Green Cricket (greencricket.ca) is Toronto (Canada) based online store operated by Susan Mey specialising in natural organic baby products. It also offers cleaning, homecare, and personal care products.

There is a list of goods in Ontario for which only 5% GST portion of HST (which is 13%) must be applied. This list includes diapers, books, feminine hygiene products, car seats, blankets, children’s clothing, newspapers. The list of exceptions is given here:

HST (PST Component) Exemptions – Ontario

The same thing is happening in BC as well. HST is 12%, but for the list of exceptions only 5% should be applied:

HST (PST) Exemptions or Point-of-Sale Rebates for British Columbia (BC)

=================

Important Update:

Green Cricket has properly fixed the problem with taxes and does not overcharge customers anymore! We have checked it for Ontario and BC only. Moreover, Green Cricket applies only 5% taxes in Ontario on all the products (not only exemptions).

Updated on January 25, 2011 after checking greencricket.ca website

=================

Green Cricket (greencricket.ca) applies 13% HST taxes on everything to be delivered in Ontario and 12% for BC! They illegally and intentionally overcharge many items by 8% in Ontario, and by 7% in British Columbia. It is happening for three months already, after new HST law came into effect. Green Cricket does it intentionally because there were complaints addressed directly to them, but greencricket.ca did not want to fix their ordering system, and they just continue to grab extra 7-8% from customers for many products. Recently Green Cricket has been featured on Groupon with approximately $35000 (35 thousands) certificates sold. And they intentionally did not correct such an outrageous mistake, and continued to cheat customers. Beware of this place! Probably they are cheating on quality of the products as well!

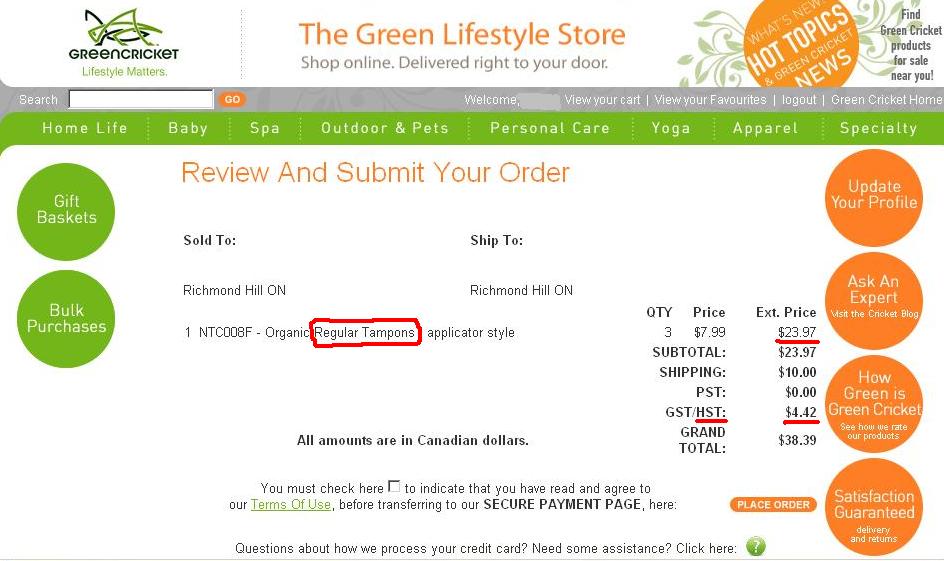

Here are the proofs from Green Cricket (greencricket.ca) website:

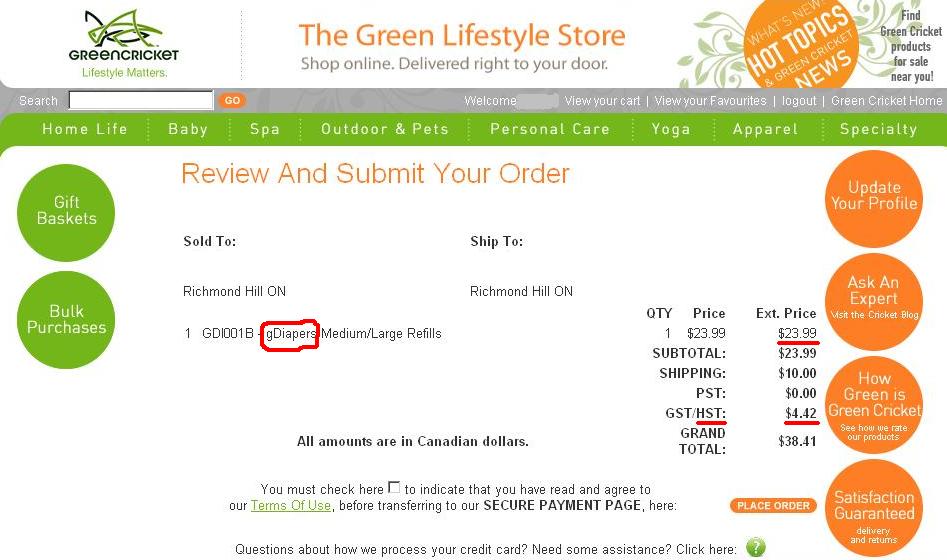

Diapers

(click on image to enlarge)

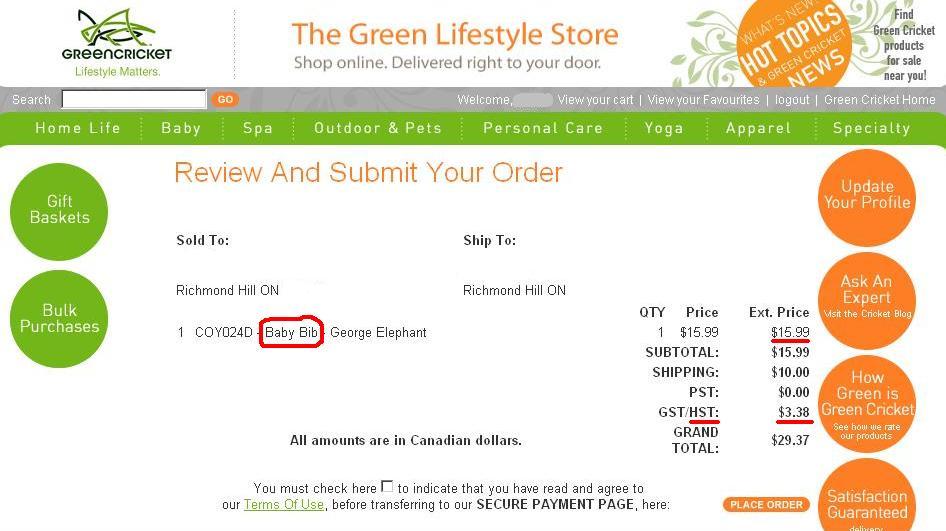

Baby Clothing

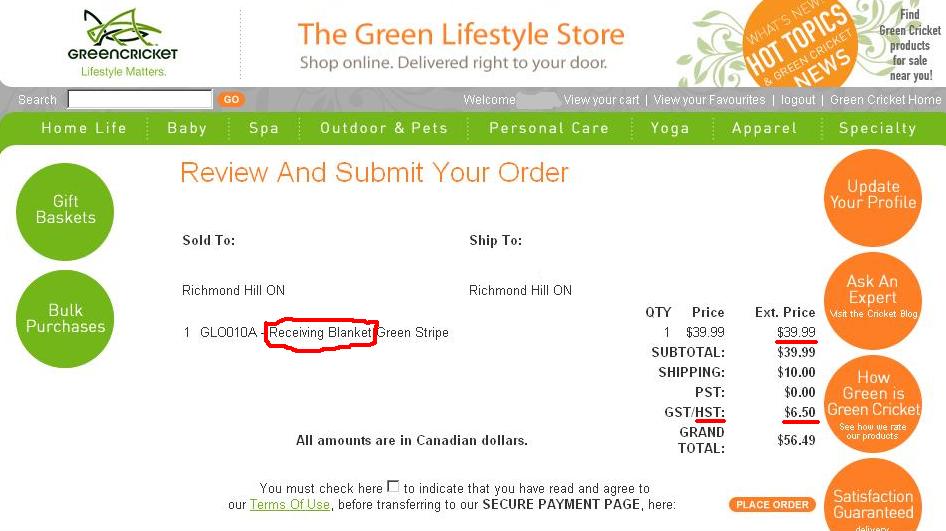

Books

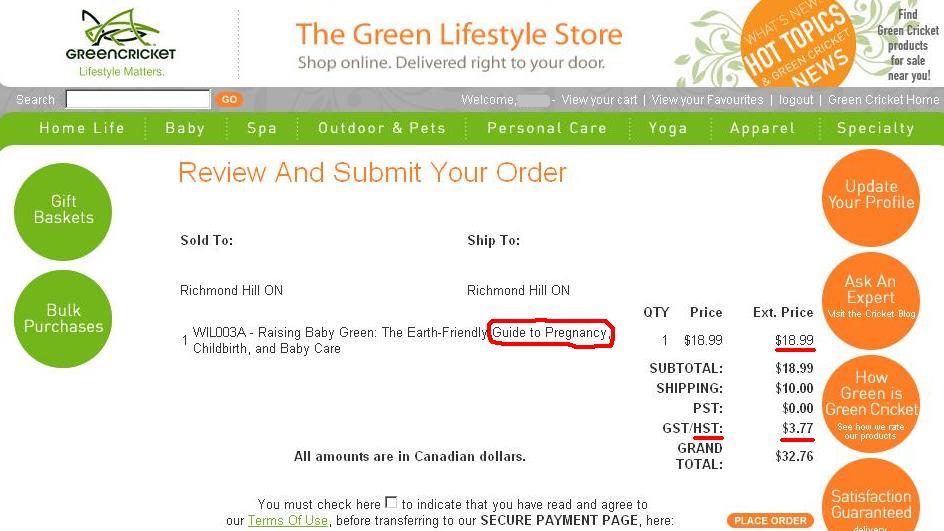

Feminine Hygiene Products

And there are many other products which Green Cricket (greencricket.ca) illegally overcharges by 8% in Ontario and 7% in BC.

Hi Susan,

On July 1, 2010 HST law came into effect, and Green Cricket started to charge 13% taxes in Ontario and 12% taxes in BC for all the products, even for exemptions which were always subject only to 5% GST. Why Green Cricket started to charge more?

It is not government money. It is customers’ money! And customers are wasting 7-8% due to Green Cricket “errors”.

A retailer must pay only 5% GST to the government when do accounting for exempt items (like those in the article). Green Cricket must do the same. No one forces the company to pay entire 13% to the government (for Ontario) which customer already paid to Green Cricket.

In Toronto you don’t charge delivery, but in GTA (where many of the Groupons have been sold) you do.

Probably Groupon sold 660 coupons, instead of 652. It does not make big difference. The total value of the Groupons sold is even more – $36300 (660 x $55 value).

Contact name for this blogpost is Trueler. You may contact via comments or “contact us” form.

Thanks,

Trueler

Trueler,

It would be better for you to call our office to discuss many of the statements in your post. There is no contact name or address on this blogpost.

We do not charge customers for orders being delivered in Toronto over $50.00. There is a flat rate fee of $10 plus tax otherwise. You are correct though, that any delivery fees (if owing) were not included in the Toronto Groupon. The $55.00 included merchandise and taxes, so I should not have referred to delivery fees as being included in the Groupon in my response to your article. You are correct that they are charged separately, but only if applicable in that case.

Groupon sold 660 Groupons on August 30 at $25.00 each directly to customers. You can contact Groupon directly to verify this.

We had changes installed for the website when HST came into force this past July 1, 2010, and we are now looking at whether there was an error in the way tax is calculated on the items you mentioned since that time. We have never had any previous issue with this. We would have no reason to charge more tax than absolutely necessary – its all government money as you know!

Thank you for bringing this issue to our attention and please contact us directly if you have any further concerns.

Green Cricket

Hi Susan,

This is not customer’s complaint. It is Trueler’s investigation which revealed that Green Cricket overcharges all the exempt items (diapers, baby clothes, etc.) by 8% in Ontario and by province-specific PST rates for other places.

It is impossible to believe that during Green Cricket’s life (over two years) nobody pointed you to the wrong taxes which you apply to many products. Maybe you refunded PST portion of the full tax (GST/PST or HST) to particular customers who complained directly to you, but ordering system has not been fixed, and Green Cricket continued to overcharge customers.

Groupon sold 652 Green Cricket coupons with $55 value. It is $35860 value in certificates sold, which is stated in the article: “$35000 certificates sold” (rounded to the lower thousand dollars). Why are you saying “not 35,000 as stated here”?

You sold all those Groupons not to customers in Toronto who have free delivery. Lots of them have been bought by customers in GTA, and you charged additional $11.30 per order.

All the customers did pay taxes, no matter using Groupon or not. Why are you telling they did not?

You are telling that delivery could be covered by Groupon. One more discrepancy. You (Susan M.) clearly stated on Groupon discussion board that delivery charge of $11.30 is extra and will be applied to the credit card. Customers could not use part of their coupon to cover delivery, even if their orders were below $43.70 (including taxes). Here are your answers at the forum (click on images to enlarge):

Thanks,

Trueler

We were not aware of any issues with taxes on the particular products mentioned by this customer, and we are now looking into this immediately, and will be making any necessary changes.

We sold 660 Groupons to customers (not 35,000 as stated here) in Toronto at the end of August, and so those customers using their Groupon did not pay for taxes or otherwise if their total order after delivery and taxes was under $55.00 as stated in the Groupon.

If customers have any concerns about their order, please call us at 1-877-476-2758 and we will address those issues promptly.

Green Cricket