These instructions are the final conclusion to the post

UPS/FedEx Brokerage Fees – avoid scam

- You ordered some goods from US into Canada by UPS and they are on the way

- Going to import some goods from US into Canada by UPS

- Already received your package and did not pay anything to the driver. It means that UPS will send you brokerage fees invoice several weeks/months later, or send information right to collection agency

- Driver showed you collect-on-delivery (C.O.D.) invoice which was ~half of the item’s price and you refused to pay at the door

There are two conditions necessary for the procedure of self clearance at Canada customs:

- Your shipment’s value for duty is less than $1600 CAD

- You have one of the local CBSA (Canada customs) offices nearby. You may find the list of offices across Canada here: Directory of CBSA Offices where Courier Low Value Shipments Program clearances are performed.

Here is the procedure of self clearing (confirmed by CBSA main office and proven many times in practice):

- Wait while your package comes to the local UPS warehouse (where you live). You will see status in the shipment’s tracking information on UPS website. If you don’t track, so just wait for the first delivery attempt and refuse to pay at the door

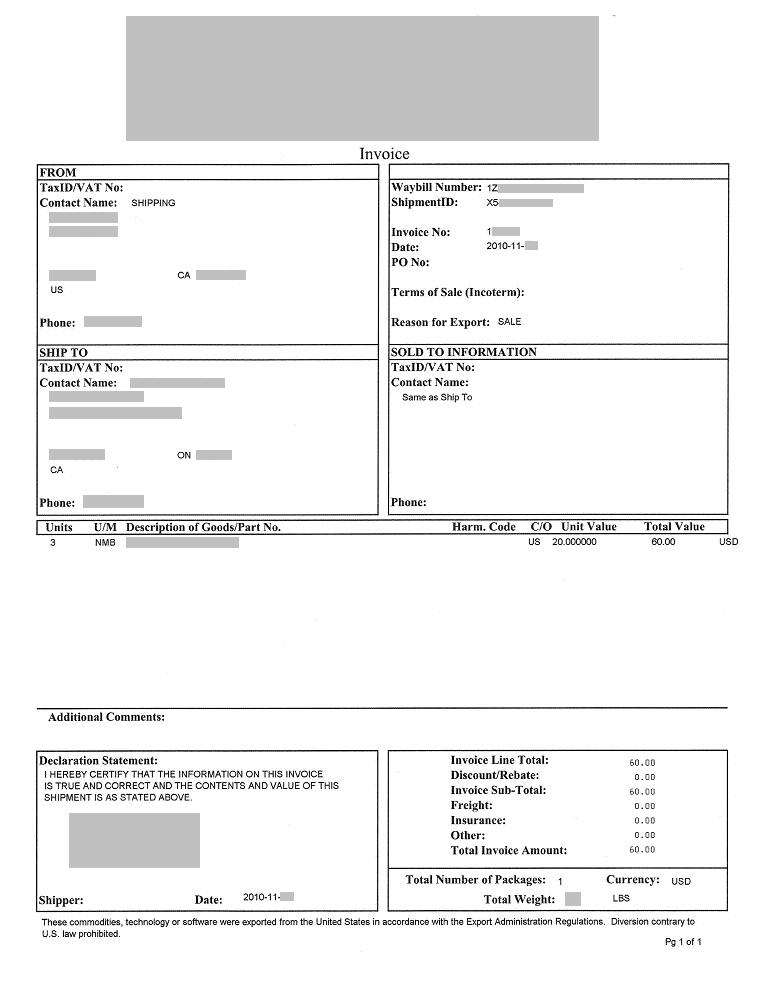

- Call UPS at toll free number 1-800-742-5877, press “3” to be connected to the billing department (or other prompt by the system), and ask customer service representative to send you shipment’s invoice. Some of the representatives call it commercial invoice. Just ask for “commercial invoice” associated with your tracking number. They can send it by e-mail or fax. Please make sure they got your address correctly – ask to spell it back. They will send it right away in .zip archive to your e-mail. Shipment’s invoice has the Unique Shipment Identifier Number needed by CBSA as well. This is how it looks like (click on image to enlarge):

- Find out what is the address of your local UPS warehouse where your package is being held. Call and ask UPS if you can’t figure out. CBSA may ask for this information during self clear. For GTA (if you see “Concord” in the tracking information) the address as of Nov. 2010 is:

UPS Center

2900 Steels ave. W,

Concord, ON, L4K 3S2

phone: 800-742-5877

- Take your shipment’s invoice, address of UPS warehouse, money to pay taxes and photo ID to the nearest CBSA office. Please take the reply from main CBSA office with instructions about self clear process for the case if officers in your local office are not aware with the proper procedure. You may find their reply at UPS/FedEx Brokerage Fees – avoid scam – section almost at the bottom of the post, just between solid grey lines. Last time I visited CBSA office in Brampton at the following address:

CBSA Brampton: office 480

197 Country Court Blvd.,

Brampton, ON, L6W 4P3

office hours: 8:30 – 16:30, Mon – Fri

!! – recently address has been changed to:

5425 Dixie Rd.

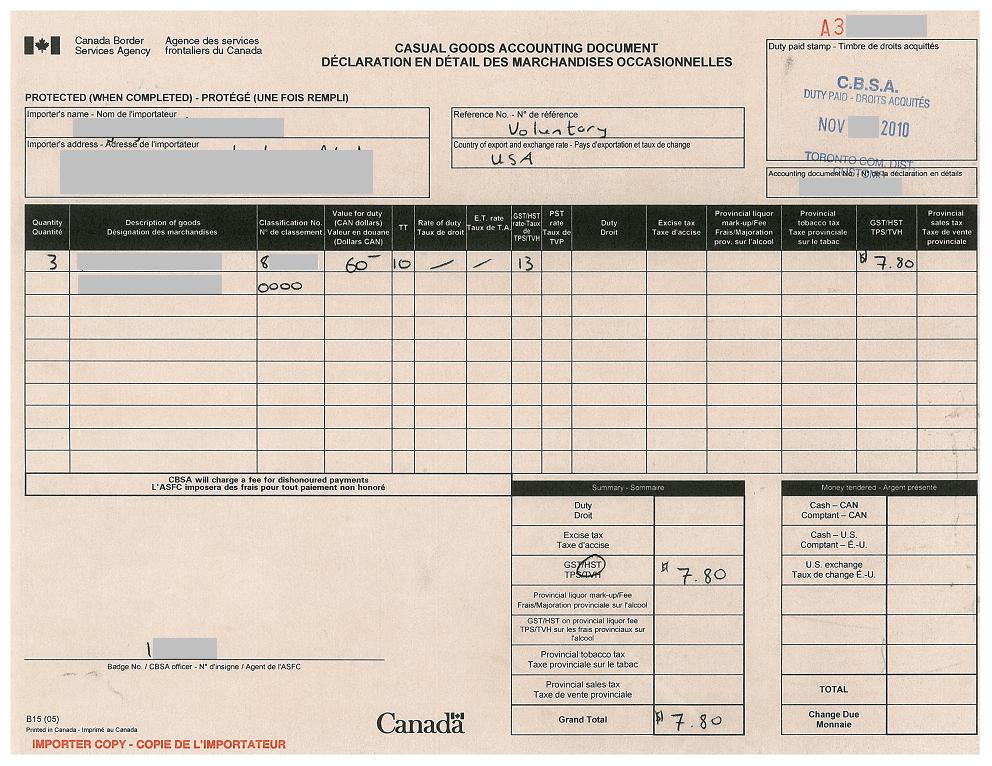

- Present your shipment’s invoice to customs officer and he will do clearance for you. After paying applicable taxes and duties to the cashier you will be provided with CBSA B15 form – Casual Goods Accounting Document, which confirms that you paid all the taxes to Canada customs. B15 form looks like this:

- Call UPS and ask how to provide them with B15 form (proof that you paid taxes) in order to waive brokerage fee invoice. They will give you fax number. Please make sure that you put your tracking number of the cover page. As of Nov 2010 CBSA B15 form should be sent here:

UPS Brokerage Department

fax number: 1-770-990-1724

- After that UPS Brokerage Department should process your B15 form and waive C.O.D. charges. It may take 1-5 days. You may also try to speed up the process by calling UPS and informing them that you already paid taxes to CBSA and sent receipt to the brokerage department. Ask UPS to schedule delivery.

You are done!

I have not done it with FedEx or other couriers, but procedure should be very similar.

Hi Ian,

If you’ve already paid taxes to CBSA, UPS can not force you to pay it again. Brokerage fee is the fee for UPS paying taxes on behalf of you to CBSA. So, there should not be any brokerage fee. This is exactly how it worked for me and many other importers.

Thanks,

Trueler

Hi Matt,

Official memo that reply from CBSA I quoted was an error?! Really? Have not seen this. Why they have not contacted me?

Seems like they just misinformed you…

Thanks,

Trueler

Hi Leanne,

As far as I remember, there were importers who paid taxes themselves at local CBSA offices for FedEx shipments.

This procedure is valid for any courier who participates in CLVS program.

Regards,

Trueler

Hi JS,

Cargo control document is not needed for sure. And UPS don’t provide it. Government organizations MUST NOT ask taxpayers for documents which they can’t get. Thanks for sending a complaint. I hope it will help to change things and make paying taxes easier for importers. What the **!! Taxpayers honestly want to pay taxes to the Government, and they don’t accept it! Eh…

Regards,

Trueler

Hi Nick,

When goods are released at the port of entry, taxes are still not paid to Canada Customs. UPS just promises to CBSA that taxes will be paid prior to the shipment is released to the importer. It can be paid by a broker, or by importer. Sometimes people answering CBSA toll free number are not aware of the proper procedure. When I called them, one time they told something like you heard, another time they confirmed that importer can pay taxes at any local office. Recently one of the importers confirmed this procedure by contacting CBSA via e-mail.

So your local office refused to follow instructions from CBSA Ottawa? How is it possible? How did they explain that?

Thanks,

Trueler

So far, it’s been a rocky process to self-clear a 200$ package through UPS. They purposefully give misinformation at every step requiring me to insist on my rights to clear my own items. They consistently use the port-of-entry as a scare tactic. My questions is on my tracking it lists the package has gone through their brokerage (I called to change this before it crossed border but was told it could not be done.) It is in my town, I have a B-15 and have paid taxes. Now I was told to fax to brokerage dept. and wait. Can they FORCE me to pay their brokerage fees after I have paid the duty myself? I hope the B-15 was not for naught.

I am trying to clear a package coming into toronto and was told by customs that I have to go to fort erie or windsor to clear(wherever it comes in) I mentioned this site and they said it is wrong and there is an official memo out saying that this is in error.

Matt

Do these procedures work for FedEx Ground who charges you upfront for brokerage fees?

**LONG READ but informative**

I just wanted to voice my frustration with this process of self-clearing.

I bought an item from a store in Seattle and they didn’t have it in stock at their store, so the company said they would ship it to me from their Tampa Bay, Florida location. The item was $200 plus $35 for S&H. Little did I know that they would use UPS Standard Shipping which charges a brokerage fee. When the UPS driver came with the package to my home in Edmonton, I was not home so he left a little yellow note saying there would be a second delivery attempt and also left a note saying the COD for the package would be $64.xx.

So I found this site doing my research on how to avoid brokerage fees. I called UPS and told them to hold the package at the Edmonton Customer Centre Warehouse until I was ready to come in and pick it up. They said the package would be at the location for 6 business days.

Having read this site, I went into my local CBSA office at the Edmonton International Airport with the following information:

-Courier Company

-Location where item is being held

-Commercial Invoice

-Unique Shipping Identifier # which is located on the Commercial Invoice.

-Tracking # from UPS

I was a bit weary about going because I have seen on other information websites (avoidbrokeragefees.blogspot.com) that you also need a cargo control document. I tried several times to request a cargo control document from UPS, and every time they said that all they have on the system is the commercial invoice. I think once the item is cleared at the point of entry, the cargo control document is issued. They had to idea what I was referring to. So I went with the items I needed based on your “procedure for self clearing†I even printed out the email from CBSA.

I even further did my due diligence, and was able to obtain the phone number of the local CBSA office (I got it from the Edmonton Airport) as CBSA would not provide it. I told the person on the phone that I would be bringing the items I listed above and if that was enough. He said yes. I also asked if the cargo control document was needed and he said I should be alright.

So I went to the office at the Edmonton International Airport. They said they could NOT issue the B-15 form because I did not have the cargo control document. I showed them the official email response and they still refused. I told them I have done this before and that I had called in before hand and the person on the phone said I would not need the cargo control document. They insisted I needed it and also mentioned that once the item is at the point of entry, a cargo control document is issued. UPS would not provide me with this. So I left frustrated, after I gave the rude and arrogant CBSA officers a peace of my mind. I called them dicks and left.

So I called UPS once last time in a last ditch effort to get the cargo control document before I buckle and just pay the ridiculous brokerage fees.

I insisted they email me the cargo control document, but the lady (who was very polite and professional) insisted she didn’t have it in the system. I told her I had done it before and that in order to get a cargo control document they would need to send the package back to the point of entry (in my case Winnipeg), and get the cargo control document issued and then email it to me. The more detail I gave her about how much I exactly knew about all this (after all my research) she put me on hold a few times.

FINALLY, after being on hold a few times, she reduced the total brokerage fee from $64.xx including taxes and duty to $23.11. Too much of a headache to further pursue this. I will be picking up the package today or tomorrow.

Lots of incompetence on UPS and the CBSA’s part. I will be sending a complaint to CBSA for not knowing the procedures, but I’m beginning to think you do need the cargo control document and the only way to get it is, to issue a “self clear†before the item enter the port of entry.

Hi Trueler,

I have tried to get my local CBSA office to accept your official response from CBSA Ottawa and I’ve also quoted the D memo 17-4-0.

They said they wouldn’t do it unless the goods were still at the bonded warehouse and that the bonded warehouse is in their jurisdiction. Since the goods were already released from the bonded warehouse the goods are considered to have been cleared by the broker, the officer said there was nothing they can do.

I asked if there was something I could have in writing that specified this and he showed me section 56 of D17-4-0:

56. If an importer wishes to account for the goods himself or herself, the courier does not release the shipment to the importer but holds the goods until the importer presents satisfactory proof that the appropriate duties and taxes have been paid directly to the CBSA. The importer must note the unique shipment identifier number and contact the courier to determine where the goods are held in a bonded warehouse until the release is effected.

He said that sinced the goods were already released from the bonded warehouse the importer can no longer account for the goods themselves since the broker has already submitted the entry.

I called the toll free number, and spoke to a lady there that said the same thing, I tried explaining to her that there weere plenty of people doing this and I also quoted the specific response you had from CBSA. The lady transfered me to a “senior” officer to confirm and the senior officer said the same thing.

The senior officer added that if UPS shipped the goods to a bonded warehouse that happened to be located in my area then I could have made prior arragements with UPS to make sure they didn’t clear my goods, but once the goods have been cleared it’s out of their hands.

Any advice? I really feel as though I don’t have any solid ground to stand on, and I don’t want to end up losing my package either.

UPS warehouse does not have to deal with CBSA office you want to pay taxes at. It’s a misinformation. Unfortunately, no one at your location wants to obey official rules. I really advice you to file a complaint.

Thanks,

Trueler

Ok I surrender. Called CBSA today, and they said I could self-clear, but had to find out what particular “CBSA” office the local UPS warehouse deals with and that they didn’t know. Called UPS and they said I had to contact the Fort Erie (the CBSA office?) and talk to a customs officer, get him to approve self-clearance, his name, his badge number, detachment number than forward all this info to the local CBSA office. After that no gurantees the local CBSA office would coordinate any of this…sounds like you people in GTA have a much easier time doing this.

Yeah I agree, I showed them the webpage off my phone of the CBSA response, but these uninformed/lazy people at the CBSA office just dismissed it as an unofficial website. It truly is infuriating that government workers do not know their own jobs, and on top of that will call UPS, a private organization to see what the rules are. On top of that, they want me to provide information from the CBSA top office, and prove stuff to them. I mean, WTF is their job exactly? It’s bad enough we pay their salaries, and they also want us to do their jobs for them?

It seems like I have to prove every little detail to them. I can foresee after showing them the official documents I found, they will question whether UPS is part of the CLVS program and want “official proof” of that.

Anyways, my package which is important to my work is in limbo over the weekend at the local warehouse. I’m going to give this one last shot at the CBSA on Monday, but if I can’t convince them with the documents I found, I’ll just pay the close to 100 bucks…

Hi Joseph,

Reply from CBSA answers all your questions and represents complete instructions how to self clear. You do not have to prove anything at your local office.

UPS participates in CLVS program.

Seems like you local CBSA office is just afraid of UPS and do whatever UPS wants them to do in spite of the importer’s rights… I think you should definitely complain about this case.

Thanks,

Trueler

Ok, the local office’s main claim was that 1) taxes and duties were already paid by UPS (can I prove this is untrue somehow?) so they couldn’t accept further payments and 2) there is an agreement when originally shipping a package via UPS that they will handle the brokerage things for me (can I prove this is untrue). I honestly just want to go on Monday and clear this up quickly. In fact, I’m not even sure if my package will be kept at the local warehouse? I told the driver I am going to try to pay the customs myself, is there policy on what they do with refusal to pay CODs? Like do they ship it back to the border or hold it for a certain number of days?

I am printing some pages off this document I found on a prior post:

http://www.cbsa-asfc.gc.ca/publications/dm-md/d17/d17-4-0-eng.pdf

The two sections which I think will help me are these:

“Authorization of Couriers

52. Casual goods imported by authorized Courier LVS Program participants may be released before being accounted for and before payment of the applicable duties and taxes. Couriers wishing to account for casual goods in lieu of the importer must request authorization from:”

-is there any chance that UPS does not do this, and can they say UPS actually paid and accounted for their shipments at the border?

“56. If an importer wishes to account for the goods himself or herself, the courier does not release the shipment to the importer but holds the goods until the importer presents satisfactory proof that the appropriate duties and taxes have been paid directly to the CBSA. The importer must note the unique shipment identifier number and contact the courier”

Now this section is very helpful.However, it appears to all hinge on whether or not you can prove UPS is one of the couriers that is part of the program that gets casual goods released prior to being accounted for and paid for?

Is the fact that it is COD mean that they are part of the program?

Thanks again. I really want to clear this up on Monday. Some of the people at the office were really rude to me. And it still pisses me off the guy called UPS, got lied to, and didn’t call the CSBA, his organization instead. Small towns…

You just show them instructions from CBSA Ottawa e-mail. It’s their responsibility to follow official instructions. If they refuse, first you may write an e-mail to contact@cbsa-asfc.gc.ca (it is from their website) providing the reply from CBSA Ottawa which I mentioned in my previous comment and information about the local CBSA office you went to.

It is really inexperience on their part. I would even say incompetence, because as you mentioned “The local office actually called UPS instead of CBSA to confirm what the rules were”. Not CBSA should follow UPS rules! UPS should follow CBSA rules! UPS have their “rules” to rip-off customers like late invoices and lie about importer’s right to self-clear in a local office…

These people were pretty hostile. What if they refuse to write a refusal? They did mention no one has requested this locally, so I’m sure this is due to inexperience on their part.

Joseph,

Please print the section “How to pay duties and taxes for imported goods” from this post:

http://trueler.com/2010/09/13/ups-brokerage-fees-total-scam-fraud-cheating-avoid-it/

and take it to CBSA office. It is an e-mail reply from CBSA Ottawa. They must follow these instructions.

UPS pay taxes on your behalf only by the end of the next month. So, it’s not true. Manifest is not required as well.

If they refuse to accept taxes and issue B15 form, ask them for written refusal and advise them that you will file a complaint to the Ministry.

Please note that it is an approach which have been proven by many importers. Most likely officers in Thunder Bay CBSA office are still not aware of the proper procedures because nobody tried it before. You could be the first one! Insist on your rights!

Thanks,

Trueler

Ok, wow I am pissed. Just went to the Thunder Bay CBSA office to try to pay for something, and they said they couldn’t do it because UPS already “paid the taxes” on my behalf. I tried to quote some stuff off this website, but they dismissed it as only a website. They said they required something off the office CBSA office. CBSA customer line was closed by the time I tried to call. Any ideas on an official webpage to give them on Monday? or should I call CBSA on Monday and get some type of direct number for the local office to call? Other things the local office mentioned were possibly requiring a “manifest” document and that they may only be able to release stuff from “certain warehouses”. My item is currently at the local UPS warehouse, after refusing to pay during the delivery today. The local office actually called UPS instead of CBSA to confirm what the rules were. Frustrating.

Hi Joseph,

I’m not sure what the customs invoice is. I guess it is the invoice which the driver shows you at the delivery time or which UPS sends month later. It is basically a bill for their brokerage services.

This is what I’ve been asked at a local CBSA office:

– Commercial invoice with description of goods and value for duty. It also had Shipment ID on it.

– Where the goods are located now. One time they were in my trunk (driver did not ask to pay at the door) and another time they were at a local UPS warehouse. Important thing is that the goods must be already released by Canada Customs at the port of entry

– If I’ve already paid taxes to UPS – No

– Photo ID – driver’s license

– Money to pay HST

Regards,

Trueler

Hi,

Sorry to post so much. So I just called UPS and was emailed the commercial invoice which resembles the one on the top of this page (not identical, basically states the value of the item which I think is the critical part?). However there is another invoice called the customs invoice that I can only get by fax, do I need that as well? I was told it has the brokerage fees on it. Thanks again.

@ Joseph:

You definitely have a right to pay taxes yourself at a local CBSA office. At the time of payment the goods must be held in your local UPS warehouse – it is a requirement which guarantees to the officer that the shipment has already been released by Canada Customs at the port of entry and inspected if needed. Tell the delivery guy that you are going to dispute C.O.D. charges. When he/she comes take a note of Shipment ID number from the package (it is different from tracking number).

Regards,

Trueler

Another thing, looking at the tracking number, the shipment has already entered Canada, do I still have time to go to the CSBA and pay myself? Even if the delivery guy comes to my door, can I refuse the package, ask them to hold, and then go to CSBA and pay at that time as well?

Hi,

I just phoned a local canada customs office, and the person I spoke to said he was pretty sure you couldn’t pay the customs yourself for a UPS shipment at the office, something about being an “inland” facility and only accepting payments for goods held in bond at a specific facility. This is the Thunder Bay office. Does this sound right to you?

Hi Joseph,

You should present shipment’s invoice to the local customs office. UPS sometimes call it commercial invoice. You can get it from them by e-mail or fax. It describes goods and specifies value for duty. It will help customs officer to apply necessary taxes on it.

Thanks,

Trueler

If one is expecting an item shipped via Ups that was a second hand item purchased on ebay, and this item was marked as a gift by the seller. What would be the means to provide proof of purchase to the local customs office? A paypal receipt? Would this raise conflicts with item on the commercial invoice etc. being originally marked as a gift? Any other way to prove the value at the custons office?

Nathan, I hope you will be successful in using your rights as an importer!

Regards,

Trueler

Hi Brian,

You got a prompt reply from CBSA for your question. That’s right: you can not prepay taxes, because the package must be assessed and released by Canada Customs at the port of entry first. Only after that you can pay taxes for your shipment at any local CBSA office. The package must be located at your local courier’s warehouse – this is a requirement which ensures that goods have been already release by customs at the port of entry.

I think CBSA representative misunderstood a bit your question, because you’ve asked about any courier, but they replied about Canada Post. However, it does not really matter in regards to your question.

Thanks,

Trueler

I have a package coming from the US, and would like to avoid paying the excessive brokerage fees associated with it. Using the calculator, it appears the fees will amount to approximately 70 dollars for a 270 dollar item.

I contacted UPS today to arrange for self-clearance and was advised that I would have to present myself at Windsor (the first point of entry) in order to clear the item myself. I advised the lady on the phone that I had done it in my home city before, and she immediately got her back up and insisted this wasn’t possible. Also insisted I give her my previous tracking number where I did the self-clearing as she “hadn’t seen someone do this in all her years”.

Rather than fight with her, I will wait for the package to clear the border and move along to my home town. We’re lucky to have a CBSA office at the airport which will process CLVA items, so wish me luck!

avoiding brokerage feesâ€

17/07/2011

Reply â–¼

brian rafferty

@hotmail.com

To contact@cbsa.gc.ca

hi

i live in vancouver and was planning on shipping a $1300 part from the usa, can i bring a computer print out of the bill, with the couriers name and tracking # to a cbsa office and prepay? and if so which office in vancouver, is 685 Hamilton Street office ok?

thanks

brian

“CBSA RESPONSE”

RE: avoiding brokerage fees **10742**â€

18/07/2011

Reply â–¼

CBSA-ASFC_​CONTACT Add to contacts

To brian

Thank you for your inquiry on pre-paying duty and taxes that may be charged for an item shipped through the mail. Unfortunately, this option is not available for imports

through the mail.

For postal imports, the Canada Border Services Agency (CBSA) calculates the duty and taxes based upon the product type, value and country of origin. However, the Canada Post Corporation is responsible for the delivery of the goods to the importer (addressee of the goods), as well as the collection of the assessed duties and taxes on behalf of the CBSA. Final accounting of all duty and taxes owing is the responsibility of the importer and is collected by Canada Post prior to the item being released/delivered.

Should you have further questions, please contact the Border Information Service (BIS) by telephone and speak to an agent directly. You can access the BIS line free of charge throughout Canada by calling 1-800-461-9999. If you are calling from outside Canada, you can access the BIS line by calling 204-983-3500 or 506-636-5064 (long-distance charges will apply). If you call during regular business hours (8:00 a.m. to 4:00 p.m. local time, Monday to Friday, except holidays), you can speak directly to an agent by pressing “0” at any time.

Thank you for contacting the CBSA.

Hi Laura,

Customs/brokerage fee is applied when any taxes are due. No taxes – no brokerage fee. If anything is subject to HST in Canada, so it is a subject to HST when imported from US. I could not find the document now if used toys should be taxed in Canada, so I can’t tell for sure. As I remember most of the used goods purchased privately are not taxable (it’s not 100%). Anyway, if UPS denies to waive brokerage fee, you may use this self clearance approach and CBSA officers will properly rate your goods and tell if you have to pay taxes on it.

If anyone can provide info how used goods are taxable in Canada it would be helpful. I’ll try to figure out later.

Thanks,

Trueler

Do you need to pay customs/brokerage fee on used items?

This sounds stupid, I bought on ebay a lot of 39 used trains for my kids (Thomas and friends) for $40, I received the UPS slip today and they want to charge me $39.30 on brokerage fees. It doesn’t make any sense, and reading your post, I know what to do…for new items, but I don’t even know if it applies for used items. Does it? I don’t seem to find information on that…

thanks!

Success!! :)

You might want to read the

first part of my story.

I gave a call to UPS today and they confirmed me that my bill was “revised to 0$”. The clerk at the UPS counter actually inquired on how I managed to waive the COD charges. It seemed like it she never saw someone doing that before.

I’m surprised that it finally worked out because UPS told me that they would only refund the taxes (~18$) and I would still have to pay to brokerage fees (~45$) plus a rebilling fee of 15$.

BTW, the UPS representative told me to fax my B15 form to 1-506-447-3706 — maybe because I wrote my question in french.

Thank you so much!

Guillaume

Sheldon, it could be a bit unclear in the post, but one of the requirements to self clear at a local CBSA office is the shipment located at a local UPS warehouse. It means for customs officers that it has been released at the port of entry. They may request to wait for it first.

Thanks,

Trueler

Hi Trueler,

Thanks for the information, I called UPS again and they have e-mailed me the commercial invoice. So now I will wait for the package to arrive as the Fort Erie Warehouse, then take the information to the local CBSA office and see how it goes.

Sheldon

Hi Sheldon,

No, that’ not true. Using this method, you can schedule another delivery to your door after you fax B15 form to UPS.

CBSA gave you wrong information as well. If the package is already in a local UPS warehouse it means that customs officers already inspected the shipment if it was necessary. They should not want to inspect it again.

Know your rights and insist on your rights!

Regards,

Trueler

I called UPS to self-clear a package and they told me I would have to go to the Fort Erie warehouse to get the paper work for CBSA, and then have to pick up the item from the Fort Erie warehouse also.

I tried calling CBSA about self-clear an item and he said that the customs officer may want to inspect the item, so it would have to be done in Fort Erie so they could go to the warehouse to see the package.

From talking with UPS, if I tried your method, I would end up having to pick up the package from the Fort Erie warehouse if I did manage to do the self-clear the shipment. Is this true?

Thanks

Sheldon

Thanks for update Guillaume.

I went to the CBSA office today and in short the hardest part was finding the building. :)

When I met with the agent, I showed him my papers and he asked “Is it for a refund?” I answered that I wanted to pay the taxes so that I can get a refund from UPS.

He also asked for my waybill but didn’t leave me the time to answer and said “ok, there’s a tracking number” and wrote the tracking number on the B15 form.

Then basically the agent said nothing for about 20 minutes while typing the form then handed me the B15 form saying “Show this and they’ll refund you.”

I faxed this with other paperwork (commercial invoice + brokerage COD) to UPS.

I’ll let you know how it turns out!

Thanks again,

Guillaume

Hi Guillaume,

Since you have documents necessary to pay taxes to CBSA, so you may just go there and send B15 to UPS after. Then COD charges should be waived by UPS – it may take 1-3 days. If you call and remind them it takes faster. Then you may reschedule delivery. I hope you will not have any problems at CBSA office paying taxes.

Regards,

Trueler

Hi from Quebec city. I’m trying to avoid paying 63$ fees on a 135$ item but I’m not sure what to do…

The delivery man came yesterday to my house asking for 63$ COD, I refused delivery and he told me to come pick the paperwork at the warehouse the next day.

Reading this blog, I called UPS and asked for the paperwork to be sent to me by email but the representative would only tell me that “the item has already been cleared”/”the work has already been done.”

I drove to the UPS warehouse and the (nice) lady at the counter gave me the waybill and the commercial invoice but told me that I should make arrangements with UPS before paying to the CBSA to avoid having to pay twice.

She told me that she could not give me the package even if I provided the B15 form, she would need confirmation from UPS that the COD fees were waved.

So should I just go to the CBSA office and fax the B15 form to UPS or will I just end up having to pay the COD charges because “the job has already been done?”

Thanks a lot!

Guillaume

Hi B Smith,

It’s indeed frustrating experience. Thanks for sharing.

I think there are thousands of people who get falsely charged duty taxes and brokerage by UPS. Several people already reported such cases here, like HST on tax exempt medical devices, on replacement items, etc.

Thanks,

Trueler

Hi Trueler:

UPS called me yesterday. They told me that they were issuing a full refund because they had erroneously charged me for both the HST and brokerage.

But the reason the brokerage was refunded was NOT because they don’t charge brokerage on Warranty Repair or other zero rated items, because in fact they do charge even if the item has no HST or duty. They refunded because the item was shipped International Express -which includes brokerage.

So now I’m even more annoyed because:

1) they charged me HST when non was due

2) they charged me brokerage when non was due

3) they refused at least 3 times to refund the brokerage when they should have known that non was due

4) all they did in the end was apologize for the errors and give me a refund of the money that was owed.

4) they charge brokerage fees on the value of items regardless of their zero-rated status.

5) they charge rediculous fees for brokerage (not only UPS do this)

So let this serve as a warning to all of us. The only way to avoid brokerage fees on standard shipping is to self clear. It’s a pain to do it but it’s the only way as far as I can see. Thankfully Trueler provides all the information and help on this site to do this.

In my case if it came down to self clearing or paying brokerage (if it had been shipped standard) it would not have been worth my time to do self clearing as it would only save me as a $10 fee.

I wonder though, how many people get falsely charged duty taxes and brokerage by UPS? I’m sure I’m not the first and I won’t be the last.

Hi Bill,

It is frustrating, but they misinformed you because they are not aware of the proper instructions. Fell free to file a complaint.

Mention in your complaint that they did not even bother to look at the instructions and showed total ignorance. Also mention that these instructions have already been honored at other CBSA offices.

Sometimes it works when you ask officers for a written refusal to accept taxes and issue B15 form.

Thanks,

Trueler

They didn’t even want to look at the instructions. They only have numbers on their vests, no names. The one lady was very quiet, and the senior lady did all the talking with a hostile overtone. I tried to explain the instructions, and referred to memorandum D17-1-3 which covers B15 forms, and was told that only flies at the port of entry.

Hi YU-JO,

These instructions are general instructions how to self clear for everyone, not only for me. They have been sent by the Government of Canada – CBSA Ottawa. If officers do not honor these instructions, they won’t honor anything on their own website. Just take their names and file a complaint to the ministry if they ask you for manifest which is not required according to the instructions.

Thanks,

Trueler

Hi Trueler,

I have same situation just like Bill as well. I went to local CBSA twice and met two officers who all told me I need the copy of shipping manifest. I provided them info as below:

Tracking number, shipping number, invoice from paypal, invoice from UPS Billing Department. (I called UPS Billing Department to request commercial invoice but it only showed like

paypal inovice which I got similar before, it doesn’t look like the one you showed us the invoice from the Instructions)

They refused me as I don’t have the copy of shipping manifest. I called USP rep and she told me they don’t have manifest number because it was low value. And I went through the

supervisor who told me the same story. They said they are able to request for me to get the copy of manifest and I need to wait up to 48 hrs. They also said they will send the

package back to Winnipeg first and give me the copy after. I was so upset and hung up..

I was talking to the same rep on the phone today again @8:30 am. I called Mandarin Tel: 1800-742-5877. Her name is Jessica and her employee number is 2311. I didn’t ask Supervisor’s name who spoke to me in English.

Are the instructions, “How to self clear shipment at CBSA and avoid UPS brokerage fee†the standard procedure issued by CBSA, or were they from your personal experience? If it’s from CBSA, could you advise where I can find it on CBSA’s website? I’m concerned that CBSA may not agree with the instructions if they are from your personal experience.

Hi Bill,

Did you show instructions how to self-clear to CBSA officers? Did they refuse to honor them? Did you write down the names of the officers to make a complaint to the ministry? Instructions clearly show that shipping manifest is not required, only commercial/shipment’s invoice.

Thanks,

Trueler

Hi B Smith,

Yes, please let our readers know. I understand that it’s not just about $10… Thanks a lot for adherence!

UPS lied in response to you here:

“A Brokerage fee is charged to process your shipment and present your paperwork to customs on your behalf”

It is incorrect information. Actually the courier must present paperwork to the customs, not the broker. It is specified in one of CLVS documents. Broker pays taxes on importer’s behalf.

Thanks!

Trueler

Shot down in flames. Calgary CBSA states I need:

Commercial invoice

Shipping manifest

This is all they want, they don’t care about any shipment identification, etc. If you do not have a manifest, they won’t do a damn thing. Why is the story different at every CBSA office? Shouldn’t they have the same protocol in all areas? Contacting UPS, I was told that if I wanted to clear the shipment myself, I’d have to travel to Winnipeg. There is no way to get a manifest from them. I give up, you just can’t win, just like everything else in this country, the rich keep getting richer, and the poor keep getting screwed.