These instructions are the final conclusion to the post

UPS/FedEx Brokerage Fees – avoid scam

- You ordered some goods from US into Canada by UPS and they are on the way

- Going to import some goods from US into Canada by UPS

- Already received your package and did not pay anything to the driver. It means that UPS will send you brokerage fees invoice several weeks/months later, or send information right to collection agency

- Driver showed you collect-on-delivery (C.O.D.) invoice which was ~half of the item’s price and you refused to pay at the door

There are two conditions necessary for the procedure of self clearance at Canada customs:

- Your shipment’s value for duty is less than $1600 CAD

- You have one of the local CBSA (Canada customs) offices nearby. You may find the list of offices across Canada here: Directory of CBSA Offices where Courier Low Value Shipments Program clearances are performed.

Here is the procedure of self clearing (confirmed by CBSA main office and proven many times in practice):

- Wait while your package comes to the local UPS warehouse (where you live). You will see status in the shipment’s tracking information on UPS website. If you don’t track, so just wait for the first delivery attempt and refuse to pay at the door

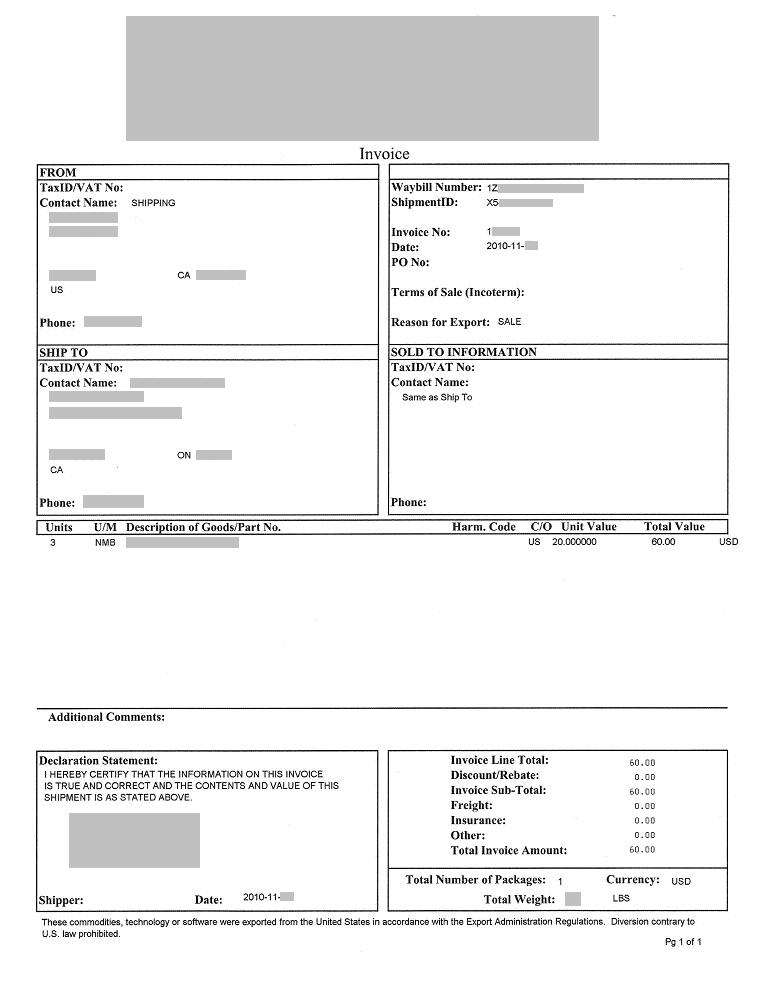

- Call UPS at toll free number 1-800-742-5877, press “3” to be connected to the billing department (or other prompt by the system), and ask customer service representative to send you shipment’s invoice. Some of the representatives call it commercial invoice. Just ask for “commercial invoice” associated with your tracking number. They can send it by e-mail or fax. Please make sure they got your address correctly – ask to spell it back. They will send it right away in .zip archive to your e-mail. Shipment’s invoice has the Unique Shipment Identifier Number needed by CBSA as well. This is how it looks like (click on image to enlarge):

- Find out what is the address of your local UPS warehouse where your package is being held. Call and ask UPS if you can’t figure out. CBSA may ask for this information during self clear. For GTA (if you see “Concord” in the tracking information) the address as of Nov. 2010 is:

UPS Center

2900 Steels ave. W,

Concord, ON, L4K 3S2

phone: 800-742-5877

- Take your shipment’s invoice, address of UPS warehouse, money to pay taxes and photo ID to the nearest CBSA office. Please take the reply from main CBSA office with instructions about self clear process for the case if officers in your local office are not aware with the proper procedure. You may find their reply at UPS/FedEx Brokerage Fees – avoid scam – section almost at the bottom of the post, just between solid grey lines. Last time I visited CBSA office in Brampton at the following address:

CBSA Brampton: office 480

197 Country Court Blvd.,

Brampton, ON, L6W 4P3

office hours: 8:30 – 16:30, Mon – Fri

!! – recently address has been changed to:

5425 Dixie Rd.

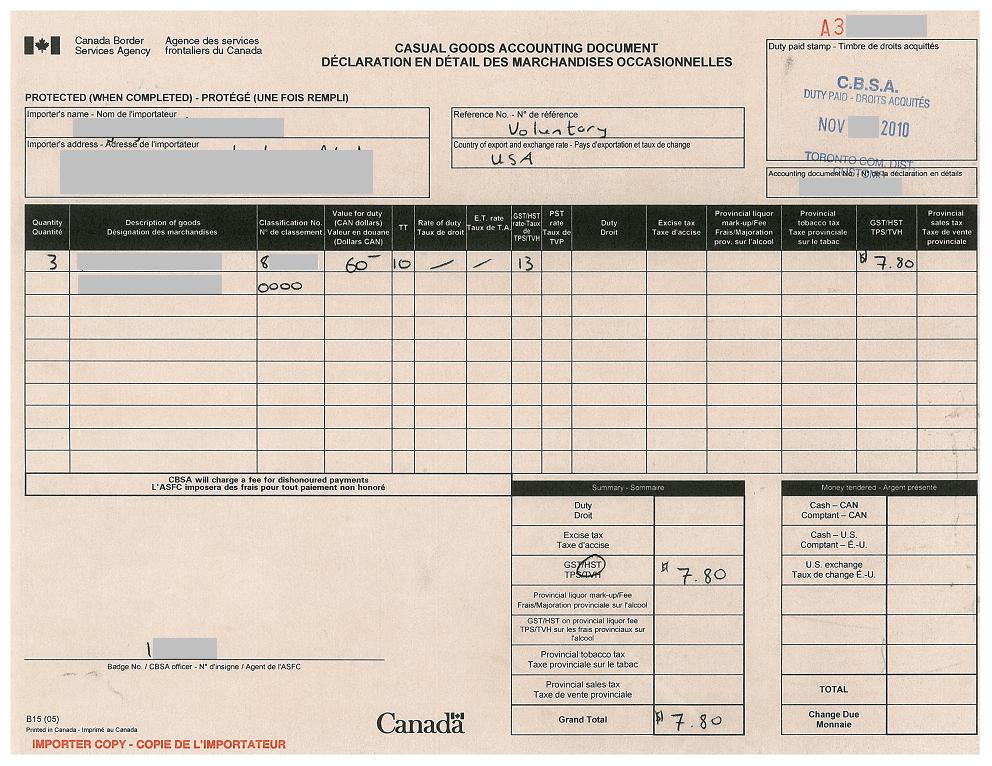

- Present your shipment’s invoice to customs officer and he will do clearance for you. After paying applicable taxes and duties to the cashier you will be provided with CBSA B15 form – Casual Goods Accounting Document, which confirms that you paid all the taxes to Canada customs. B15 form looks like this:

- Call UPS and ask how to provide them with B15 form (proof that you paid taxes) in order to waive brokerage fee invoice. They will give you fax number. Please make sure that you put your tracking number of the cover page. As of Nov 2010 CBSA B15 form should be sent here:

UPS Brokerage Department

fax number: 1-770-990-1724

- After that UPS Brokerage Department should process your B15 form and waive C.O.D. charges. It may take 1-5 days. You may also try to speed up the process by calling UPS and informing them that you already paid taxes to CBSA and sent receipt to the brokerage department. Ask UPS to schedule delivery.

You are done!

I have not done it with FedEx or other couriers, but procedure should be very similar.

The response to my email escalation is below. I think I’ll let them phone me. I’d like to find out what their side of the story is. I fear my complaint won’t change their practices.

By the way, I mentioned my prior problem in the email. Primarily because they also tried to charge HST and brokerage on a zero-rated item. I’m not sure if that had any effect.

If you’re interested I’ll let you know what they say.

——————————

Good day Brandon,

I am with UPS Canada and received a copy of your email sent to UPS Public Relations. I apologize for any inconvenience that this situation has caused you. I am forwarding the information to the Director of Customer Service for further review and follow up with you. The entire amount of $16.36 is being refunded. Is there a daytime phone number that you can be reached at?

Hi Trueler:

UPS is arguing that even though the item is a Warranty Exchange it still has a “value for duty.” If I can’t win this battle it means that any Warranty Exchanges that get done in the US – including items purchased in Canada as this item was – will be charged brokerage fees based on the value of the item. That is NUTS. It is wholly unfair to the consumer. It’s a total rip-off.

I have composed an email which I hope will make it higher up the chain of command. It’s not about the $10, I’m irked!

Dear Brandon,

Thank you for your response. You are correct. Our web site states “the value for duty”. The “”the value for duty” of your shipment was $39.99 USD. Please note that value for duty is not the same as duty charged.

A Brokerage fee is charged to process your shipment and present your paperwork to customs on your behalf. All courier shipments with a value exceeding $20 CAD require customs clearance by a broker. The customs clearance procedure requires the broker to perform, on behalf of the importer, a number of tasks. Tasks include, but are not limited to, auditing import documentation, classification of the commodity being imported, and preparation and transmission of accounting information to Canada Customs. The UPS Customs Brokerage published rate schedule is competitive with industry standards.

You may find our rates for customs clearance into Canada at:

http://www.ups.com/content/ca/en/shipping/cost/zones/customs_clearance.html.

When accessing the link for Rates for Customs Clearance into Canada, please review the complete fee schedule provided. Please note: Entry Preparation Charges, Disbursement Fees and Additional Services may apply to your shipment.

Please contact us if you need any further additional assistance.

Phyllis T

UPS Canada Customer Service

B Smith,

I would continue to argue with them until they issue full refund. Just because you are right in this case and they are not.

The main argument is clear. Brokerage services are used to pay taxes by UPS on importer’s behalf to Canada Customs. There is no tax in this case, therefore no “brokerage fee”, no “Brokerage Entry Preparation fees”, no other fees should be applied.

If no luck, you may ask for detailed explanation why they charged taxes initially. Ask who is responsible for this error. Inform them that double taxation is a very serious offense and CRA usually investigates every case.

Unfortunately UPS does not respect customer’s time and money, but they do respect their own time, and after several e-mails they will probably issue a refund. Or call them and do not let representative go until success. It worked for me several times, but it may take a lot of waiting time on the line: rep -> supervisor of the rep -> supervisor of the supervisor of the rep -> brokerage fee waived

Regards,

Trueler

Here’s what they said this time. Any suggestions as to who to contact or what arguments to use?

Cheers,

Brandon

——————————-

Dear Brandon,

Thank you for your reply.

A warranty replacement item still has a value for Customs purposes and for loss or damage. The shipper correctly declared this replacement item to be valued at $39.99 USD. Therefore, the Brokerage Entry Preparation fees are applicable based on the full value of the goods.

I apologize for any misunderstanding regarding when entry preparation fees are applicable.

Please contact us if you need any further additional assistance.

Phyllis T

UPS Canada Customer Service

Right, there should not be any brokerage fee, since the value for duty is zero.

I just sent a reply stating that the value for duty should be $0 since it is a Warranty Replacement. We’ll see if that’s enough or if I have to escalate.

So, I got a not entirely satisfactory reply (see below). Comments?

Cheers,

Brandon

— ——————————————–

Dear Brandon,

Thank you for your e-mail regarding tracking number 1Zxxxxxxxxxxxxxxxx.

You are correct. Warranty replacements importing to Canada should not have any taxes applied. However, on Standard service shipments from the USA, Brokerage Entry Preparation fees are applicable based on the full value of the goods.

I have processed a rerate request to have $5.06 in taxes adjusted and refunded.

I am truly sorry for the inconvenience caused by this rating error.

Please contact us if you need any further additional assistance.

Phyllis T

UPS Canada Customer Service

Hi Trueler:

We have a copy of the commercial invoice. It says in very large font Warranty Replacement. UPS have no excuse. This is a crystal clear customer rip off. I sent them an email. If that doesn’t work I’ll phone them up. I’ll post back when it’s resolved.

Thanks again for your help. It’s good to know there’s someone on your side in these battles.

Cheers,

Brandon

Hi Brandon,

It obviously should not have any HST or brokerage fee on it. If you wish and have time, call UPS to ask what are these taxes for. Tell that it is a warranty repair. If they don’t agree that it is a warranty case, get commercial invoice from them. If the invoice does not specify “warranty repair” or “replacement”, so contact seller for refund due to wrong goods specification. To avoid hassle, you may use e-mail communication with UPS and seller for your convenience and to save time waiting for the next representative.

I hope this helps.

Thanks,

Trueler

I should have mentioned that my son accepted the shipment and paid UPS, unfortunately.

-Brandon

Hi Trueler:

A few months ago you helped me reduce a $182 brokerage/hst charge to $0. I have a new situation with UPS and I was wondering if you have any advice.

My son sent in a portable hard drive for a warranty repair. The company sent a UPS sticker etc. to send it in. It went to the USA. They shipped the warranty replacement item back to him UPS. UPS charged us $10+hst brokerage and $5 hst. Total $16.36

Quite obviously there is no HST and thus no brokerage on a warranty repair item. Is there a strategy to use with UPS to get these charges reversed without having to go through the cbsa? For $16 it’s not worth a big hassle, but I hate UPS ripping us off.

Cheers,

Brandon

Hi upsketch,

Actually showing that letter to customs officers helped many importers and myself.

The same idea (that any importer can do self-clearance in any local CBSA office for personal goods below $1600) is provided in CBSA memorandums you can take a look at their official website. Links are provided in comments. So, there are official CBSA instructions posted on their website standing behind this approach.

Since initially UPS and CBSA rejected to honor those memorandums, I thought maybe they were outdated, so I contacted CBSA in order to confirm. It took more than a month to get a reply from CBSA. I’ve also got a call from CBSA Ottawa and the person responsible for CLVS program explained the procedure again.

Regards,

Trueler

hey again trueler – look i like what you have done – and how you answer people in your forum – but i called yet again, spoken with 3 CBCA officers – all deny this is possible.

as much as i want to argue your point – its hard to because i have nothing to go on – in terms of like – a specific section of the cbsa act. its hard to say like – i saw a letter online.

if you can elborate – pls do – in terms of how you actually get the CBSA to become educated and familiar with this type of brokerage.

thanks

Hi upsketch,

People already reported success in paying taxes at Brampton CBSA office which relocated to 5425 Dixie Rd.

As soon as you get B15 form from CBSA after paying taxes, you should contact UPS to waive C.O.D. invoice and schedule delivery.

Thanks,

Trueler

Truler,

Can I go here?

CBSA Casual Refund Centre?

55 Town Centre Crt

Scarborough, ON M1P 5B5

thanks trueler – i am going to give it a go.

i just hope they dont ship my package back to windsor.

shoudl i just go pay the duty today – and tell UPS how it is?

also – can you recommend an office in toronto to pay the fees? is scarborough the only one near toronto more or less?

It is a reply which I got from the Government of Canada – CBSA. I’ve posted it here:

http://trueler.com/2010/09/13/ups-brokerage-fees-total-scam-fraud-cheating-avoid-it/

in “How to pay duties and taxes for imported goods” section.

CBSA representative and UPS gave you incorrect information. You don’t have to go to the port of entry.

Regards,

Trueler

Well the officer who i spoke with on the phone simply said when it comes to couriers – duty has to be paid at the port of entry – end of story.

ups of course agrees. they do not deny that i can clear it myself – but it must be dont in windsor, ON.

are the instructions on the cbsa website as well?

its hard to reference something that is not supported by an actual part of the customs act….or is it? do you have a more offical link?

thanks,

Hi UPSKETCH,

Did you show instructions from CBSA how to self clear in your local CBSA office? How did officers respond?

Thanks,

Trueler

i am determined to pay my CBSA fees myself.

the package was already cleared in windsor ontario by UPS.

they are making the second delivery attempt today – i wont accept it. i have the commercial invoive – am in toronto- and can pay the duty at a cbsa office in scarborough.

cbsa and ups denies i can pay the charge here and it must be paid at windsor. pls help!

I have a package en route to Calgary. Last night, I used the “Contact UPS” portion of their website. I provided tracking number, and requested the USIN and commercial invoice. Today I received the USIN and copy of commercial invoice via e-mail. Now I just have to wait for the package to arrive in Calgary and visit the CBSA. I’ll post up how things go when the time comes.

I’ve become fed up with UPS. The last item I purchased from the US was declared as “country of origin: Canada.” Even though I wasn’t required to pay any taxes or duty, UPS still nailed me ~$45 in “broker fees.” I called them to see what the deal was. The agent I spoke to told me “We represented you through the customs process and filed paperwork on your behalf.” I lost my cool and told them that it was BS and if I knew that was how they operate I would have self declared the item, followed by hanging up.

Thanks Man!

Success! Follow-up from my previous message here is what happened:

1. Tracking online yesterday a.m. showed parcel had arrived at Richmond BC.

2. Called UPS to say I wish to do clearance myself and had very courteous response saying no problem, they will arrange it accordingly. The CSR said it’d take a day for the parcel to be released if I collect it myself and I need to pick up all the documents from Richmond warehouse first and I don’t need to fax anything back afterwards.

3. Today a.m. UPS called to say parcel is ready for me to do clearance and I have five days to do it.

4. I first went to CBSA as I already had a commercial invoice copy.

5. CBSA officer plainly refused to accept commercial invoice and said I need to go to UPS first for a yellow form with pink copy. As CBSA and UPS warehouse are both in the YVR vicinity so I didn’t argue and just drove there (only took 2-3 min.).

6. Got the forms, with IN BOND printed on top L corner, SUMMARY SHEET top R and Customs Delivery Authority at the bottom. They were already printed and ready for collection.

7. Went back to CBSA and paid taxes. They kept the pink copy. The Ref. No. on B15 is the same as the Cargo Control No. on the yellow form and is not the shipment ID.

8. Returned to UPS with B15 and yellow copy and took the parcel.

Overall it took 2h between arriving at CBSA and leaving UPS with parcel, mostly due to waiting in line. I saved UPS fees over $80 (inc. tax, all estimated from website) and over $50 duty (and tax on duty) which wasn’t charged by CBSA but would have been added by UPS brokerage (FedEx did last time for a similar item). I drove about 20 miles (32 km) and paid $2 for parking outside CBSA.

I don’t know if the procedures are different because Richmond is the port of entry or the protocol is different here. At least here UPS is fully co-operative and don’t even enter any brokerage process after I called but let me handle it as requested.

Thanks Jordan for updates! Sorry for my delayed responses these days.

Hello Trueler

Just to update with everything. I got the B15 form. Went back the 2nd time this same night and the lady agent helped out like magic. She knew her shit. Gave her commercial invoice, my receipt from the webstore, piece of ID and thats it. she told me to sit down and she’ll get my B15. not even 5 minutes she called my name and asked me to pay. Paid 12 something. I was out there less than 15 minutes. Will fax it first thing in the AM then pick up my package in warehouse. Didnt have to file COD dispute cuz the UPS guy didnt use the doorbell and claimed no one was home when i was there waiting for package the whole day. Told UPS theres no need for delivery cuz I will pick them up tomorrow. Didnt tell them I got the B15 and just go there. That way, there will be no surprise BS. They sent the commercial invoice via email easily. They didnt ask for why.

Thanks Trueler

Learned something very important from this

Thumbs up

Ok I just went to CBSA in Pearson airport. With me I have the commercial invoice. And the CBSA officer told me that I dont have sufficient paper works. She told me i need to bring the waybill # with me. And when i showed her the # which is stated as “bill of landing/ air waybill #” in the commercial invoice she said its not the right one. Then right when i left the CBSA office i called UPS and requested the said “waybill #” and the UPS personnel said that my waybill # is my tracking #. Also earlier on the day before me going to CBSA i called and asked if “shipment invoice” and commercial invoice is the same and the answer is no. And also they told me that i cant get it not till tomorrow or friday. Is shipment invoice is what i need? is that where i can find this said “waybill #” ? thanks.

Hi Jordan,

You need commercial invoice from UPS, not only a number. It should specify goods and value for duty. Online you may find only unique shipment ID number.

I think you did it right with UPS, assuming that by self-clearance they mean you coming to the port of entry.

However, we have a case when UPS advised the importer that taxes can be paid at any local CBSA office. So for others if UPS call you, ask how you can self-clear and if there is a necessity in coming to the port of entry.

Thanks,

Trueler

Hello Trueler its my again

To continue of what happened today, UPS called me 2 x today and left me a message. I called back UPS as my item was stuck in Windsor Ontario not until i will call them back and tell them to clear my items. I did not mention anything about self clearing as i read from other peoples previous experience that UPS gives ton of trouble. So i avoided that. Although i asked the UPS lady i was talking to on the phone about the brokerage and she was telling me its 30$ + customs/duties. She also told me there are 2 ways to pay them: 1. link my credit card to them so it will automatically pay or 2. pay at the door (i chose this based from what i heard here.) I also asked when is its gonna arrive and she said maybe tomorrow. now my question is, Do I email UPS now to get my commercial invoice #? I am also a member of UPS as i registered just now. I read somewhere here that i can obtain the commercial invoice through there? Where exactly is it? Thanks

Hello Trueler

So my package (package is TShirt x 2) has reached Windsor Ontario (i believe my port of entry). And I got a call this morning from UPS. Couldnt answer it so they left me a msg. The UPS personnel asked if i want to clear it or i have a brokerage for me to do it? if its business or its personal. Then left me a # to call. Do i have to call them back to and tell them to clear it and tell them its personal? If i wont call they wouldnt clear my package? Will be it stuck in windsor?

thanks man

PS. I might have more questions coming up.

Hi Man,

There is no need to let UPS know about self-clearance. When they know about it, they usually scare importers to send package back to the port of entry. Having an invoice you are ready to pay taxes in your local CBSA office. Just wait until it reaches local UPS warehouse, because it is a requirement for CBSA to accept taxes and issue B15 form. You should also know the address of UPS warehouse when you show up at Canada Customs office.

“Package data processed by brokerage” just means that the same invoice has been received at the port of entry, and nothing actually processed.

Regards,

Trueler

Hi Trueler,

Great work you’re doing!

My parcel (under $1000) was shipped via UPS Standard from Michigan yesterday. I emailed UPS last night for the shipment’s invoice and received it this morning as a pdf file. The ShipmentID number is exactly the same as the Bill of Landing/Air Waybill No. in this case.

Now the tracking shows:

Hodgkins, IL, United States 06/09/2011 Departure Scan;

Richmond, BC, Canada 06/09/2011 Package data processed by brokerage Waiting for clearance

It isn’t expected to arrive until a week’s time. As it is already processed by brokerage before even arriving in Canada, should I now tell UPS that I’ll self-clear, or still wait until it gets to Vancouver? I’m concerned that they’ll say it’s too late to self-clear then. I don’t know if the port of entry is Vancouver or somewhere in eastern Canada.

Your advise would be greatly appreciated.

As to the CBSA email reply under “How to pay duties and taxes for imported goods”, would it be possible to append an exact date to it to show at least it is a recent communication? Thanks.

Hi Jordan,

Answering your questions:

1. The earliest time to go to CBSA is when package arrived at a local warehouse.

2. Tell the driver that you are going to dispute C.O.D. charge, so the shipment will be held in UPS warehouse and not sent back to the seller.

3. Commercial invoice can be obtained from UPS – they should send it to your e-mail or by fax upon request. I don’t think driver will want to do this.

CBSA should not ask for manifest. UPS usually tells that in order to get manifest you have to go to the port of entry – tell this to Customs officers if they ask you for manifest.

6. It will depend on the helpfulness of the UPS representative at warehouse. They do not have to do this.

Thanks,

Trueler

Hello Trueler

Wow i just found out about this website(bookmarked) as i just bought something from a webshop and did a little bit of research about their shipping methods and found out i have to pay other things to get my package. Now i also want to dodge all this type of payments from UPS. I spent like 1.5 hours reading all the process needed + comments from previous experiences.

Things needed:

1. Commercial Invoice #

2. Manifest(if needed)

3. Photo ID

4. Money

5. Original CBSA email (if you can email them to me pls)

Now I have questions?

1. When is the best time to start all this process? Is it when my package is in Mississauga and is “processed”?

2. normally in tracking when it says that its processed in the warehouse i will be getting that package in the same day, Do i refused to accept the item and start the CBSA processed then?

3. Can someone correct me if im wrong. i might have read it wrong. So if you refused and file COD dispute, you’d be able to ask for your commercial invoice # from the driver off the bat?

Just recapping the process

1. go to CBSA with items needed mentioned at top.

2. File for a self clearin @ the office (britannia – still gotta figure out where is that)

3. Pay for the taxes

4. ask for the B15 (but in order to get that I might need to call for UPS for “manifest” and would also ask for their fax # to where to fax it)

5. Fax B15 to w/e the # is

6. Pick up item @ Mississauga Warehouse (Instead of faxing, would i be able to bring the B15 form there and maybe fax it from there?)

Sorry for sucha long post.

And thanks in advance

5.

I’ve been given the same fax number(it’s a Brokerage Re-rate Dept). Sorry, forgot to share it.

Also here is the Mississauga warehouse address:

3195 Airway Dr

Mississauga

L4V 1C2

Thanks for update!

An update. I managed to pay the taxes at the CBSA office on Britannia last night. Like Mike, when I went “after hours” the officer I had told me I needed additional information (he said I needed the slip from the package stating that the item was indeed at the warehouse). When I explained my frustrations (3 customs offices, and two calls to CBSA that day) he offered to try calling UPS for me (after 17:00, so I didn’t think UPS would be around). Then one of the other CBSA agents overheard us and told him exactly how to handle the request. At the end of it all I was able to pay my taxes on the item.

The $10 I spent in gas driving around everywhere outweighs the $40 I would have spent in brokerage fees at UPS, and I’m treating this all as a learning experience. I now know which office to go to for 24/7 service, and next time I’ll have a copy of my current B15 which shows what the officer did.

The paperwork is now sitting with UPS. The fax number they gave me was different than the above, and I called on two different days to ensure that I got the same one: 1-506-447-3706. I’ll give them until Friday and then follow-up (they said 1-3 days), as I’d like to get my package on Friday if possible from Concord.

I’ve also sent a letter to the CBSA email address, asking them why Front Street West won’t process these claims. Stay tuned.

Mike provided info in the next comment that the office is open 24/7

Thanks Trueler. Is there any indication of the hours for these locations? Looking at the link you provided the individual went after 23:00, which would be super-convenient for me; one reason I can’t make it during the week is I am assuming the offices are open 08:30-16:30, and the CBSA website is a little cryptic on the issue.

Hi PMP,

It’s really unfortunate when not only UPS, but CBSA also make obstacles by not allowing importers to use their rights… It’s really strange that CBSA office at Front Street doesn’t allow UPS and DHL clearing. I’m wondering why it has been allowed to set. Sending you to the port of entry where manifest was recorded is against the proper procedure as well.

There was a successful case of self-clearance in Brampton office recently:

http://trueler.com/2010/09/13/ups-brokerage-fees-total-scam-fraud-cheating-avoid-it/#comment-12312

But you don’t have a chance to go there any time soon. Sorry, but I can’t advise anything else here.

Regards,

Trueler

I currently have a package sitting at the Concord office where I being charged a $150 COD fee. I’ve followed the instructions on this site, obtained the commercial invoice from UPS via email, and tried to go to the closest CBSA office to my work (at 1 Front Street West). Inside that office is a sign saying that they do NOT handle UPS or DHL clearing (it is posted on the inside of the office, behind the counter), and the officer there told me I had to go to an office in Mississauga (at 6500 Silver Dart Drive).

I also called CBSA on the phone, and they told me that I had to go to the CBSA office where the manifest was originally recorded.

What gives? The sign at the Front Street location was put up by the manager there. Any ideas? I’m at the point where I am going to have to pay the full brokerage just because I can’t get out to Mississauga any time soon.

Thanks.

I should add that I did not obtain a manifest from them, I had it provided to me by the forwarding agent. The manifest was then stamped and now I am able to pick it up at the warehouse.

Well I recently purchased something from China. The forwarding agent I used was Jet Sea International Shipping. I went to the Pearson Customer broker office (2720 Britannia WHICH WAS ridiculously hard to find due to google maps not publishing government buildings..) and was told by the customs officer that I will still have to pay these fees that I have been invoiced from the forwarding agent (Documentation & Handling Charge). I did bring it up in the conversation with the officer that I would require a B15 form which would allow me to pick up the shipment directly from the warehouse avoiding any fees. The guard looked at me and said that it was not necessary as I was not paying “brokerage fees”.

In any scenario, I got my papers (manifest or inbond document) and got the hell out before the customs guard was going to say anything else. I felt like I was going to get shot.

Best of luck guys

How is it CBSA does not know the process. I mean they must of done at least a few times during their tenure. Is it not part of their job repsonsibility? Even more importantly.. does their unaccountability or lack of over site when serving the public allow to just say what the please or give the public a harder time than necessary.

Hi Novek,

Manifest should not be required. There were many cases of paying taxes to local CBSA without manifest. I think officer was not familiar with proper instructions.

BTW.. carrier is indicated right on the invoice. Where the package was being held – you know and could provide that info to the officer.

One more point. Is this fair that the Government organization requests the document (manifest) from you which you can’t physically obtain?

Thanks,

Trueler

Alright, I went to CBSA at Pearson armed with the commercial invoice and all the supporting CBSA emails from your other post. The officer said that the invoice was not enough to clear the package. She said I needed the manifest because it shows who the carrier was and where my package was being held.

I thought fair enough. I called UPS and requested the manifest and they flat out refused! What should I do?

Hi Novek,

No, UPS does not pay anything to Canada Customs at the port of entry, and they do not have to.

Thanks,

Trueler

Question, in order for your package to leave the port of entry does UPS have pay Canada Customs?

Reasom im asking is because FEDEX actually called me to tell me that they had the package at their warehouse and asked my if I was going to clear the package on my own.

UPS makes it seem like the only way for the package to leave Windsor is for UPS to pay customs. Thus, in turn making it hard for you to clear your item on your own because they already forked out cash to clear your package at Windsor, basically you own them and for you to self clear and just pay HST, they would be losing money.

Hi Krzysztof,

This is something new from UPS… According to CLVS documents the courier pays taxes to CBSA during accounting process which takes some time. They are required to do it by the end of the next month after shipment. I’m in doubt that they rushed to pay taxes solely for your shipment to CBSA. So, I think they just gave you incorrect information. I don’t see another explanation why they refused to provide you with a receipt. The only explanation is that they just don’t have it now because they have not paid taxes on your behalf yet.

Give another try contacting UPS. Ask them where to send B15 form you got from CBSA – it should be a fax number of the brokerage department. When you send it, ask to waive your C.O.D. invoice because you provided proof of tax payment.

You might want to mention in your conversation, that UPS requires you to pay taxes to the Government twice for the same goods. It is a serious offense.

Hope you will be able to sort things out.

Thanks,

Trueler

Clarification: UPS said they had already paid taxes/duties, but that I cannot have the receipt now, and that I would get the receipt once I pay UPS’s fees and pick up the package.

Not enough luck. UPS told me they had already cleared the package through the customs, and that they can provide me with a receipt once I pay their fees and pick up the package. The person I spoke with declined to provide me with a receipt of having paid taxes/duties on my behalf.