Harmonized Sales Tax (HST) has been introduced in Canada on July 1, 2010 – exactly the date when people across the country celebrate Canada day. The “celebration” started on June 30 evening commute with very long lines of cars at gas stations trying to save 8% off the gas price which run up by 8% up to $1.04/liter on July 1 due to tax reform in Canada. It was really a mess at gas stations on that day, adjacent roads and driveways were blocked by “lines” of vehicles…

HST is supposed to combine Goods and Services Tax (GST = 5%) and Provincial Sales Tax (PST = 8%) into one singe sales tax = 13%. But there is still list of exceptions from PST portion of HST. However this list is very small, customers should know about this and carefully check their receipts especially during the first weeks after transition.

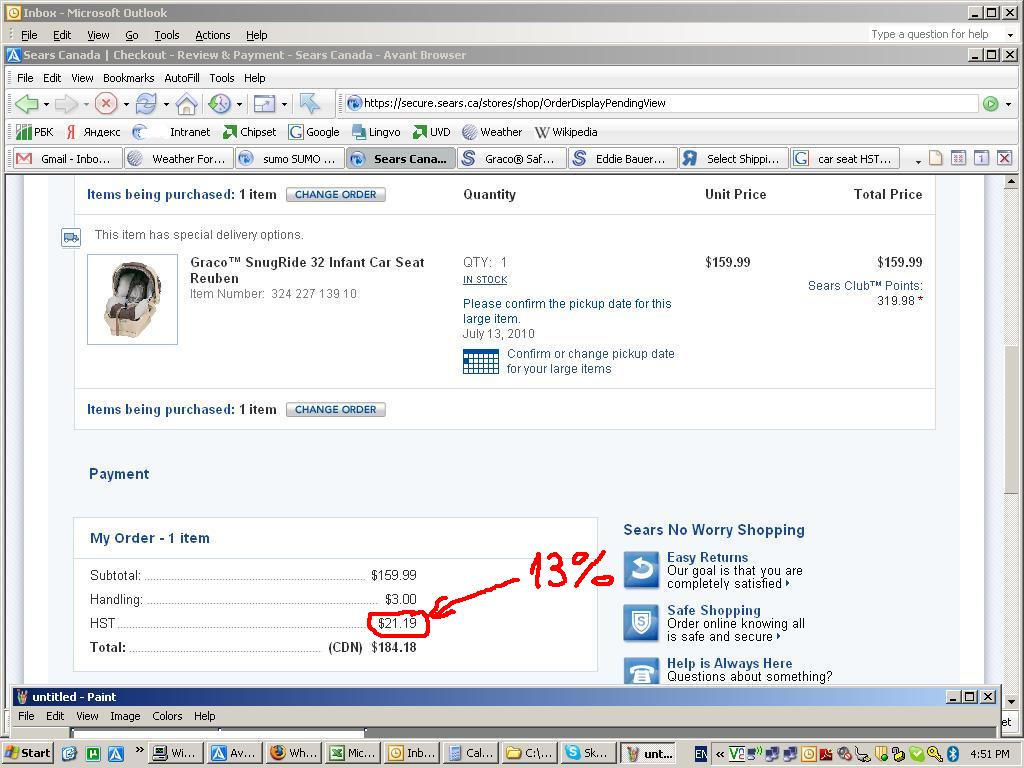

On July 2 I was looking for infant car seat by browsing through online stores. When satisfied by quality, price, and delivery option on sears.ca website, I proceeded to checkout and was extremely surprised. The price of the car seat was taxable with 13% HST !!! Here is a screenshot:

Car seats for children are always an exemption from PST, and used to be taxed only with GST=5%. After July 1 it is supposed to be an exemption from PST portion of HST as well, that is sales tax must be 5% as before on car seats, not 13% as sears.ca offers. It is ridiculous… Then I’ve checked another online sore – toysrus.ca. And what you think?? The same! Car seat is overcharged by 8% as well as on sears.ca website. Here is the screenshot (please click on the picture to enlarge):

In order to confirm I went through official documents on Canada Revenue Agency website (www.rev.gov.on.ca). Here is an excerpt from the document:

Consumers will not be required to pay the Ontario component of the HST (8 per cent) on goods that qualify for the point-of-sale rebates. The qualifying goods are:

Children’s car seats and car booster seats

- that are restraint systems or booster cushions that conform with Transport Canada’s safety requirements for Standards 213, 213.1, 213.2 and 213.5 as described under the Motor Vehicle Safety Act

- excluding children’s car seats and car booster seats that do not meet Transport Canada safety standards and travel systems that are a combination stroller carrier and car seat sold in a single package

It is hard to believe that so big companies as Sears and Toysrus specializing in retail for many years did not carefully prepare for tax transition, taking into account that all the documents have been provided by the government while in advance before July 1.

Given facts can mean only two things:

- Sears and Toysrus offer car seats that do NOT meet Transport Canada safety standards (only in this case they can charge additional 8% PST portion). It sounds unbelievable, because both of retailers state that all car seats do meet safety standards

- Sears and Toysrus online stores make use of customers trustfulness to the “respectful” retail stores with knows names, and overcharge 8% on some goods

This is very frustrating situation. Customers should rely on retailers who must obey all the applicable trading laws, and not spend valuable time to make sure that all the laws are obeyed during the final bill preparation.

Is this what we pay taxes for??!

Please spend some time on reviewing your bills and receipts during the first weeks/months after transition. Please go ahead with any questions, concerns or suggestions in comments or contact form regarding the new HST law. We will try our best to give relevant information.

WOW 2015 and Sears is still doing this!! When I emailed and called them out on it they just said sorry and didn’t even offer to try and fix it!

I have a store near home the guy charged 15% gst pst even after a year of gst reduction to 13%’ and for kids item I bought on walmart charged me gst! same thing I bought from no frill they charged me hst! later refund me pst! once I show bill from walmart. Too much fraud here now.

Hi Dawn,

Thank you for spending hours programming your store to charge HST correctly. Customers appreciate it. Looks like big corporations did not spend enough time pushing this task to the customers’ shoulders.

POS is not a discount… it is a law. Sending receipts to Canada Revenue worth time and money. Should customers care about this? I think no…

Hi Johnny,

Do you really think that claiming a rebate with CRA by the consumers after retailers outrageous mistakes is an acceptable practice?

Retailers did grab extra money, because most of consumers did not realize that there is a PST exception list.

If Sears or Toysrus has charged excess tax they are required to remit it to the government, so these retailers are not making a windfall as several of you have indicated. They would be required to remit the tax charged to the government.

A consumer has the option of requesting a refund of the portion of the Ontario (or BC)HST paid in error on an item with a point of sale exemption, such as a qualifying child’s car seat, by filing a rebate claim directly with the CRA.

We run a small children’s products store and the HST has been a real challenge for us. We have spent hours programming our store to charge HST correctly and I have only found one other store that does it correctly. Stores are not required to provide the POS discounts so it is perfectly okay for a store to charge 13% (or 12%, or 15%) and then you can send your receipt in to revenue Canada to get a refund. Also the HST on shipping is supposed to be prorated with the POS rebate. It really is buyer beware, but at least you can file a claim with the government and get what you are owed back.

I never, ever imagined I would have to know this thank goodness for the internet, right?

Grandes cosas aqu.

Anon Y. Mouse: Sears and Toysrus definitely won’t admit that it was an intentional mistake.

Have you tried contacting Sears to see if they made an honest mistake, and if they will fix it? They’re probably not reading your blog.

Hi Andrew,

I see your point. As you mentioned it is a financial system. I think financial system is not a good place for stupidity. Any lawyer (from Sears or Toysrus) can easily prove that the mistake was not intentional, but it was just a simple stupidity… even if it was intentional.

No comprehensive testing process. What can I say… It is very unfortunate. It is again a financial system. Testing process should consume even more resources than development in order to get appropriate quality.

I strongly believe that there is a user-friendly interface for sales guys to make changes to the prices, descriptions and similar stuff. It might be good to have an ability to control applicable taxes by sales guys as well.

Sears and Toysrus let the mistake go into production – it is an outrage. But why? Because they are trying to save their money by neglecting quality assurance process. They prefer to move this responsibility to the customers. But I did not get any honorarium from the stores for finding this issue…

Stupidity happens, but there is absolutely no place for it in the respectful financial/selling system.

Thanks a lot for bringing up list of exceptions with QA at your company. Really appreciate it! There is another list for BC residents – HST (PST) Exemptions or Point-of-Sale Rebates for British Columbia (BC)

Thank you for your input and sharing of the information and thoughts!

Trueler

Hi digitalicon,

Thanks for your input! Can you please send us a receipt when you receive an item? Or if you have electronic order confirmation with the price, it is good as well. We will help to investigate.

One question to clarify. Does your order have any shipping/handling fees? They are taxed with 13% HST also.

Thanks,

Trueler

JohnB,

1. =) You think that such a big stores can sell items as is?! Taxation must be correct, it is the law, and is not the customer’s responsibility.

2. Did you mention product “coding” in your previous comment? If an item is coded as a car seat => it must be 5% taxable. What’s wrong?

Mistakes do benefit only stores in the vast majority of cases. It is not a secret or something new. Just take a look at digitalicon’s experience with Toysrus in the comment below. Probably you are so lucky that mistakes benefit you other than goods’ and services’ owners.

Hi Trueler,

I’d like to re-sum-up my comment before. You say in the article that there are only 2 possibilities: either Sears and Toys ‘R’ Us are offering non-standard safety seats or they are purposefully scamming people for an 8% overcharge.

My point is this: you are saying this is done on purpose to the detriment of customers, but it is much more likely to have been caused by stupidity. Doing something like this online for Sears or Toys ‘R’ Us would not be something the lawyers would let happen on purpose, because it only sets things up for a headache for the whole company. And while it might seem like there is a rigourous testing process for the web for companies like this in 99 cases out of 100 there is not. There is likely one person (or small team of persons), who also has to do work on 75 other websites that week, and everybody is clamoring for them to do their work.

“I think it is definitely someone from the sales team.”

Yes and no: the web team will be responsible for making any of the changes actually happen on the system. You get that this is a programmatical change, right? A salesman won’t be able to do it.

“It is very trivial and easy: just change tax properties for affected goods.”

The fact that you say straight up that this will always be a trivial act leads me to believe that you aren’t a developer; any time you are working with a financial system, every single thing is non-trivial because you are dealing with money and you can get fired and/or sued if you mess up. There very likely is not a single tax element per each item. It is very likely that there is a database that controls the tax, or some other form of programmatical control. For a system such as Sears or Toys ‘R’ Us it is probably impossible for a non developer to make a change to the tax for a particular item.

“There is also quality assurance department in every big company.”

This is true, but not necessarily relevant. A lot of big companies contract work like this out; the companies that they work for may have a good QA department… or they may not. They might have a QA manager who writes fantastic cases and tests, or they may have an intern who has no idea what they are doing and has very little supervision.

“It is indeed an outrage!”

Perhaps it is, but maybe it’s more of an outrage that a mistake of this magnitude made it to production, instead of an outrage that “Sears is stealing your money”. I am 100% sure that if Sears or Toys ‘R’ Us could have caught this mistake in QA and changed it, they would have.

“web developer will keep his job, don’t worry”

Actually, them keeping their job has me vaguely worried. ;D I read through the list of exceptions, and brought them up with QA at our company as places to specifically test all implementations of HST, which is what each place should have done.

I’m not saying that the whole issue is acceptable; what I’m arguing is that the article says that the companies are stealing, and that’s probably not the case. My mother always told me growing up: “Never attribute something to malice that can be attributed to stupidity.” Stupidity happens much more often than malice, and it’s far more detrimental.

So pick up the phone and call Sears and Toys ‘r’ Us and let them know about their mistakes… and get your money back!

The problem is much larger than knowing which tax rate to apply. We just purchased a baby toy (which in Ontario should be taxed at 13% under new HST rules) and the Toys R Us website added $7.30 HST to a $49.99 item! It’s a simple calculation to do, but here it is:

49.99 * 0.13 = $6.4987

and therefore NOT $7.30!!!

What can we do about this?

Trueler

1. Big mistake … customers’ money. Caveat emptor.

2. No. (It has been *described* as a car seat … that has absolutely nothing to do with the tax code applied to that particular item. (Any data structures course will teach you that you use a data element for a single purpose only and that “doubling up” to use a data element (such as a description) for a secondary use (use as a tax code) is a terrible practice.

Mistakes only benefit the stores? Hardly. For this very specific example that’s true but life is filled with many examples where the “benefit” (such as it is) benefits the customer.

Hi Eject,

Exemption list for BC and Ontario are different. Due to huge demand from our readers I prepared the list for BC as well as for Ontario:

HST (PST) Exemptions or Point-of-Sale Rebates for British Columbia (BC)

HST (PST component) Exemptions – Ontario

If there is more complexity, so it is worth to assign more resources for achieving best results.

It looks like a tendency… Not only Sears and Toysrus. Home Depot in BC also did the same trick. Thanks for that information. BTW, do you have any proofs, like receipts, for example? It would be nice to create one more post and let people know about Home Depot as well.

Thanks!

Hi JohnB,

Different products have different tax rates – this is true. There is an example of violation – car seats.

About possibilities you mentioned:

1. This is a very big mistake. It is customers’ money. Overcharging is a huge violation. Algorithm must be extensively verified before release. It does not acquit stores at all.

2. Can not be true by definition. In the example car seat has been identified as car seat, so the product has been coded correctly.

3. Definitely can be true. Stores could just put 13% tax (for Ontario) in the spec on everything regardless of exemption list about which they were aware of in advance.

We must note that mistake benefits only stores (Sears and Toysrus), but not the customers. Stores grabbed extra money overcharging 8% (for Ontario), customers lost money.

There is absolutely nothing wrong about July 1. Don’t be confused! The tax came into effect exactly on July 1, 2010. In general, if the services are being provided after July 1, or goods are being acquired after July 1, so HST should apply. Before July 1 – GST/PST. If services (like piano lessons, memberships, etc.) start before July 1 and end after, so it is prorated scheme: GST/PST should be charged on the part of services performed before July 1, and HST should be charged on the part of services performed after July 1. It does not matter when you pay.

If you have been ripped off by misinterpretation of transition rules when paying for, let’s say, piano lessons, please speak up – we will try to investigate and help.

Best Regards,

Trueler

I should also point out the exemption lists for BC and Ontario are different, which makes the implementation a bit more complicated for any developer, but not impossible. Anytime there is more complexity, it is easy for things to fall through the cracks.

As well, this is not the first time this type of thing has occurred. Last month in BC it was discovered that Home Depot was changing PST on some PST exempt items. BC has (had?) a list of items that it considered to be PST exempt, like insulation or safety items like fire alarms. Home depot explained to be a problem in a software update that wasn’t caught.

For Ontario: There are a bunch of possibilities here.

Different products (not just car seats) have different tax rates. There are some that are tax free, some (not many) that are 0 rated (meaning they are taxable but at 0%, some get 5% (GST only), some get the full HST (13%).

So the possibilities are:

1. The tax algorithm is incorrectly written.

2. The product may not have been coded correctly.

3. The tax algorithm may have been correctly coded to the specs the developer was given but the specs were erroneously described (have you ever read all the pages and pages of documentation — it’s amazing how much a simple tax can take to fully describe).

You are, by the way, wrong about July 1. The tax came into effect at least a month before then. If you purchased a service (piano lessons, say) that were to be delivered after July 1 but you paid before June 1 then you paid the original tax rates. If, however, you paid for them on June 1 then you had to pay the full HST rate on them.

In short: the July 1 date was only 1 of several dates that you need to consider.

Hi Andrew,

Thanks for sharing.

Web developer that is IN CHARGE of implementing taxation algorithm MUST know all documented exemptions from HST. This spec was already available in the internet in March 2010. 4 months to prepare!

However, I’m in doubt that web developer is in charge of tax transition. I think it is definitely someone from the sales team. So, web developer will keep his job, don’t worry :)

The solution to the problem is not trivial and easy to implement… It is very trivial and easy: just change tax properties for affected goods. The exemption list is not too big (unfortunately for the customers).

There is also quality assurance department in every big company. The work is to guarantee that everything works properly according to the specification, including checkout process during which taxes are being applied. Spec should be provided by the sales department.

And one more thing. Sears and Toysrus did find resources and time to implement HST taxation scheme instead of GST/PST which increased prices by 8%. So, they knew about the new law, right? The exemption list is provided as the inalienable part of this law.

It is indeed an outrage!

Eject, that is right, for BC and Ontario car seats are exemptions from PST portion of HST, that is 5% should be applied. Thanks for pointing this out.

It is hard to believe that so big companies as Sears and Toysrus specializing in retail for many years did not carefully prepare for tax transition, taking into account that all the documents have been provided by the government while in advance before July 1.

I work for a large web development company. Sears and Toys ‘R’ Us aren’t our clients, but we have customers that compete with them. There is so much red tape between the people who read the HST spec and the people who implement the changes to websites that it is very easy to imagine that this is the fault of ignorance and not malice. The web developer that was in charge of making this change very likely just didn’t know that there were any exemptions for HST. And because of the outrage of posts like this one, he may lose his job.

I’d recommend you, and all your readers, call in to Sears or Toys ‘R’ Us and asking them about the issue. And keep in mind that a solution to the problem is probably not trivial and easy to implement.

A little misleading here:

“Harmonized Sales Tax (HST) has been introduced in Canada on July 1, 2010”

HST was introduced in Ontario and BC on July 1st. In your article you are only discussing Ontario’s HST and exemptions (although car seats are exempt as well in BC).

Wow… Thanks for posting!

Hi JT,

If car seat is a combination with a stroller, then yes, it is not covered by this exception. But the given car seats are not combination, they are standalone seats. These car seats should meet safety standards – 5% must apply, not 13%

“excluding children’s car seats and car booster seats that do not meet Transport Canada safety standards”

Is there a chance the car seats -do- meet the safety standards, and thus, are not covered by this exception?