Did you do shopping at Toys “R” Us after July 1, 2010? If your purchase list included any of the exempt items, so you have been overcharged by 8% in Ontario and 7% in BC for those items. It is one more HST rip off by retailers against customers.

The reason is that Toysrus applies full HST tax (13% in Ontario and 12% in British Columbia) almost on everything, regardless of exemption list. All products from this list must be taxed only with 5% GST portion of HST. Provincial portion (PST) should not be applied due to point-of-sale rebate law.

There are following products in the list: children clothes, books, diapers, feminine hygiene products, car seats, some prepared food, newspapers, etc. For the most detailed lists of exempt items you may search for related posts at trueler.com

For example, if you are buying a car seat for your child which costs $300 CAD in Ontario, you have to pay 5% GST portion of HST ($15) on it which will total you to $315. But Toysrus will charge you 13% HST ($39), and it will be $339 That is $24 overcharge (8%).

The reason why Toysrus keeps this practice is unknown. Maybe they are trying to collect more tax money for the government? But no one forces them to pay 13% HST to the government for exempt items they sold. Probably they just keep extra profit because most of the customers are not aware of the new HST law in details?…

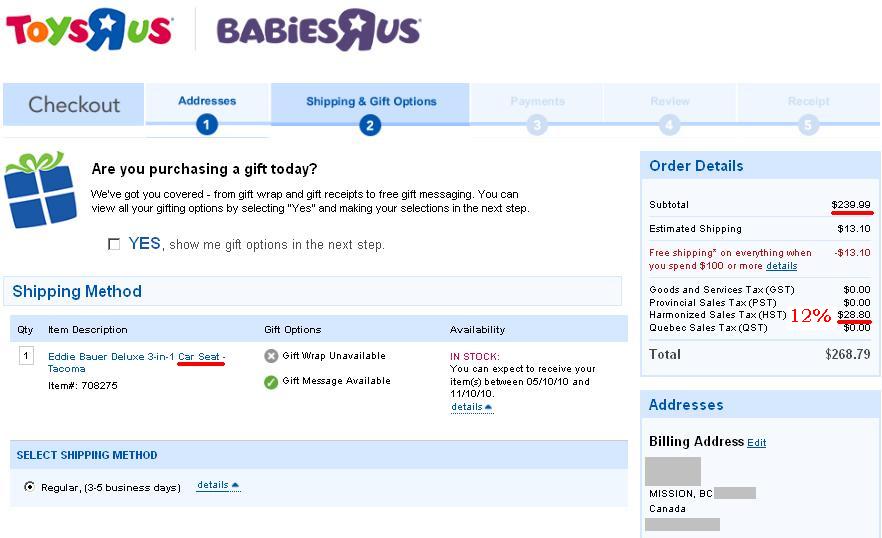

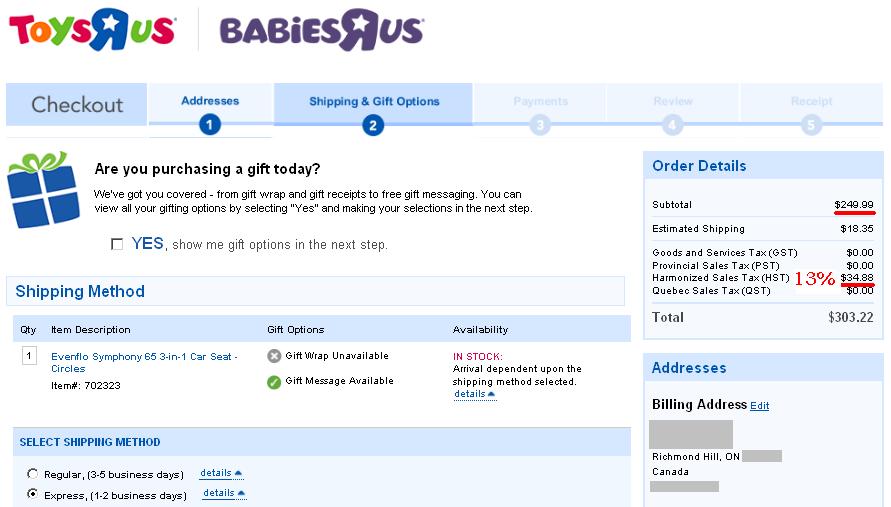

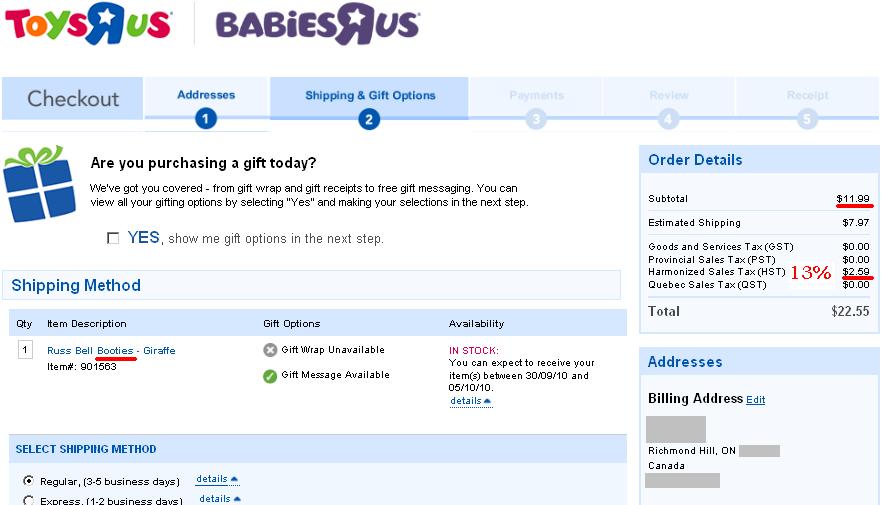

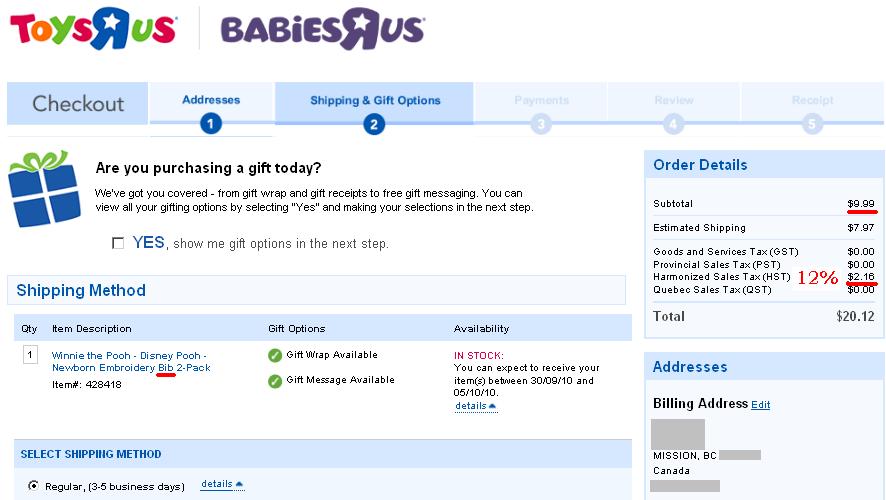

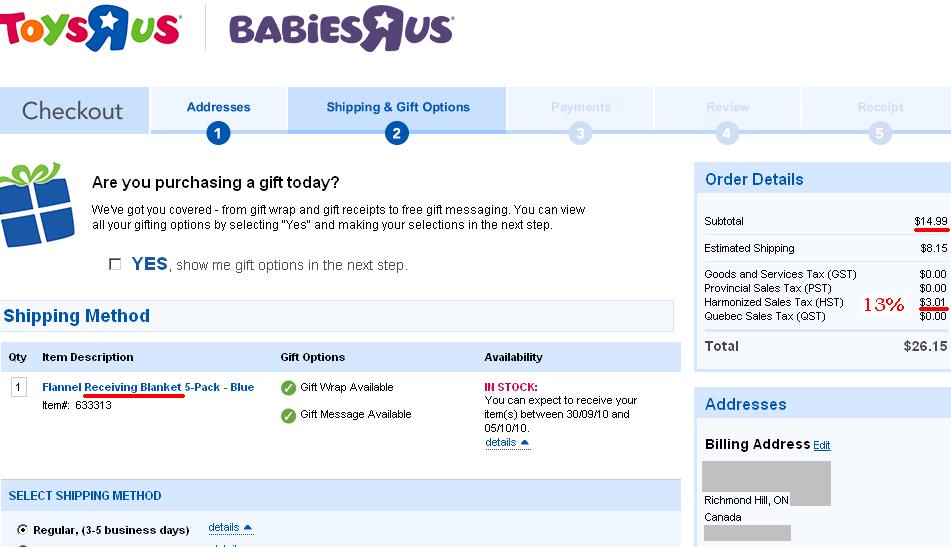

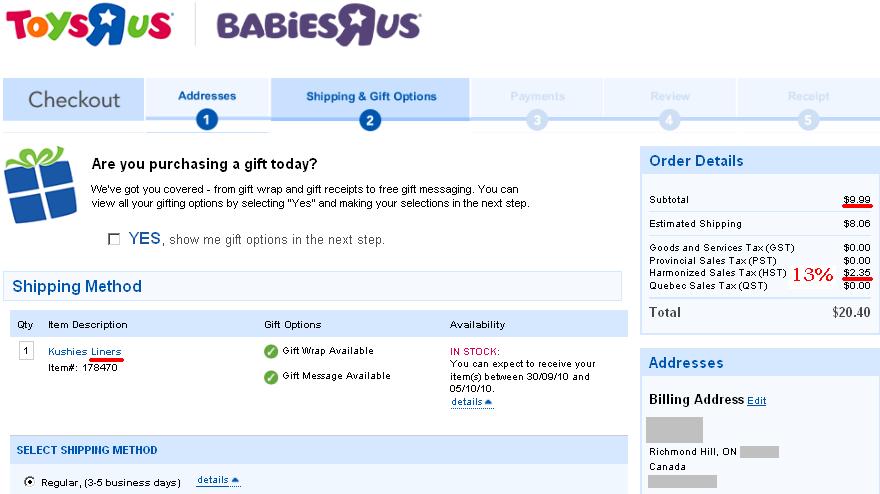

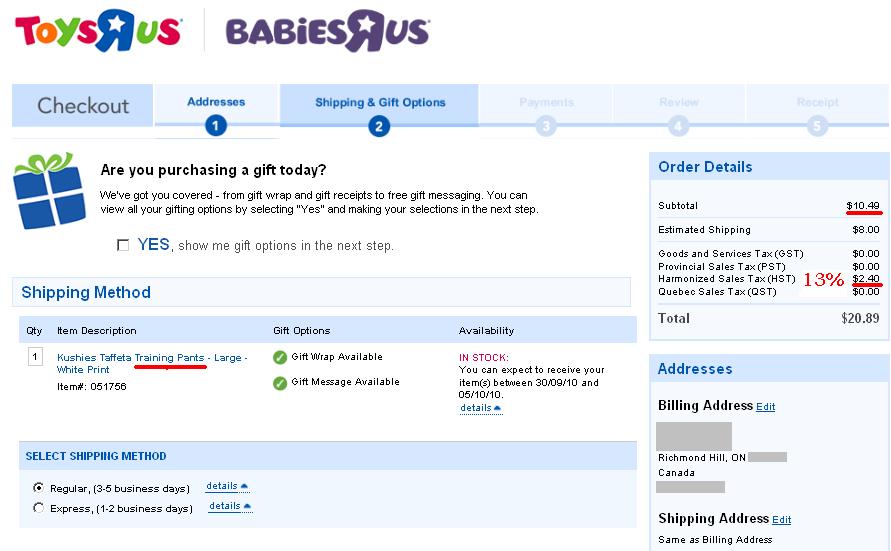

Here are the screenshots from Toysrus.ca online store website. They show that full HST tax is applied to exempt items by Toysrus. Please click on images to enlarge if you wish.

Car Seats in British Columbia:

Car Seats in Ontario:

Children Clothes (Baby Booties, Baby bibs, Receiving Blankets):

Diaper Liners and Training Pants:

Is it anything for baby or certain items? What about crib bumpers, mirror for the car, wash cloths, bottles, soothers etc?

Still doing it in 2018!!!!!

Just wanted to add that Hudson’s Bay is the same way. They charge you for HST when you buy it online but when you return it to the store, they’ll only refund you the GST.

Be smart as to where you shop!

Hi Lien,

Some companies overcharge people with taxes due to HST transition for almost one year. I think CTV and Global are not interested. However you may try to contact them and let us know about your experience.

If you’d like to, you may send a copy of your receipt to me and I will post an update that Toys R Us is still doing that. Let me know.

Thanks,

Trueler

Wow i just bought a romper and had exact change for GST at Toys r us just to see they charge HST. I called head office but I really doubt they will refund the extra tax charged. As consumers what can we do in regards to being overcharged for exempt items?? It might be a story for CTV or Global?!?

Hi Michele,

Thank you. Please let us know when you have a reply.

I have contacted Toysrus several times and asked to fix all problems with taxes, but they ignored my requests…

Trueler

End of November, 2010 – this is still going on at Toys’r’Us.

I was charged HST on baby sleepwear. I just wrote to the Ontario Ministry of Revenue about how it polices the implementation of the exemptions. Will let you know if I get a definitive reply.