with the Border Services office at the Kelowna Airport, and it appears that they may be able to help me self-clear!! They will be socked in with charter flights all weekend (they were so polite, patient and understanding that I simply asked them what the most convenient time for *them* would be), so I will be meeting with them at 0800hrs Monday morning. While our terminology differed, it appears that I do have the documentation that they require to complete the job.

Wow. What a difference 200km makes! Osoyoos was arrogant, condescending and patronizing, refusing to even look at the explanations I had printed out (“We don’t need to look at some website, we know how to do our own jobs”); whereas Kelowna Airport was polite, patient and very willing to examine anything I would bring in, in order to see if they can help me or not (willingness to learn/investigate! AWESOME!).

I will keep you updated on my progress.

Thank you, Trueler, but the really big problem is that they will probably refuse to read and/or recognize what I have printed out. Their attitude was, “we don’t care what some web site says, we know how to do our own jobs”.

If I was to show them anything that would actually catch their attention, it would probably have to be an actual eMail directly from CBSA (complete with headers and the sig/name of someone that can confirm for them that this is legit) or a letter on an official letterhead. Otherwise, my 4hr round trip will probably be completely wasted (2hrs down, 2hrs back).

I will try eMailing the address you have above. I will explain my situation and attempt to obtain truly official documentation that they simply cannot ignore.

Hi René,

You don’t have to print entire articles. Just reply from CBSA (from CBSA-ASFC@canada.gc.ca) with instructions – it is at http://trueler.com/2010/09/13/ups-brokerage-fees-total-scam-fraud-cheating-avoid-it/

It is signed by

Canada Border Services Agency

Ottawa, Ontario

K1A 0L8

Government of Canada – Gouvernement du Canada

They must follow these instructions.

Self clearance can be done in any office listed on that link. To inquire about other offices please call CBSA.

Regards,

Trueler

It turns out that Osoyoos in BC doesn’t recognize these web pages as being legitimate, and refuses to allow the recognition of importing for anything that is not physically present. I did a 2hr trip from Kelowna, BC down to Osoyoos only to be told that because the merchandise I ordered was in a UPS warehouse in Kelowna and not physically present, they could not work with me. Even when I waved the commercial invoice in their faces and told them that it was proof that one of their co-workers already verified the shipment in Richmond, they refused to accept that document as proof that it had cleared customs.

I showed them this article, but had failed to print out the previous one and did not have it on me. However, I suspect that they will also refuse to accept the previous article as well (as proof), since they refused to even look at my printouts for this article. Real arseholes, the lot of them. The first person was a “I have worked here for 15 years and I know how things work” person, and his supervisor was an improvement only in the fact that he was at least polite in his disdain and arrogance.

Unfortunately, I did not get their names. By the time I had calmed down, I was halfway back to Kelowna.

So I wouldn’t mind a few pieces of info.

I wouldn’t mind an e-mail contact at CBSA who could email me back with an actual statement that I can print off when I head back down there. If I am to bludgeon them over the head with proof, I want a 50-lb sledgehammer, not a 0.0005-lb NERF hammer. Having an “official” e-mail statement, complete with an email address (and hopefully, direct phone number) that they can confirm with, would most likely be my most effective ammunition against their ignorance.

I was wondering if it is possible to self-clear at any Canadian Customs office, not just one at a border. Kelowna has an International Airport, so the airport itself also has a Customs office, just not one listed in the Directory link at the very top of this page. Can any official Customs office do self-clearing, or only those listed on that link?

What other information (precise CBSA website links, etc.) can I use, especially if they refuse to consider any non-CBSA based information (like this website)?

If the Kelowna Airport customs is not able to do self-clearing, I would love to be able to head down Monday morning and very politely “educate†them as to their inability to do their own jobs.

Hi jim,

Did you show them instructions how to self clear? Those provided by CBSA which I’ve posted here. How did they react?

Only in the case if you showed those instructions to the officers and they did not want to follow them, you may file a complaint as LVSinfo suggested in comments here:

UPS/FedEx Brokerage Fee – avoid scam (Canada)

There is a mailing address of the minister in charge of the CBSA.

Thanks!

Trueler

yes i did about form B15 he said again you need the manifest for it, he didn’t want to help me he said this office does FEDEX only not UPS. I called the 1800# they said the same thing there is absolutely no one you can complain to about this.

I went to the 197 county court bld for a second attempt with failure as a second

attempt. Again a different officer gave me the same information as the previous

time I went. He said you have to have the MANIFEST and even if you do get the

manifest he said this office only does FEDEX shipments and not UPS ironically.

I asked the man where I should go like the last time and if it’s at the same place

as where the item is held in Concord and he didn’t know the answer where I was supposed

to go and I got his badge number so I can verify this with CBSA toll free. After that

I called the toll free CBSA number pressed zero for an agent and again the same

information was mentioned that you need the manifest and that they don’t know where

the item is first inspected and charged taxes and that you have to arrange that before

the parcel enters Canada with UPS and that it’s too late to do it at this moment was the response.

Another major problem with UPS is even if you arrange to pickup your parcel after a week

they will make 3 attempts to deliver anyways and then afterwards you only have 5 business days

to make payment arrangements otherwise the parcel is sent back to the USA because they don’t

have a place to store the parcels either. So I decided to pay the brokerage fees and avoid

the headaches and risks because of the time constraints imposed by UPS to self clear packages.

I didn’t even know where to go and clear it even if I had the manifest but atleast I didn’t

go to the airport like the previous customs officers said I should go.

Hi Jim,

We know that several people (including myself) already successfully cleared shipments in Brampton office with shipment’s invoice.

Yes, they asked for manifest myself as well, but when I showed instructions how to self clear – they just cleared my items with shipment’s invoice. Did you show them instructions?

You already know where the package is being held and what Canada customs wrote down in the inspection – it has been released by customs and it is in Concord.

Probably there was a new customs officer, so he was not aware of the proper procedures.

Please call directly to CBSA, so they will investigate what happened. Give them the names of the officers who refused to self clear in Brampton. They should help.

Toll-free CBSA telephone number (English): 1-800-461-9999

Thanks!

Trueler

I went to the 197 county court cbsa office, cbsa at this office have no clue how i can clear my ups shipment myself, they only do importers/commercial forms not form 15. I told them my ups shipment was held in concord and wanted to clear it in brampton. I showed them the shipment invoice that was declared by the shipper that ups emailed me they said you will need to get the manifest from ups which has the information where the package is held and what canada customs wrote down in the inspection. They also won’t clear the package at the brampton office they said I had to go to the toronto airport to clear it because they thought it was from air when I told them it was ground service and that they only do commercial clearances at this office not personal that I am requesting and that I need to get the manifest from ups. It’s very odd at the beginning cbsa wanted to deal with me but when I didn’t have the manifest and showed them the shipment invoice from the shipper they told me to go somewhere else.

Hi Mike,

Thanks for your question.

Please call directly to CBSA in order to figure out if paperwork can be done via fax or e-mail.

Toll-free CBSA telephone number (English): 1-800-461-9999

Because the brokerage fees are unregulated, and you have a right to self clear, and the needed time and effort to put your rights into practice are not feasible (driving 300 km), CBSA will probably make a concession.

BTW, where are you located?

Thanks,

Trueler

Is it possible to do the CBSA work via fax or email? I am 150 km from the nearest LVS office.

Hi Sumit,

It is up to you. If Brampton CBSA office is close to you, it is definitely worth self-clearing. Ask UPS to ship it to the Toronto warehouse and tell that you will do self-clearance in Brampton office, so UPS won’t need your credit card. Ask UPS for shipment’s invoice and shipment ID number when ready. Tell UPS that CBSA does allow self-clearance in a local office. I’m referring to the Brampton office, because I successfully did self-clearance there and other people reported successful cases as well.

If CBSA office is far from your place and you would like to avoid any kind of hassle, maybe it is worth to pay $90 of brokerage. Does it include taxes? There may be other fees as well: ask UPS for exact amount they are going to charge and ask for detailed invoice, if you decide to go this way.

Let us know your decision.

Thanks,

Trueler

Hi Trueler,

I have received a package at a UPS store in lewiston, NY through Amazon.com. Due to some reason i cannot drive and pick that up.

Now the UPS store in lewiston is ready to ship it with if i can give them my credit card information and they said that i will have to pay the brokerage fee which will be $90 as it is a plasma TV.

Can you suggest if I should deny the brokerage option before shipping and if they will let me do that. or i just let them ship and use the process as advised above.

thanks

Hi Brian,

Thanks for keeping us in loop and for sharing experience. I’m sorry for the hassle you experienced.

Best Regards,

Trueler

Just another update, I waited it out to see if the delivery would really be re-scheduled to me and what would happen… and it made it at 6pm EST tonight.

The driver rang the doorbell and said there was a COD of $97.17. The original amount that was owed.

I told him “there shouldn’t be any C.O.D. remaining, as I’ve already cleared the package through customs and paid the taxes on it.”

He made a call to the UPS brokerage department, and after a couple minutes of waiting for them to get back to him, they finally responded to him with some kind of an authorization number that he wrote on to his copy, tore off the second copy to give to me and handed me the package. End of story.

So far so good. Hopefully an invoice doesn’t show up on my doorstep a couple months from now…

Hi Brian,

Thanks a lot for detailed update! I really hope they just deliver the package to you without any fees.

Just wanted to post an update:

Yesterday morning, I’d had my girlfriend fax the completed B15 form to UPS Brokerage in Fredericton. I called them 45 minutes later to see if it had been received, but was notified I should wait approximately 24 hours for any changes to appear in the system, which I was fine with.

When I got home late last night, I checked the tracking again, only to find this status:

“RECEIVER STATED THEY DID NOT ORDER AND REFUSED THIS DELIVERY / UNDELIVERABLE INTERNATIONAL SHIPMENT. UPS IS OBTAINING FURTHER INSTRUCTIONS OR APPROVAL FOR RETURN SHIPMENT.”

At no point, did I refuse the shipment, so I tried calling UPS right away, but the Canadian offices had already closed for the day.

This morning, at 9am, I gave them a call again, and I spoke to Kathy, who explained the status as due to the representatives having limited possibilities on what they can change status’ too. As such, they may not accurately represent exact progress.

In any case, she did confirm that notes stated my fax had been received, indicating that I’d cleared the package myself, she agreed that I should not have to pay any brokerage fees if I’ve self cleared it, and that she would be putting in a request to stop any movement of the package back to the port of entry.

While was not clear on whether the brokerage fees had been waived and sort of dodged the question a couple of times, she stated that she’d also scheduled the package to be re-delivered to the original delivery address with a request to confirm that brokerage fees are to be waived.

We’re almost there… the light is at the end of the tunnel. Let’s see how this goes…

Brian

Regarding gifts…

If it is really a gift, so in most of the cases you won’t be required to pay taxes and brokerage fees in spite of the insurance value which sender provides to UPS when shipping. This is usually applied to shipments sent from residential addresses.

If it is a “gift” (marked as a “gift” by some US store), so it may be taxed and brokerage fee applied according to any of the UPS instructions, or taxes and fees may be waived if the value is below some allowance. However it is illegal, and customs officers can inspect any package when it crosses Canadian border and re-qualify it at least.

Hi Brian,

UPS should not send your package to Fort Erie! It is a total lie from them. You already paid taxes and have confirmation – B15 form. Send it by fax to the brokerage department and call UPS and ask them to waive brokerage fee and schedule delivery to your home. Again they should not send package to Fort Erie, don’t allow them to do so. Ask for supervisor, don’t hang up until they do what you need. If they do send it back – call CBSA and complain that you paid taxes, provided proof to UPS, but they do not release shipment to you.

I hope this will help.

Thanks for update.

Trueler

Okay, I just called UPS again to get clarification on the Fort Erie issue.

First off, back to my previous message, I got the brokerage specialists name wrong. It is “Anne”, not “Mary.”

I just spoke to “Sonia”, call ending Dec 7, 2010, 18:42 EST, who said that because the original port of entry is Fort Erie, once we get this “clear zone” (self clearing), then I would have to pick up the package at Fort Erie, as UPS would not longer carry the shipment to their warehouse in Concorde.

She also gave me a different fax number to send the B15 to, which is the brokerage group in Fredericton, NB – this number matches the numbers posted elsewhere on your blog: 1-770-990-1722.

I told to her that the CBSA officer stated that I was allowed to clear shipments at an office other than where the goods are being held, and she said I was correct with that, but that UPS would HAVE to send the shipment back to the port of entry (Fort Erie, in this case) to release the shipment to me in person.

She also began to refer to separate “clearing papers”, that would indicate the shipment could then be turned over to UPS, but that would have to be taken care of internally with the CBSA.

I’m not sure where to go from this point. I feel like I’m stonewalled on this.

-Brian

Hi Trueler,

Thank you for your responses.

CBSA did ask me if I knew where the shipment was being held, although, they did not write that down anywhere on the B15.

I was fully successful in getting the item cleared at Brampton CBSA. They said that they could not assess a shipment with a value of “$0”, despite this being an exchange, but the officer I dealt with did me a supposed favor by re-declaring the jacket value to just $100, given the situation with it being an exchange. This meant I would just pay $13 HST on it. Their justification was that because my girlfriend did not have to pay anything on the initial import (she was waived, despite being over her exemption limit), that this was “better than paying the $97 that UPS wants.” I don’t really see the justification in that, but they have a point there – I would rather pay them the $13 HST and 110km worth of travel across the 407 than to pay UPS another penny.

I’m fine with that and have no real complaints, although, I think that in a proper technical sense, I still shouldn’t have to pay anything to the CBSA as this was still a warranty exchange, as I’ve never had to pay anything to the CBSA in the past for exchanges.

At this point, I just want this to be over with, without having to pay an exorbitant amount to UPS, so I will settle with $13.

I’m glad that I am not the only one in thinking that UPS charging me such excessive brokerage fees on an exchange item is ridiculous. You are right, their job as the broker, is to collect on behalf of CBSA. Their job is also to do the paperwork to file importations through the CBSA, but I still can not see the justification of charging $60 to broker an exchange item that has already cleared customs and technically, no money needs to be collected on behalf of the CBSA. It’s quite ridiculous, and the brokerage representatives that I spoke to on the phone somehow tried to justify the charge by saying “it still costs money to file the paperwork to the CBSA.” I suppose the $60 they’re charging still costs me less than the 1.5 hours it took me to drive to the CBSA, the 110km (round trip) I’ll have to pay to 407 ETR, plus gas, plus wear & tear on my vehicle… but that doesn’t make it right either.

The “re-write fee” is even stupider, and it almost makes me boil with rage. They’re the ones who decided to not declare the shipment as a warranty replacement, why do I need to pay for their stupidity? Most humans, if they read “item exchange” on the commercial invoice, would that not equate to “warranty replacement?” Instead, they tell me that because it was not specifically written as “warranty replacement”, they would not honor it as such. Absolutely ridiculous.

As a correction to your statement:

“For example, when you receive a gift sent with UPS, you do not pay brokerage fee.”

This is incorrect. When you receive a gift, you DO pay taxes, and as such, brokerage fees would be levied. Exemptions ONLY occur if the value is BELOW $60, and the package is declared as a gift. Likewise, if the package is declared as $20 or less (doesn’t matter if it’s declared as a gift or not), then it will be auto exempt from taxes and fees as well. It doesn’t seem to be worth it to do the paperwork to collect $1 in GST in that case.

But I digress…

Following your steps to give UPS a call to find out where to fax the B15, I just spoke to “Mary” in the brokerage department, December 6th, 17:44 EST, who told me that I can not clear personal shipments the way that I want to do it, and that in order to do so, the shipment would have to be sent BACK to Fort Erie, where I would then need to present myself to pick it up.

I argued with her, saying that the CBSA officer stated that I am allowed to self clear my personal shipments and pay any duty/taxes owing at an office other than where the goods are being held, and that refusing me to do otherwise would be illegal.

She then requested to put me on hold while she figured this out, and she was gone for about… 10 minutes. When she came back, she said that I could try the following which *may* work, but without any guarantee from her. She said she would have to put in the request to transfer the shipment back to Fort Erie, and in the meantime, I could fax my B15 to the Fort Erie brokerage at 1-905-994-5368 and we would have to wait to hear back from Fort Erie.

What is in Fort Erie? I’m totally confused as to why it has to go back to Fort Erie. Why does it need to go back there?

They must be making this confusing on purpose, just to dismay anybody who wants to attempt this magical method of self-clearance…

What can I do at this point?

Regards,

Brian

Hi Brian,

This is for your second message.

It is good that UPS provided you with Shipment’s ID.

When you fax B15 back to UPS brokerage department, you may call them and notify about it, so they will act faster. At the same time you may ask when invoice will be waived. I think it should not take more than a day, probably several hours. They can redirect you to the brokerage department who receives the fax.

Regards,

Trueler

Hi Brian,

In order to get the “Unique Shipment Identifier Number” you may create an account at UPS website and login. When you put in your tracking number you will see one or more numbers in the “Reference Number(s):” section. One of them should be “Unique Shipment Identifier Number”. It is usually a combination of 11 digits and letters. You may print this page.

If commercial invoice has specification of goods, you are good to go. Take a note of UPS warehouse address in Toronto, CBSA may ask for this as well.

I don’t have an answer to your second question, if you can clear package for your girlfriend. Since it is the same address on your photo ID, it may work. But I can’t guarantee. Sorry about this.

I don’t understand why you should pay anything. Jacket already crossed border with your girlfriend. She paid taxes or it was in the personal amount limit. You do not have to pay taxes twice. The only reason of going to CBSA is to get a confirmation (B15 form) that all the applicable duties and taxes paid. So you will need to present them with return/exchange receipt.

The thing that UPS still tries to charge brokerage fee + “re-write” fee is very strange. Brokerage services are used to pay taxes to Canada Customs on behalf of importers (accounting process). You do not have to pay taxes in this case, so no brokerage fees should be applied. For example, when you receive a gift sent with UPS, you do not pay brokerage fee.

I think it is worth trying to call UPS one more time and tell that it was exchange and accounting for the package is not required. It is just exchange, you did not buy anything. You already paid for delivery. Why you should pay for some services that you did not requested? Tell them about it. Ask for supervisor and explain.

Let me know if it was helpful.

Thanks,

Trueler

Hi Trueler,

As a follow up on my above story, I called back to UPS shortly after typing the above comment, and tried asking for the Shipment ID Number again.

At first, the rep had no idea what I was referring to when I specifically asked for “the Unique Shipment Identifier Number.” However, when I said “I need the Shipment ID Number… it’s an internal number that UPS uses that’s different from the tracking number”, that’s when he knew what I referred to and was a bit more compliant.

At first, he politely asked “may I ask what you need this for?”

I truthfully responded “I’m going to self-clear my shipment through customs”.

He then put me on hold, and when he came back, he politely provided me with the number.

It looks like that’s all I need to go forward with clearing this with the CBSA office in Brampton.

I’m just worried because my girlfriend’s name is on the shipment, but my photo ID’s address matches the shipment. Unfortunately, I’m in a bit of a rush because it will be 5 days as of this coming Thursday, so I need to give a shot at this anyways. I’ll report back what my experience was.

Do you know how long it generally takes for the brokerage invoice to be waived once I’ve faxed in the completed B15?

Thanks again,

Brian

Hi Trueler,

Thanks for your time and effort in creating this INVALUABLE resource. God knows how many times I’ve been screwed by UPS in the past with their outrageous brokerage fees.

I’m contacting you now because of their latest “scam” against my girlfriend and I, and I have two questions at the end. I just thought I’d fill you in with the story first:

Three weeks ago, my girlfriend took a trip to NYC (we live in Toronto), and she purchased a jacket for me as a gift. When she crossed the border, she did declare the jacket along with all her other purchases. We never try to lie or cheat to customs, as we have heard too many horror stories.

When she presented the gift to me, we found that the size was a bit too big, and I tried on a smaller size at a local store with the same jacket and it fit better. The store owner in NYC was kind enough to do a size exchange for us as long as we paid for shipping back and forth. I was not doing the contact with the store owner – my girlfriend was. She did not think to ask what shipping method they would ship by, and they ended up sending via UPS Ground.

Several days later, I received a knock on the door, and this $280USD jacket arrived with a $60 brokerage fee on it plus $37 for HST, totally $97. This is nuts, especially for a jacket that’s already crossed the border twice (this would be the third time.)

Lots of arguing with UPS over this issue across twenty some-odd calls, but UPS was finally “willing” to negate the $37 HST since this item is technically a “warranty exchange item”, and shouldn’t have sales tax applied to it again, but they ended up charging me an additional $15 for a ridiculous “re-write fee” as a re-declaration of the shipment, and they would not budge on the brokerage fee. That comes to a savings of $22, but I was still not satisfied with having to pay $75 for something that I can clear myself (thanks to your helpful blog.)

So… I’m going through the process and collecting data now, however, I’m stumped on the “Unique Shipment Identifier Number”. What is this number, and what does it look like? I have a copy of both the Commercial Invoice, as well as the sales return/exchange receipt, and I don’t think there is any such Unique Shipment Identifier Number located anywhere.

There are fields listed for “Bill of Lading / Air Waybill No.”, “Invoice Number”, and “Purchase Order No.”, but those are not filled in.

When I asked UPS what the “Unique Shipment Identifier Number” was, they just kept telling me to use the tracking number. Would that be okay?

Secondly, this shipment was sent to my girlfriend’s name, but we share the same address. Would this be an issue when I go in to the CBSA to make payment and collect the B15? My photo ID has the same address… just the name is different.

Thanks again for all your help, Trueler. You are a saviour! Nothing beats sticking it to the man!

-Brian

Hi JoeS,

It is because personal shipments can only be cleared by importer or broker. ID proves that you are importer.

Why would one need id at the CBSA office?

It shouldn’t matter who pays the tax and duty

so long as its paid,right.

Then produce the proof to UPS that payment was made.

Hi Saz,

You are welcome. It is good for you :)

Just one more advice. When you receive your package, just ask them to confirm that you don’t have to pay anything. Send them a message through contact form (on UPS website), so you will have written reply with confirmation that you don’t owe anything. There are some cases when people do not receive invoices from UPS, but receive a notice from collection agency half a year later that brokerage fees owed.

Thanks,

Trueler

Hi Trueler,

Just called UPS to ask them for the invoice and shipping # and I am told there is no need to self clear as the shipper takes care of everything. I confirmed with the person on the other line if I should be expecting an invoice in the mail and replied in the -ve. She said shipper takes care of everything.

So I guess I don’t have to CBSA and self clear my package. :)

Thanks for all your help,

Saz