On November 15, 2010 Groupon featured a new deal in Toronto: “$30 for $60 Worth of Children’s Toys, Gear, Clothing, and More from Peek-A-Boo“.

It looks like a good deal, but first of all I’ve made some research. I could not find any reviews, complaints or positive feedback, so I just went to their website: www.peek-a-boo.ca

Variety of goods is quite small. Probably assortment in their actual store in Toronto at 603 Saint Clair Ave. W is bigger.

Prices are not low, not too high. I’ve tried to add several items to the shopping cart. It showed 13% tax almost on everything! On some products it showed misterious 8% tax! I can’t tell from the top of my head which products are subject to 8% tax in Ontario now.

Peek-A-Boo store in Toronto specializes in Children’s products, many of which are subject to 5% GST portion of HST only. Not 13% (full HST), not 8% (PST portion of HST). Such products are: children’s clothing, car seats, books, blankets, etc. For more detailed list of products which are exemptions, i. e. are subject to 5% tax please see:

HST (PST component) Exemptions – Ontario

It looks like Groupon staff did not make enough effort to figure out if this business (Pick-A-Boo) deserves the right to be advertised. Groupon admitted tax cheating business to be featured on the main page, which is seen by a lot of people.

It is not the first case when business which overcharges taxes is featured by Groupon! About three months ago it was similar complaint for Green Cricket online store, which was charging 13% HST on everything:

Green Cricket wrongly charges HST on Diapers and other Exempt Items

Groupon users and all other customers! Beware of Peek-A-Boo overcharges! They grab up to 8% of extra taxes for children’s clothing and footwear, bunting blankets, books, etc.

Note that current Groupon coupon does NOT include taxes, so it will be extra. And they charge too much of this extra. If you’ve already purchased this deal, or like their products and going to buy one, do not forget to dispute your total bill at checkout, so correct taxes will be applied.

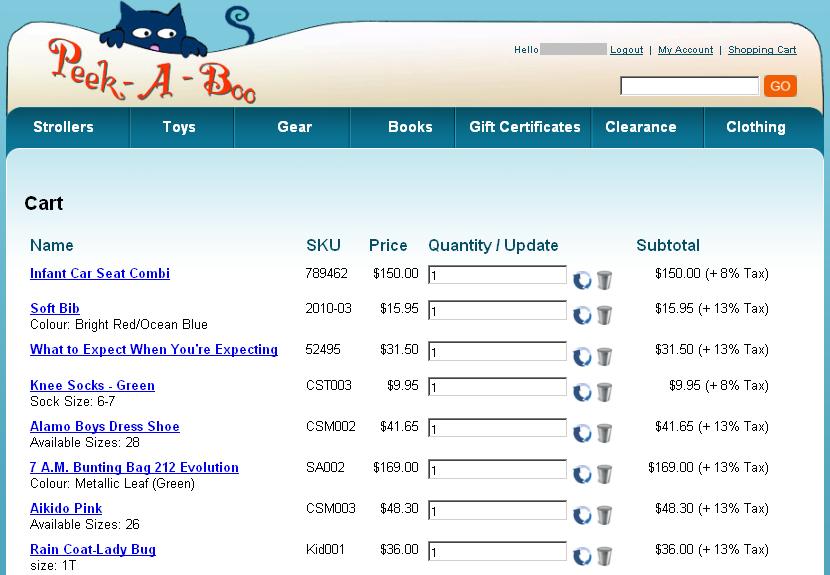

Here is a screenshot of my shopping cart at peek-a-boo.ca (click on image to enlarge):

It shows 13% tax instead of 5% on:

- Baby bibs: “Soft Bib”

- Books: “What to Expect When You’re Expecting”

- Children’s Footwear: “Alamo Boys Dress Shoe”, “Aikido Pink”

- Children’s Clothing: “Rain Coat-Lady Bug”

- Bunting Blankets: “7 A.M. Bunting Bag 212 Evolution”

And 8% tax instead of 5% on some products:

- Car Seats: “Infant Car Seat Combi”

- Children’s Clothing: “Knee Socks – Green”

All these products are exceptions from PST portion of HST according to the Point-of-Sale Rebates document provided by Canada Revenue agency, and should be charged only with 5% GST at the checkout.

Update as of Nov 15, 2010 11 p.m. (end of the first deal day)

“Peek- A.” (probably the same person who left comment here as “John C. from Peek-A-Boo”) commented on Groupon discussion board that there were very few items with incorrect tax rates, and he corrected them. John C. from Peek-A-Boo posted comment here as well telling that it was not intentional, it was only eleven items added by a new employee, and he corrected them.

I went to Peek-A-Boo website in the evening, and there were still many exempt items with 13% HST applied instead of 5%.

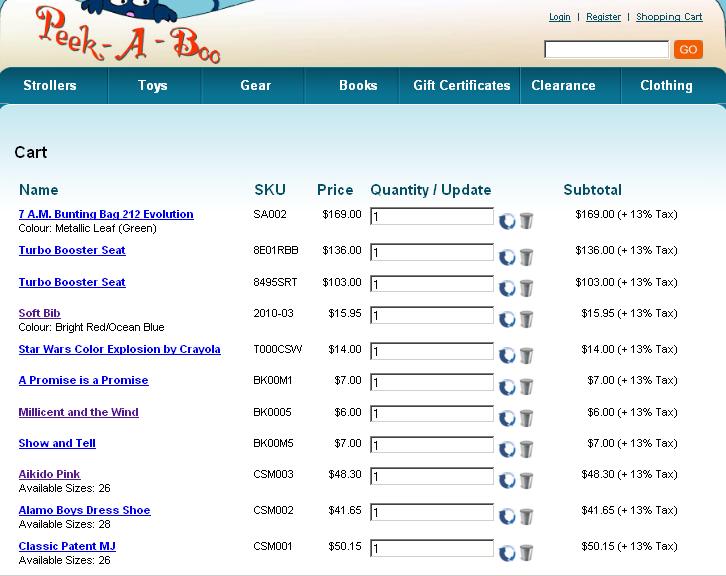

Yes, they fixed some products, but even after that I could find at least eleven items with incorrect taxes applied! Such products are: car booster seats, books, shoes, other footwear, baby bibs, bunting blanket. Here is a new screenshot taken at ~11 p.m. after “correction” by John C. from Peek-A-Boo:

As everyone may see, the problem with taxes has not been resolved by Peek-A-Boo. They have been informed, and they admitted “mistakes” on their website, but they did not want to go through the list of exceptions provided by the government and properly correct everything!

The only conclusion I can make after that:

Peek-A-Boo intentionally overcharges 8% of the price for many exempt items, like books, clothing, car seats, etc.

I bought number of kids products at Peekaboo with my family last month. I checked my bill and I want to let you know that all the taxes in every product were charge correctly. I noticed that they are using a software, the cashier scanned every product except the product with no bar code. I also noticed, that the cashier when she input the product with no bar code, she looked at the binder(I guess, it is their guide). I believed that scanning a product, the taxes are programmed by the management already. There is no reason that the cashier even though she is new will make a mistake.

The saleslady who help me select the right shoes for my kids was extremely nice and very patient. She was very knowledgeable when it comes to getting me right shoes for my kids. They have very good selection of shoes by the way and better selection of toys. My kids run around and made mess but the cashiers were kind enough not to get bothered by it. I did really appreciate it very much. My family especially my kids had really fun shopping at Peekabo.

Thanks Grant for the useful link!

People who bought this Groupon should think how they will use it after Peek-A-Boo claimed several incorrect statements and did not fix the problem with taxes.

John C.,

You did NOT fix all the items. There are still a lot of them with 13% tax applied instead of 5%. You may see update to the article above.

Please fix it as soon as possible, and do not mislead people that you corrected everything!

Thanks,

Trueler

What despicable customer service, will be returning my Groupons and contacting the Informants Lead Program. I encourage you all to do the same: http://www.cra-arc.gc.ca/gncy/nvstgtns/lds-eng.html

Hi John C.,

Your response is incompetent.

All the children’s footwear, baby bibs and bunting blankets should be taxed at 5%. Please refer to the document:

HST Exemptions – Ontario

It is clearly identified under “Children’s Clothing” and “Children’s Footwear” sections. Please do not mislead customers!

All children’s clothing, all footwear, all books, car seats – it is far from “very few items” as you mentioned on Groupon discussion board misleading users again.

HST law is in effect since July 1, 2010, i. e. for almost 5 months. You state that it was not intentional. But it is hard to believe that nobody pointed out the problem to you.

Please make sure that you do not overcharge customers in the physical store in Toronto.

Thanks,

Trueler

Trueler,

Thank you for pointing out that there were some mistakes made with the taxes on our website. It was not intentional, and it has been corrected. The mistake occured eleven items added by a new employee. Your article states that bibs and bunting bags should be taxed at 5%, but this is not correct. Only clothing, books, car seats and shoes under $40 in value are taxed at 5%. We are embarrassed that we have been sloppy with our site, but your reporting is also a bit sloppy.

if they cheat with taxes, what to expect from customer service?! not this deal.

WOW, was going to jump on this…but I am not sure any more. Dont want to drive down to bathurst and st. clair to dispute charges. Im out.

Wow, thank you, Trueler! You saved my money ;)