These instructions are the final conclusion to the post

UPS/FedEx Brokerage Fees – avoid scam

- You ordered some goods from US into Canada by UPS and they are on the way

- Going to import some goods from US into Canada by UPS

- Already received your package and did not pay anything to the driver. It means that UPS will send you brokerage fees invoice several weeks/months later, or send information right to collection agency

- Driver showed you collect-on-delivery (C.O.D.) invoice which was ~half of the item’s price and you refused to pay at the door

There are two conditions necessary for the procedure of self clearance at Canada customs:

- Your shipment’s value for duty is less than $1600 CAD

- You have one of the local CBSA (Canada customs) offices nearby. You may find the list of offices across Canada here: Directory of CBSA Offices where Courier Low Value Shipments Program clearances are performed.

Here is the procedure of self clearing (confirmed by CBSA main office and proven many times in practice):

- Wait while your package comes to the local UPS warehouse (where you live). You will see status in the shipment’s tracking information on UPS website. If you don’t track, so just wait for the first delivery attempt and refuse to pay at the door

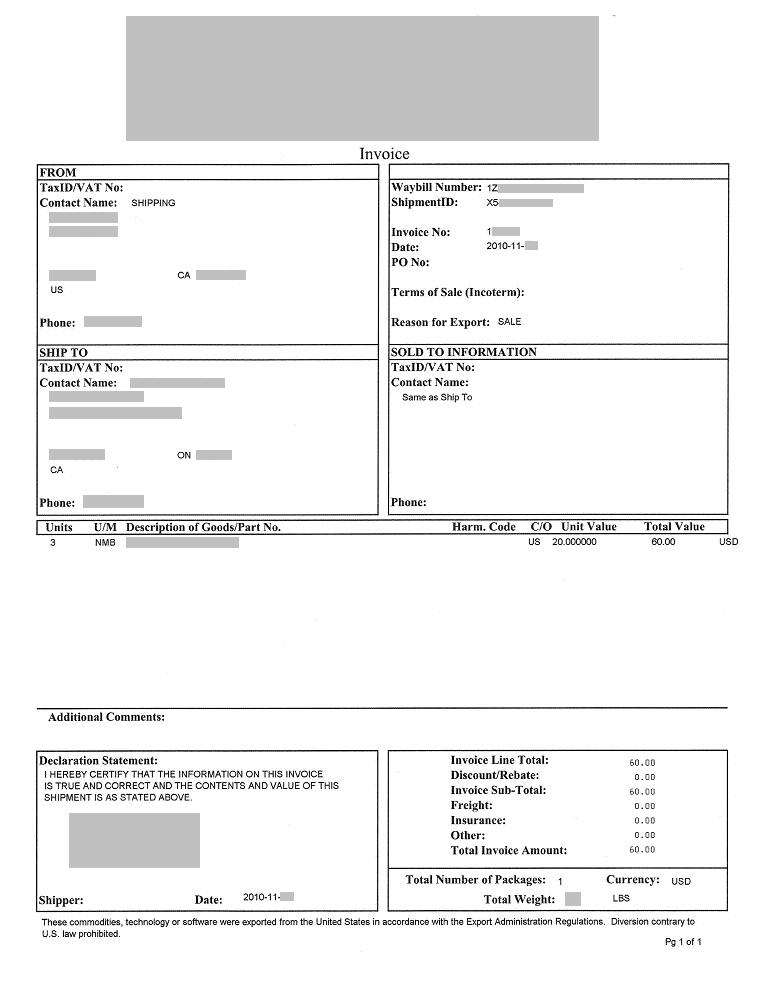

- Call UPS at toll free number 1-800-742-5877, press “3” to be connected to the billing department (or other prompt by the system), and ask customer service representative to send you shipment’s invoice. Some of the representatives call it commercial invoice. Just ask for “commercial invoice” associated with your tracking number. They can send it by e-mail or fax. Please make sure they got your address correctly – ask to spell it back. They will send it right away in .zip archive to your e-mail. Shipment’s invoice has the Unique Shipment Identifier Number needed by CBSA as well. This is how it looks like (click on image to enlarge):

- Find out what is the address of your local UPS warehouse where your package is being held. Call and ask UPS if you can’t figure out. CBSA may ask for this information during self clear. For GTA (if you see “Concord” in the tracking information) the address as of Nov. 2010 is:

UPS Center

2900 Steels ave. W,

Concord, ON, L4K 3S2

phone: 800-742-5877

- Take your shipment’s invoice, address of UPS warehouse, money to pay taxes and photo ID to the nearest CBSA office. Please take the reply from main CBSA office with instructions about self clear process for the case if officers in your local office are not aware with the proper procedure. You may find their reply at UPS/FedEx Brokerage Fees – avoid scam – section almost at the bottom of the post, just between solid grey lines. Last time I visited CBSA office in Brampton at the following address:

CBSA Brampton: office 480

197 Country Court Blvd.,

Brampton, ON, L6W 4P3

office hours: 8:30 – 16:30, Mon – Fri

!! – recently address has been changed to:

5425 Dixie Rd.

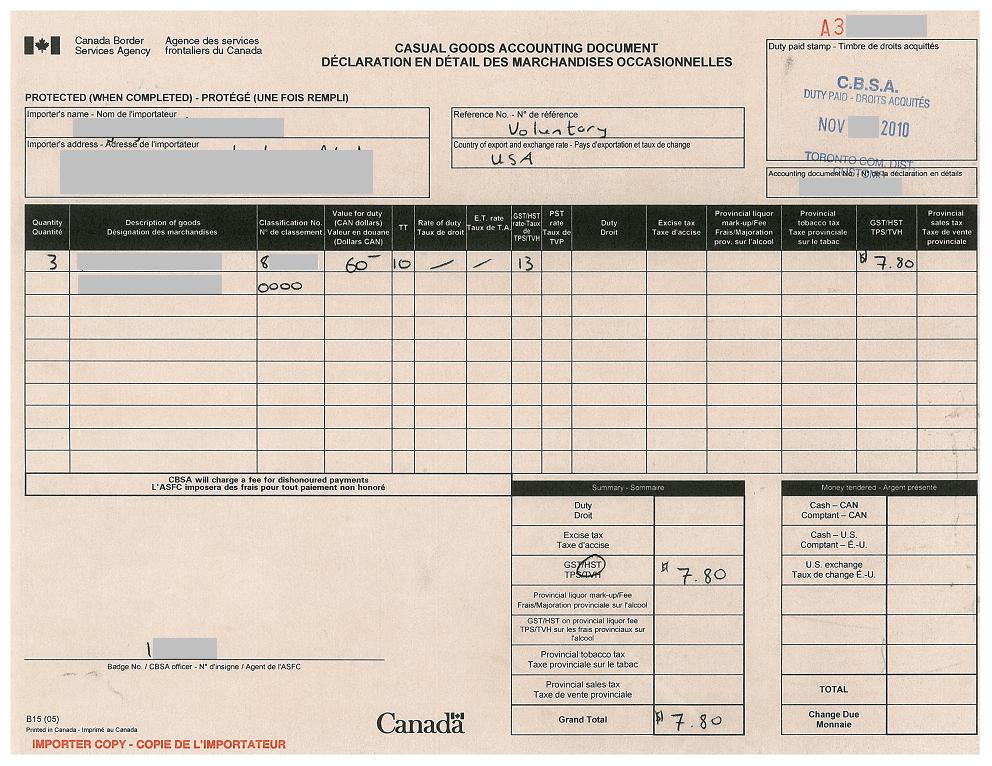

- Present your shipment’s invoice to customs officer and he will do clearance for you. After paying applicable taxes and duties to the cashier you will be provided with CBSA B15 form – Casual Goods Accounting Document, which confirms that you paid all the taxes to Canada customs. B15 form looks like this:

- Call UPS and ask how to provide them with B15 form (proof that you paid taxes) in order to waive brokerage fee invoice. They will give you fax number. Please make sure that you put your tracking number of the cover page. As of Nov 2010 CBSA B15 form should be sent here:

UPS Brokerage Department

fax number: 1-770-990-1724

- After that UPS Brokerage Department should process your B15 form and waive C.O.D. charges. It may take 1-5 days. You may also try to speed up the process by calling UPS and informing them that you already paid taxes to CBSA and sent receipt to the brokerage department. Ask UPS to schedule delivery.

You are done!

I have not done it with FedEx or other couriers, but procedure should be very similar.

Hi Jones,

Shipping manifest is not required to pay taxes in a local CBSA office. It has been confirmed. Only shipment’s/commercial invoice, unique shipment ID number, address of the warehouse where goods are located at the time of accounting process are required. Also Photo ID and money to pay taxes are required.

I have replied to Clive’s comment where to find the actual e-mail. Please find it at the same place.

If you prefer to call e-mail from CBSA signed by Government of Canada “not official”, you may do so. It does not change things. It already helped many importers in Canada to pay taxes in local CBSA offices and avoid high brokerage fees.

After my request to CBSA a long time ago to confirm the process, I got a call back from CBSA Ottawa, and they confirmed the procedures of paying taxes. They also promised to send instructions of how to self clear which I posted in order to help other importers. UPS and local CBSA offices must follow them. Otherwise feel free to file a complaint to CBSA.

You may find supporting documents here as well:

http://www.cbsa-asfc.gc.ca/import/courier/lvs-efv/menu-eng.html

Thanks,

Trueler

Trueler –

I live in Calgary and I have the exact experiences as Clive, and similar to Ace. CBSA wont release it without the Shipping manifest.

So I called the UPS port of entry location brokerage department, and requested the manifest. She gladly faxed it over. BUT as soon as she faxed it, the request was made internally to UPS return the package to Vancouver. After about 4 phone calls, UPS waived the fee, and re-routed the package back to Calgary.

I have read all of your websites – and simply put – your “List/form/reply form CBSA” is not official. Can you post a link to the actual email? Can you forward this “official reply” to me? (This should include a CBSA contact.

I believe the Calgary office agents are very knowledgeable and have helped me tremendously; I doubt they are doing this to be difficult.

Thank you

Hi Clive,

Probably the woman you talked to at CBSA is not competent and not aware of the proper procedures.

This info is a reply from CBSA Ottawa with instructions how to self clear. It is signed by CBSA, Government of Canada and sent from their e-mail address. Isn’t it the same as “posted on their website”?

If CBSA office refuses to accept taxes and issue a receipt based on these instructions, please ask them to contact CBSA in Ottawa and clarify the process. If they do not want to help, please take their names, written refusal and send a complaint to CBSA. However in this case you will have to pay brokerage fee, because reply from CBSA may take a long time.

I hope this will help.

Regards,

Trueler

Thanks Trueler. I gave CBSA this info and they would not take it. If it was posted on their website or had a persons name to contact at the CBSA, they might look at it. They still wanted the shipping manifest and not the shipments invoice. You can not get the shipping manifest from UPS, unless you are at the point of entry. Which was Winnipeg, and I’m in Calgary. Not sure what to do, as UPS holds your shipment ransom until the brokerage is paid.

Is there anything on the CBSA website? Or is there a contact person at CBSA? The woman I talked to at CBSA was not friendly or helpful at all.

Hi Clive,

Please find the instructions from CBSA with specified documents at:

UPS/FedEx Brokerage Fee – avoid scam (Canada)

in the “How to pay duties and taxes for imported goods” section between solid Grey lines.

You may want to copy it into a document file and print it in order to show at CBSA office.

Regards,

Trueler

I tried clearing with the Shipments Invoice and the CBSA in Calgary, said that will not work. They needed the Shipping Manifest. This is a personal item (YearOne car parts), and CBSA would not have anything to do with me, unless I had the Shipping Manifest. Where is the document located so I can show them that this can be done?

Thanks,

Hi Tristan,

Unfortunately only personal shipments can be cleared at any CBSA office. To self-clear commercial stuff you need to present yourself at the port of entry.

Regards,

Trueler

Hi Trueler – I tried to follow what you posted best I can – I’m a business that is importing dog toys to sell, my standard order is around $300-$400 dollars. I Was told by CBSA today that I cannot clear items myself unless I am in the port of entry, which UPS tells me is Montreal for my location (I am in Halifax). Any Advice? The officer at CBSA was adamant that I cannot clear items myself unless I’m at the port of entry

Trueler,

Just wanted to thank you for this info. I saved myself $33 dollars using this info. The only thing that was different was the fax number, which I seemed to have misplaced. But they gave it to me and said I needed to fax my B15 there because that is where they do “rate adjustments.”

Thanks again for the info! It works (I did it in Kitchener) and UPS tried everything to convince me that it was not possible to do this. But now I am picking my package up free of charge (aside from the $8 duty I gladly paid customs) on Tuesday.

Hi Clive,

Shipping Manifest is not necessary for the Canada Boarder office. CBSA should clear the shipment without manifest. Shipment’s/commercial invoice, unique shipment ID number, and the address of UPS warehouse are needed.

UPS usually provides shipment’s/commercial invoice by e-mail or fax by request. Just don’t mention about your intention to self clear.

Show instructions to CBSA officers telling what documents should be provided by importer in order to pay taxes.

Regards,

Trueler

For Calgary, you will need a copy of the Shipping Manifest to be able to get the proper forms from the Canada Boarder office. You can only get this if it is coming by air. If it’s coming by ground, you will have to pay the brokerage fee. I have been fighting with UPS all day. UPS does not make this easy!

Thank you for the reply Trueler

I will do the self clearing when the package is near the warehouse. I will let Fedex know that I want to self clear it :)

I will hopefully save 40+ bucks !!

I read thru all the comments, hopefully the person i talk to @ brampton location won’t ask me for manifest or w.e

anyway I will update you

Thanks!

Hi Lee,

Right, there is no necessity to notify the seller about your intention to self clear.

I live in the same region and I used Brampton location – it was on my way. There is a location in Pearson Airport (Terminal 1), but parking is expensive there and it may be a hassle to go there during rush hour.

If the tracking information allows you to see when package leaves Canadian port of entry and goes to FedEx warehouse in Toronto, it is worth to wait until this point, then call FedEx to request shipment’s invoice, unique shipment ID number, and the address of their warehouse. For example, when UPS (I’m not sure about FedEx) hear about intention to self clear, they just block the package at the port of entry. And self clearance at CBSA can be done only when the shipment already released by Canada Customs at the post of entry!

I hope this helps.

Thanks,

Trueler

Hey Trueler sorry about spelling ur nickname wrong

Anyway I read ur other article and I guess I will call Fedex as soon as they ship the item(so when tracking # is available) and then let them know I will self clear it

Is there any closest CBSA office near Bathurst/Steeles (vaughan)?

Thanks

Hi Tureler

Thank you for the great article.

I have a question tho.

I just ordered some clothing from website in united stats. They are going to ship it via Fedex.

I haven’t received any tracking number or anything. But I called Fedex to inquire about the brokerage fee and how to self clear it, they redirected me to fedex trade network. and the lady told me it will be 45$ for brokerage fee. I asked her how to self clear it and she said I have to notify the seller/shipper that I want to self clear it.

Is this true? Or should I wait until it comes to nearest fedex location to my house then go to CBSA office to file in and self clear it like you wrote it so?

Thanks

Hi Simon,

According to UPS, Expedited and Air deliveries include brokerage fees. However, they could change it recently (but I’m not aware of this).

As for which CBSA office to pick. They have send instructions advising that any CBSA office can be used in order to pay taxes, they did not mention that it must be CLVS one. I believe that office at the airport should be able to handle this. If it is close to you, it is worth to try, after confirming that you really have to pay fees to UPS and figuring out how much tax need to be paid.

Regards,

Trueler

@Trueler

Based on the information you had provided to me, I managed to find this location: http://www.cbsa-asfc.gc.ca/contact/listing/offices/office807-e.html

However, that location doesn’t deal with CLVS (Courier Low Value Shipments), only the Casual Refund Centre. I can’t distinguish the difference between CLVS and CRC.

As for the UPS thing, the product was actually shipped by UPS Worldwide Expedited (probably the same as UPS Standard Air, no?). Probably it included the fees – to my own observations.

There is also a CBSA office at the Oshawa Airport (near where I live), but they don’t offer the services as mentioned above. That’s the best that I can give to you.

Simon, I believe Air UPS delivery already includes all the fees. Isn’t it right?

It is worth to try the closest CBSA office. As I remember from the list, there is an office i Scarborough, or even Ajax.

I’ve stumbled reading this reference and recently, I bought a pair of shoes from an American website. If I recall, the package was shipped by UPS Standard Air and the price from which I ordered the product to be shipped to is $40.00US – that included brokerage and entry fees. That was added and the taxes was $38.75US (or something like that).

Since I don’t live near one of the CBSA offices (I live in one of the Durham Region municipalities of Ontario – in that case, Ajax/Pickering) that specialize in CLVS (the nearest “logical” one is in Mississauga, I guess I have to end up eating up the costs – anyways.

The site that I had visited too didn’t give me any other options for shipping. Do you have any other suggestions?

You can also e-mail me with instructions as well if you prefer. Cheers.

Hi Allie,

If your closest CBSA office (not mentioned as CLVS) is really close, you may try it, because CBSA advised that every importer can pay taxes on a shipment below $1600 at ANY CBSA office. Please make sure you take print out of the reply from CBSA with instructions along with other information (invoice, shipment ID, address of warehouse).

I think we have experience described in comments on self clearing in non-CLVS offices.

If you have a strong desire not to pay any money to UPS, you may try it. I understand that you believe it may be a big hassle (indeed it can be). It’s you choice!

Just curious.. I won’t sleep without an answer :) $75 is about 65 liters of gas. For 13 liters/100 km it is about 500 kilometers at a typical highway speed for a typical sedan. Are you driving up to 200 km/hour or is it a big truck?

Thanks,

Trueler

After reading through all of this, I was gung-ho to attempt to self clear. Then I realized that the closest CBSA office does not do CLVS, the closest CLVS office is an hour away. It will cost me $75 in gas to avoid paying $80 in brokerage fees.

Good to hear that it worked for you with UPS!

Thanks for experience from Calgary! I believe your receipt from CBSA should be enough for UPS, singe you have paid necessary taxes. And if someone forces you to pay taxes on the same item again, it would be serious offense, and CRA will definitely want to investigate.

I could not find “B15” on the sheet which cashier provided to me after I paid taxes for the first time (did not really try). I found it only at home – in the left bottom corner. However, looks like your receipt is different.

Thanks!

Trueler

…It was just a receipt.

I then went to UPS depot and asked to pick up my package. The clerk quickly grabbed the package and it had COD written all over it. They began to ask for payment and I told them I don’t have to pay the brokerage as I self cleared the package at customs. I game them the ‘receipt’ and pointed out the tracking number on it. The person took my receipt and commercial invoice to the back for a while, came out about 10 min later and said okay you’re good to go, but we have to keep your receipt. I’m guessing they weren’t sure what to do so just kept the paperwork….

So in short, self clearing worked for menexcept not as described here, seems the agents are quite stuck on getting a waybill or manifest, and if that is the case it may be impossible to satisfy them. I hope this will be simpler as time goes on. It would be real helpful to have an actual bulletin or memo (on letterhead) to use at customs to show all we need is the commercial invoice, I’d number, I’d, and pmt…

Okay so Success in Calgary…sort of.

A little background, I ordered an item that had a $35-40 value for customs. Ups thought that I would pay them an extra $20 for ‘brokerage’ fee. I spent so many years writting ‘I cannot receive shipments from UPS in the notes section of all my orders I guess I just forgot this time.

I called UPS and asked for a copy of the commercial invoice associated with my shipment, they gave me no issue with sending this except they could only ‘fax’ not e-mail. I took the commercial invoice that had both the tracking number and the unique 11 digit ID to the customs office and told them I’d like to self clear. I can confirm as others have that the customs agent told me they needed a waybill or shipping manifest, seems like they wanted something they can stamp. I gave them a copy of the instructions from this web site and they read it and said it doesn’t say that you need it, but that’s what it means…

The customs agent was quite helpful, I told them that I didn’t ship the product so how am I supposed to get this? They said I’d have to get this from UPS, the customs person however said don’t go heading over there yet we’ll see if we can do this from here. She called UPS locally (depot) and asked if they could fax over the waybill or manifest. The UPS agnet just kept responding that the package had already cleared in Winnipeg. The customs agent them put me on the phone and I asked the Ups agent for a copy of the waybill, she said that it had already cleared, and I explained that it hadn’t cleared yet as they are a bonded facility in the low value shipment program. The ups person then said that they don’t have a waybill for it, and as I repeated this out loud the customs agent said that they may actually not have one. It’s at this point that I said then how is anyone supposed to self clear? The customs agent then told me to ask if I could get my package if I had a B15 and the ups agent said sure!. Got off the phone and the customs person processed my charge of 1.90ish.

I left the cashier with a ‘receipt’ (computer printout), that had a note on it that said ‘importer would like to self clear, does not have a manifest or waybll’ showed the paid GST and had the ups tracking number on it…nowhere did this sheet say B15, I think

Hi Brenda,

Just sent it to you. Again, it is the same as in the article plus footer-signature of the Government of Canada which I’ve already given in comments.

Regards,

Trueler

Trueler, could you forward those instructions to my email as well, please?

Eric,

Looks like it is enough to go. Please take a print of instructions from CBSA which I’ve forwarded to you as well.

Good Luck!

Trueler

Trueler

Thank you for all your responses, I really appreciate it.

As mentioned previously, I was denied at the CBSA office.

I’ve used Commercial Invoice from UPS at the CBSA but the officer demanded that I need a manifest.

So I’ve got a manifest at the Concord location (Well, not too sure if it indeed is a Manifest but I asked for a manifest and this was given, as well as the page has “Manifest detail” on top of the page).

Now I have:

1) Commercial Invoice from UPS (1 Page)

2) Manifest from UPS Concord location (2 Pages)

3) CBSA’s instruction letter (1 Page)

4) Page I’ve printed out with Courier name, Unique Id Number (Which is a number that is on Commercial Invoice, that is not a Tracking number) and the location of the package (1 Page)

I don’t know what else I would need (Other than my personal ID and money to pay the taxes), so if I missed something, please let me know.

And wish me luck on monday! Hopefully I don’t get denied and have to travel again.

Thanks again!

Hi Eric,

I think it is better to call UPS and ask not to send it back until you get B15 from CBSA after paying taxes. I’m wondering if you were able to get shipment’s/commercial invoice from UPS or seller and unique shipment ID? If you have them, you are ready to self clear at CBSA office. Print the reply from CBSA with instructions and take it with you as well.

Regards,

Trueler

Hi Brenda,

I think it is better to try the closest location. CBSA suggested in their reply that it can be done in any customs office.

Trueler

Thank you for your response.

For me, went to a degree where it complicated for me.

While I was at work, my brother refused the deliver, thus they never provided any documents themselves and took the package.

I had to call them back to hold the package for 5 days for me to pick it up.

Thus why I’m in this mess. Should I call them to keep it as C.O.D?

I plan to pick up the package after I go to CBSA since the package is kept at Concord for me to pick it up

Any advice on this matter or possible actions I may have done wrong?

Hi Eric,

In my case the driver left the shipment with me without asking to pay anything. It was supposed to be a late invoice (in two months).

After receiving my shipment I did self-clearance in Brampton, and then faxed B15 to the brokerage department. I’m not sure how long did it take to be processed, because I did not follow up with UPS.

I remember someone else experience when he received a package on the next day after providing B15 to UPS.

If you have B15, ask UPS where to send it by fax, send it, then call again and tell this, schedule another delivery when brokerage fee is waived. Ask not to send your package back, because it is a C.O.D. dispute, so 5 days limit should not be applied.

Regards,

Trueler

Trueler,

How long did take for you to waive your brokerage fee with B15 form?

I may have to rush the process since my package is going to be sent back on monday.

Thanks again!

Hi Trueler,

Thanks for the quick reply. It seems we have a main CBSA office here in Fredericton, a service location at the airport and a sufferance warehouse (whatever that is) at another location.

__

# FREDERICTON- 204

* Sufferance Warehouses

o Day and Ross Inc.

* Service Locations

o Fredericton International Airport

__

The airport location lists this for services offered:

Services Offered Airport of Entry (AOE/55)

(International Airport)

Note: 140 with staged off-loading

What appears to be the main office in Fredericton (204) offers these services and the airport location reports to this office:

Services Offered Designated Export Office (EXPORT)

Electronic Data Interchange (EDI)

Inland Customs Office (INLAND)

__

Do you think either of those look like good prospects? I’m thinking the airport is the location I would have to deal with, but I have a sinking feeling they will tell me that they don’t handle the process of self-clearing.

Eric,

Looks like it is the most convenient: free parking, not in busy area. There is an office in Pearson airport, but it may be a hassle to drive there and parking is very expensive. I remember from the list, that there is an office on Front street in Toronto Downtown, but it is hard to find parking there as well. It is better to check the list, and probably confirm by calling to CBSA if another office can assist you in paying taxes for the goods which have already been released by Canada Customs in the port of entry. Please keep in mind that some CBSA representatives on the phone may be not aware of the proper procedures and will tell you to go to the port of entry. Actually, when I called CBSA for different questions, I got two answers that I can do self clearance in any CBSA office, and two answers that I have to go to the port of entry.

Regards,

Trueler

Is Brampton office the closest for me if I live in GTA?

It’s pretty far and so far I didn’t have the time to go.

Last time I saw there was Newmarket location but it seemed like a warehouse location.

Thanks Trueler for everything so far!

Hi Brenda,

Do you have other CBSA offices nearby? It should work as well.

Regards,

Trueler

So, if we don’t have a CBSA office that offers the “Courier Low Value Shipments Program” service, we’re out of luck? I live in New Brunswick, and there is only one location (far away from me) that offers that service.

I’m so pissed at this shipper for using UPS ground because he “didn’t know” about the associated fees. I’m pissed at myself for not inquiring about the shipping method prior to ordering from Amazon.

I have a package on the way, and instead of being excited, I’m dreading its arrival.

Thanks Trueler. I called again today and was able to get the commercial invoice from UPS.

From my knowledge Waybill # and unique id # are different things. However, I remember someone was claiming here that they are the same.

Just try to login at UPS website (if you don’t mind) and you should see one more number which is unique shipment ID. Actually unique shipment ID # and tracking number have several characters in common.

Anyway, you will need shipment’s/commercial invoice from UPS or seller. It usually has unique shipment ID # on it as well.

Hello Trueler

Thanks again for your reply.

Only numbers I have are tracking # and Waybill #.

Is Waybill # the unique id #?

I just want to be prepared for any outcome on my next meeting with the CBSA agent.

Thanks so much for all your help!

Hi Eric,

No, the ID number is different from the tracking #. You may find it on the shipment’s/commercial invoice which UPS can send to your e-mail by your request. Alternatively, you may see shipment ID number when you logged in on UPS website (it usually becomes available only after registration).

Regards,

Trueler

Hey Trueler,

Thanks so much for your help and advice

I’m going to try do visit Brampton again because I did not find any custom office at the Concord.

I’m gonna show them that document I’ve printed; document that you’ve guided me above.

Is unique ID for package the Track# of the shipping item?

Or do I need to get this number separately from UPS again?

Thanks again!

Hi Eric,

Definitely not the entire post! It is in that article almost at the end between two solid grey lines. Just copy it to a word document, put below the following signature:

Canada Border Services Agency

Ottawa, Ontario

K1A 0L8

Government of Canada – Gouvernement du Canada

and print. It is exactly CBSA instructions which you show to the officers. If they have any questions or concerns regarding the process, they can call CBSA in Ottawa to confirm.

Regards,

Trueler

Trueler,

I apologize for being such a simpleton,

Could you be able to show me the CBSA’s instruction?

Is it this?:

http://trueler.com/2010/09/13/ups-brokerage-fees-total-scam-fraud-cheating-avoid-it/

If so, do I just print that and show them?

Once again thank you very much for your response

Hi Eric,

I have not heard about CBSA office in Concord. Have you seen it? Probably it is possible to do all the paperwork right at the UPS warehouse in Concord? It would be really good! However, I heard that it is very crowdy…

I’m sorry that you got refusal in Brampton office. Please feel free to file a complaint to the Canada Customs (contact information is given in comments to the parallel thread at http://trueler.com/2010/09/13/ups-brokerage-fees-total-scam-fraud-cheating-avoid-it/ ).

BTW, did you show them instructions from CBSA? When I was clearing my shipment they told me the same about manifest and FedEx, but when I showed instructions they changed their mind and issued me B15 form after I paid taxes to the cashier.

Thanks,

Trueler

Hi Donnie,

According to the reply from CBSA it is possible to clear in any local Canada Customs office. They did not tell that it must be CLVS office. Now I believe that “CLVS office” means that it is possible to perform some complex procedures related to LVS program, and it is mostly used by courier companies.

However, it is better to confirm.

If anyone had luck with self clearing in office which does not provide CLVS services, please speak up!

Thanks!

Trueler

Trueler,

I’ve been experiencing few problems at the CBSA.

Today I visited the Brampton location to do my clearing with documents listed above:

shipment’s invoice, address of UPS warehouse, money to pay taxes and photo ID

However I was told that these are not sufficing documents for me to clear the item.

I asked two officers since I did not understand the protocol fully.

-One officer told me that I need a manifest (Cargo shipment document) from UPS in order for me to clear the item.

-Another officer told me that they do not clear the item at the Brampton location for UPS; in order for me to clear it I would have to visit Concord UPS location, get a Cargo shipment document and clear it there with a custom located in Concord. Brampton only deals with FedEx and UPS is dealt at Concord.

So I went to Concord and got myself some document (which I’m not too sure if it’s manifest since the rep who served me told me that information are not available until the item is scanned (not sure what she meant).

Doc she gave me does have ‘manifest’ on top of the page so I assume it’s a valid document.

I am pretty lost on what I am not doing right or who is right. To be honest, I’m in a edge of just paying the brokerage fee and not deal with it since nothing have been working out as the process told above.

If you can give me feedback or an advice I’d appreciate it, Thank you.

Hi Nelson,

I’ve sent you official reply from CBSA. It is the same as in the article + this signature at the bottom:

Canada Border Services Agency

Ottawa, Ontario

K1A 0L8

Government of Canada – Gouvernement du Canada

Regards,

Trueler