These instructions are the final conclusion to the post

UPS/FedEx Brokerage Fees – avoid scam

- You ordered some goods from US into Canada by UPS and they are on the way

- Going to import some goods from US into Canada by UPS

- Already received your package and did not pay anything to the driver. It means that UPS will send you brokerage fees invoice several weeks/months later, or send information right to collection agency

- Driver showed you collect-on-delivery (C.O.D.) invoice which was ~half of the item’s price and you refused to pay at the door

There are two conditions necessary for the procedure of self clearance at Canada customs:

- Your shipment’s value for duty is less than $1600 CAD

- You have one of the local CBSA (Canada customs) offices nearby. You may find the list of offices across Canada here: Directory of CBSA Offices where Courier Low Value Shipments Program clearances are performed.

Here is the procedure of self clearing (confirmed by CBSA main office and proven many times in practice):

- Wait while your package comes to the local UPS warehouse (where you live). You will see status in the shipment’s tracking information on UPS website. If you don’t track, so just wait for the first delivery attempt and refuse to pay at the door

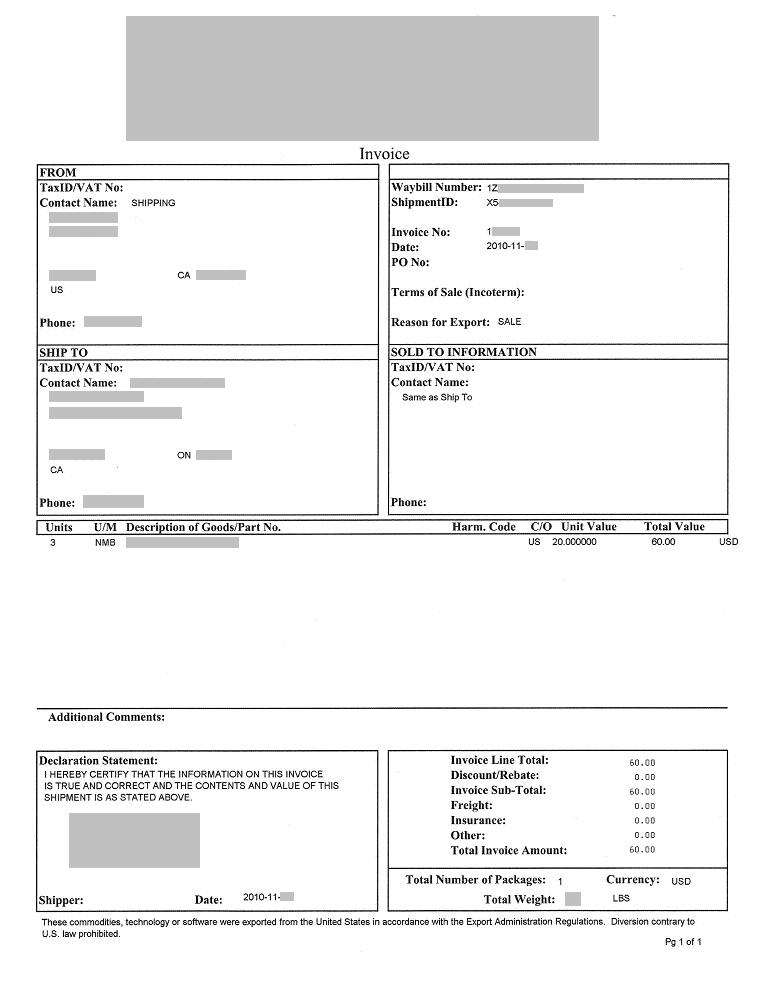

- Call UPS at toll free number 1-800-742-5877, press “3” to be connected to the billing department (or other prompt by the system), and ask customer service representative to send you shipment’s invoice. Some of the representatives call it commercial invoice. Just ask for “commercial invoice” associated with your tracking number. They can send it by e-mail or fax. Please make sure they got your address correctly – ask to spell it back. They will send it right away in .zip archive to your e-mail. Shipment’s invoice has the Unique Shipment Identifier Number needed by CBSA as well. This is how it looks like (click on image to enlarge):

- Find out what is the address of your local UPS warehouse where your package is being held. Call and ask UPS if you can’t figure out. CBSA may ask for this information during self clear. For GTA (if you see “Concord” in the tracking information) the address as of Nov. 2010 is:

UPS Center

2900 Steels ave. W,

Concord, ON, L4K 3S2

phone: 800-742-5877

- Take your shipment’s invoice, address of UPS warehouse, money to pay taxes and photo ID to the nearest CBSA office. Please take the reply from main CBSA office with instructions about self clear process for the case if officers in your local office are not aware with the proper procedure. You may find their reply at UPS/FedEx Brokerage Fees – avoid scam – section almost at the bottom of the post, just between solid grey lines. Last time I visited CBSA office in Brampton at the following address:

CBSA Brampton: office 480

197 Country Court Blvd.,

Brampton, ON, L6W 4P3

office hours: 8:30 – 16:30, Mon – Fri

!! – recently address has been changed to:

5425 Dixie Rd.

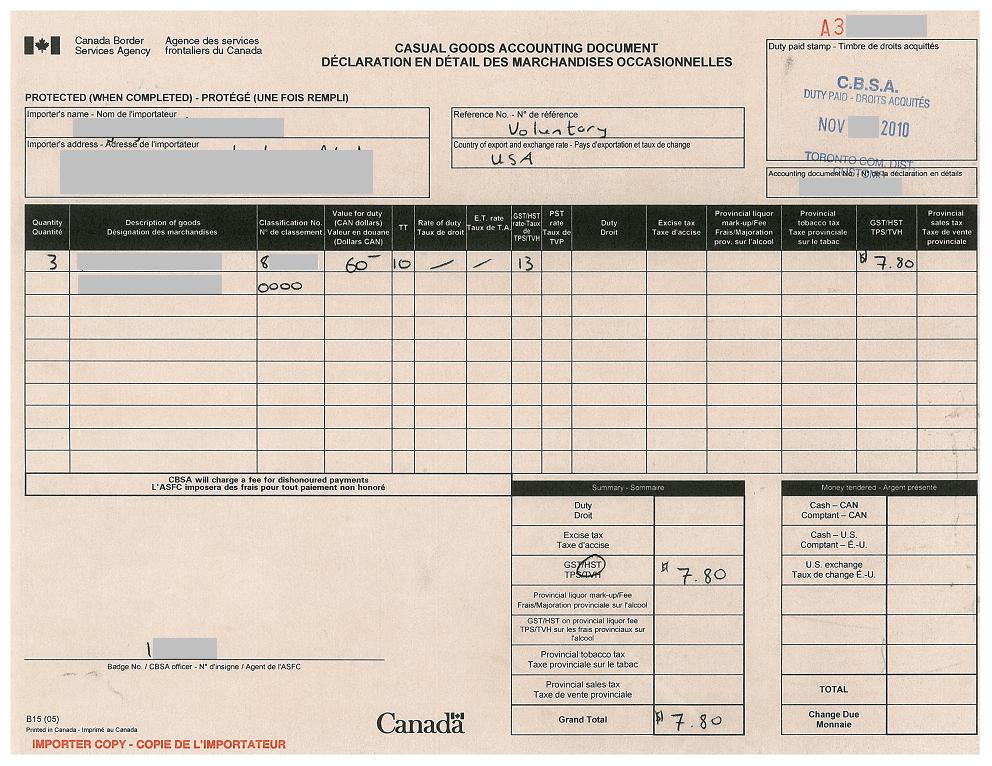

- Present your shipment’s invoice to customs officer and he will do clearance for you. After paying applicable taxes and duties to the cashier you will be provided with CBSA B15 form – Casual Goods Accounting Document, which confirms that you paid all the taxes to Canada customs. B15 form looks like this:

- Call UPS and ask how to provide them with B15 form (proof that you paid taxes) in order to waive brokerage fee invoice. They will give you fax number. Please make sure that you put your tracking number of the cover page. As of Nov 2010 CBSA B15 form should be sent here:

UPS Brokerage Department

fax number: 1-770-990-1724

- After that UPS Brokerage Department should process your B15 form and waive C.O.D. charges. It may take 1-5 days. You may also try to speed up the process by calling UPS and informing them that you already paid taxes to CBSA and sent receipt to the brokerage department. Ask UPS to schedule delivery.

You are done!

I have not done it with FedEx or other couriers, but procedure should be very similar.

Update, UPS has sent package back to Fredericton according to tracking.

The response I received to my email requesting the commercial invoice follows. I have sent an email back quoting paragraphs 17, 18, 21 and 56 of memorandum D17-4-0 and their responsibilities as COURIER. We’ll see what comes back.

Dear Craig,

Thank you for your e-mail.

This shipment imported on 04/24/12. Shipments are available to clear the day after they import. The port will contact you when the paperwork is ready.

You may pick up the paperwork for clearance at the following address:

UPS

1099 King Edward Street

Winnipeg, MB

R3H 0R3

Hours of operation are Monday – Friday, 10:00 to 15:00 CST.

Please contact us if you need any additional assistance.

Leigha O.

UPS Customer Service

Nice that someone thinks UPS is improving. Although I had read this site earlier, yesterday I received a call from UPS saying I had a package in their system (I had thought it was coming USPS). I said I wanted to self clear, and was told “that isn’t going to happen, it’s in Winnipeg”. I’m in Calgary. She then emailed me the shipment ID, but not the commercial invoice. I have requested the commercial invoice through the email route suggested above.

When I review the tracking information. Under Fredericton it says “Receiver assigned clearance to non-UPS broker Shipment is remaining in UPS control / Shipment transferred to Free Trade Zone or alternate broker per customer request” in the “Activity” section. What does that mean? That appears to be where it entered the country as it is the first Canadian entry. It currently shows a Winnipeg location and activity states “Arrival Scan”. Any thoughts?

Thank you so much for this information!

I called UPS today to get the invoice to self-clear my new laptop – which is arriving today.

She told me that because it went through Windsor as the port-of-entry it could not be ‘uncleared'(she said it’s the only one the works like this. (I don’t know how much of that is true).

HOWEVER, she said that because I wasn’t given the option to self-clear beforehand, she would waive the brokerage fee.

So, now it’s being delivered as per usual, I don’t have to leave the house, and I don’t have to pay a brokerage fee :) Super happy about this.

Thanks so much for the information – without it, I’d be down an extra $80 .

BTW, forgot to mention, I’m glad I stumbled across this site. The info is fantastic and it certainly sounds like a number of people (but not all) have experienced success in avoiding getting ripped off by UPS.

Has anyone living in the Edmonton area tried to self clear, and what was the experience like?

I’m considering ordering several car parts from the US and the main form of shipping is UPS ground. One place offers USPS shipping, but with a $50 USD premium (as opposed to $30 via USP Ground).

Just a followup to my prior post (directly abve)

On the scheduled delivery date, UPS recorded as ‘customer refused’. I didn’t. UPS called the shipper and the shipper called me and I told them my story. They asked me to contact UPS.

I ended up speaking with someone in Montreal. I explained that I had not refused the package. They said that the self-clear processes are still being developed and that it will take another 2-3 weeks. Moreover, they offered to investigate and were able to get my package moving. It was left on my doorstep two days after scheduled delivery.

From my experience, I believe that UPS will follow through and get this working in a few weeks.

I have gone through the usual process described here.

1) Confirmed with UPS that my package will be shipping via Windsor early next week. I was actually asked if I wanted to self clear, but I had no idea if there was a local office near me so didn’t say so at this point.

2) I determined that the nearest CBSA office was literally across the street from me.

3) I walked across the street to the Toronto CBSA on my lunch hour and described my situation. 10 minutes later, I had a B15 showing that I had paid all duty and taxes owing. For good measure, the agent also stamped by copy of the invoice and a copy of the UPS tracking page, and he noted the UPS shipping number on the CBSA form B15.

4) I phoned UPS to advise them of my payment and ask how to send the evidence to them. It was a different agent this time, and she refused to accept it, and said that I would have to go to Windsor Ontario. I made it very clear that this was wrong, and in contravention of CBSA guidelines. I recorded her name and identification number.

5) I faxed my stamped CBSA receipt to UPS (770-990-1724) with a very short note stating that under section 56 of Memorandum D17-4-0 from the CBSA I was providing evidence of duty/hst payment for my shipment, and asked them to record it so that no duty, tax, or brokerage fee would be collected. I provided my contact information, the shipment number, and the invoice marked with the CBSA “duty paid” stamp. I kept a copy of the fax confirmation page noting that this was sent.

Am now waiting to see what happens next…

Well again, as with EVERY time I have to get UPS as a shipper, they try to scam AGAIN. I even explained it to the women there, a supervisor and so forth – and they still insist that I cannot clear anything without going to windsor. Such BS. makes me so angry. Pointed out what she is saying is false and not within our law and I was told ‘good luck’.

UPS is so darn greedy.

Well, I just called CBSA and they immediately knew what I wanted to do but it appears that my local UPS warehouse is not bonded and that UPS has already paid the import fees.

As a result, I have to pay the UPS brokerage fees or forfeit my package. The CBSA agent said there was nothing they could do — despite the fact that I was not informed of the fees until it was delivered to my door.

Hi all,

This site is an invaluable resource — thanks for taking the time to do this!

I’m part way through the suggested process, but I now seem to be stuck in dealing with CBSA. Here’s the story so far —

1. A UPS driver brought my package yesterday and tried to get me to pay about 90% of the goods worth in COD fees. I refused. To his credit, he said that I could arrange my own broker.

2. I found this web site and arranged found the local warehouse and (after much calling) finally got a copy of the Invoice. (Note that UPS lied in the first go around and told me that it would take a few days for the invoice to be scanned into the system.) I delayed the package shipment a few days while I sort the process out.

3. This morning I went to my local CBSA location (the Kitchener Airport). After explaining that I wanted to do a casual importation and pay the fees the representative refused! Then she phoned UPS for advice on what to do!! She told me that since the package was at the local warehouse — which is not a bonded facility — then customs couldn’t inspect it. She said that it appeared that UPS paid the import taxes so I HAD TO PAY THEM their brokerage fees.

4. I politely asked her to ask her supervisor. She phoned Hamilton and eventually reported to me that I have to deal with UPS.

5. I showed her the letter from the CBSA official from this web site but she insisted that I must deal with UPS.

Any advice on how I can proceed? I’m going to send an email for clarification to the CBSA to get some pressure on the local office to allow me to get a B15.

Am I wrong in this? Have I missed anything obvious?

Thanks to all!

JGM

I received my shipment (which I had no idea was arriving by UPS) It was dropped on my doorstep and 2 weeks later I received a Customs Brokerage Invoice.

Is it too late for me to clear the items myself at my local CBSA office? I didn’t even have the option of refusing the package so I could self-clear because it was dropped off without getting a signature.

I would have refused and self-cleared if I were given the chance – I live within a 5 minute walk of the Halifax CBSA office so it would be easy for me.

Thanks for feedback!

SO, i went to the ups warehouse today in victoria BC and the 2 guys there REFUSED to give me my parcel. They showed me what appeared to be a response from their “boss” saying i had to be in the port of entry, but the CBSA said i didnt. I asked the guy what has more power the government or UPS and he said obviously the govt, but he refused to give me my package until i paid my brokerage, even when i had my B15. So after half an hour of arguements, I went home and called ups and the kind lady said she would delete the brokerage fees and schedule a delivery. She also said I did not have to be in the port of entry. So UPS lied to me and gave me a fake email response…. Those assholes

Hi,

Wow. I happened on all this information by accident, and am glad I did. Sorry to sound redundant, but I’m on a time crunch for my package. I wanted to clarify exactly everything that I need. I’m located in the West end of Toronto, close to Mississauga.

What I have

-commercial invoice from UPS via email

-photo ID

-money to pay

What I need

-warehouse address (the one listed above or do I ask the delivery guy?)

Questions

-if I go to the CBSA with what I have and what I need, they should be able to process my payment?

-is it possible for me to take the receipt after payment from the CBSA to the UPS warehouse and pick up my package instead of faxing and waiting?

Thank you so much trueller for all your efforts. It is definitely frustrating when companies do business like this.

Janice

An update…

I called UPS this evening and explained that I wanted to get a manifest in order to clear the shipment myself. She said that it would require the shipment to be sent back to Windsor and that could not be done.

However, she agreed to waive the brokerage fee and I paid the duty and taxes over the phone. I arranged delivery and hopefully that will settle everything. A bit of wasted gas and time but everything appears to be settled.

Still, this blog post has a lot valuable information and I have learned a lot through my experience. I cannot thank you enough Trueler for this.

I tried to clear a package myself today, only to be told by two agents at both Mississauga and Pearson that they needed the manifest. Also, the agent at Pearson said the Concord warehouse is not bonded. Even showing the official reply, she said that she needed a manifest because that was how she had always done it.

Phoning UPS for the manifest was of no help. One rep said I had to call the shipper to obtain it and another transferred me to brokerage who said I had to go to Windsor to clear. I am now waiting on the shipper to call me back.

Then when I phoned CBSA, I was advised that since UPS already cleared customs for me without first notifying UPS that I wanted to self-clear before the package arrived in Windsor, I was out of luck.

I now wonder if I have done something wrong in failing to provide a manifest.

Unfortunately UPS really try to invent some new things to misdirect us and force to pay…

I called UPS this morning to follow up on the fax that the UPS employee had sent for me. Nothing was received – do they really try so hard to misdirect us? They did clear the package for delivery so I expect they just wanted to send me a bill to follow. I’ve scanned and emailed the B15 – the email address they provided was fredbrok@ups.com – I will call again tomorrow to ensure they have received it and that I will not be receiving a bill in the mail.

I’m still waiting on the delivery…

Thanks a lot Hel for information!

Trueler

First of all, thanks so much for the invaluable advice. I’ve done everything up to the point of receiving the package, only because the package was still in the hub (it just arrived in Concord today) when I went to the UPS warehouse with my B15. I’m keeping my fingers crossed that when delivered tomorrow, the driver can authorize that it’s been cleared.

I never usually write any comments on the internet, but in this case I feel I have to give back.

As soon as I saw on the UPS website that my package was at the local warehouse, I called UPS for my shipment/commercial invoice. The operator was surprisingly very helpful and even suggested she would wait on the phone while I checked that I received my invoice via email.

For those of you in Toronto, the correct address at Pearson is actually in the cargo area, not in the actual airport. I originally went to T1, 1st floor, but that is only passenger customs and the officer was clueless. She did however give me the correct address where I did receive my B15. The correct address is:

2720 Britannia Rd. East, Cargo 3, First Floor

Mississauga, ON

Tel: 905-405-3899

The address of the Concord warehouse, as noted elsewhere on this site is:

2900 Steeles Ave. West, Concord, ON

The employee at UPS was actually really sweet and helpful, however the employee on the phone I spoke with while I was there was trying his hardest to discourage me until I (as I have read to do on this site) stated that it was my legal right, at which point he put me on hold before he told me I could fax the B15 to the UPS Fredericton Teleservicing Department: 1-506-447-3706. When I originally told him I had cleared the package myself, he asked me if I physically went to the port of entry to clear it. Not until I explained it was my legal right did he change his tone. Then he advised me that I should have called UPS earlier to inform them that I would be self clearing. I ensured him I would the next time – yeah right, so they could hold it at the port of entry? As noted, VERY IMPORTANT: WAIT UNTIL THE PACKAGE ARRIVES AT THE LOCAL WAREHOUSE.

The only worry I have is that the UPS employee in Concord actually faxed my B15 for me and when I asked for a fax confirmation, she advised that they don’t receive any, only if the fax doesn’t go through successfully. I’m going to keep my fingers crossed and see what happens tomorrow.

Just want to say thank you Trueler and for everyone whose comments have helped me on this issue.

Good luck everyone!

Hello Again,

I wrote a post on this page just a few hours ago about my current situation with UPS. The one thing that I am wondering about is when I spoke to the brokerage guy this morning I requested the shipping invoice to be sent to me via email. The brokerage person said that they would send it to the CBSA themselves. Now I am wondering if this is a way for them to get around me NOT paying them some sort of fee? Also, I was reading some older posts on this page and another question came up. Will I be able to pay the taxes at the CBSA and pick up my parcel on the same day? or will UPS tell me there will be another 5 day delay? Or is this just if I wanted the package shipped to me? The custom’s office is only a few blocks from the UPS warehouse so I was hoping to take care of this in one shot. :)

Michele

Hi,

I had a sports good package being delivered to the Vancouver area. I tried asking UPS for the invoice and the lady that took my call was about to do that when she told me that my package got a “formal entry into canada”, which she explained was a shipment that the “govt manifests”. Basically I was told that since the customs people had to know the details of/check the package before it was released to UPS (at the port) the UPS people had to handle the customs and pay the taxes on it already. Which now means that I cant self clear the package and have to pay the brokerage+tax to UPS (which btw comes to about 80% of the value of the shipment, which is between the $40-100 range). So now I have 5 business days to respond after which my shipment will be sent back.

Does anyone have any insight on whether this is even legal considering what this site mentions about the importer not being liable to pay ups for their overpriced services?

{P.s Thanks a lot for the info here! :)}

Hi,

I don’t know if anyone else in the comments has done this, but it is possible in Greater Vancouver to physically clear your items and pick them up at the depot instead of waiting for re-delivery and potentially getting another clueless driver who tries to clip you for the inflated brokerage fees.

In my case I drove down to the depot near YVR airport.I then got the shipping manifest from UPS (they made me wait about 20 minutes for it, but I didn’t have anything to do that day and I had a book to read so that was OK), then drove the ~10 minutes to the CBSA also near YCR. I presented all the documentation, they processed it and the duty and tax was in line with what I expected, so I paid up and then got my return documentation and went back to UPS’s depot to get the package.

Done like dinner!

Hi Trueler.

I went to the CBSA office at Pearson Intl. and advised the CBSA clerk I had the ‘Commercial Invoice’ and address of the UPS warehouse where the goods were being held, he refused to issue me the B15 advising me I must obtain the ‘Cargo Control Documents’ from the UPS warehouse and that he “does this sort of all the time”. It was Sunday afternoon, so I headed to the other side of the Airport and being Sunday of course UPS was closed. I immediately went back and went to another clerk this time advising him that the ‘Cargo Control Documents’ would not be issued to me but that I had the ‘Commercial invoice’, he too was reluctant. I showed him the official response from CBSA in Ottawa from my phone and he spoke with his supervisor which advised him to issue me the B15 since the goods were being held in a non-bonded warehouse.

At this time I witnessed something quite appalling between the two different CBSA agents, a verbal argument broke out in front of me between the first and second agents I went to. The first agent advised him the ‘Cargo control documents’ would not be released to me, including the manifesto. At this point the second agent advised him he must comply with the policy and not make up his own, the first agent that refused: his reply to this was “I don’t like this guy!” right in front of me. I could not believe the argument kept escalating between the two, the [elderly] second agent was coaching the younger [first] officer. It’s unfortunate that our tax dollars are paying for their salaries and the reason he did not want to assist me was because: he didn’t ‘like this guy!’ not to mention his lack of knowledge with the procedure.

My take from all this is that you have to be diligent and calm during your request, request to speak to a supervisor if need be, as some of the agents themselves are not aware of the policy and procedure regarding this whole ordeal or are just blatantly reluctant to assist you.

Hey Alex,

Actually, I can confirm that you are mostly correct.

I used to work for an online retailer in a department that processed damage and loss claims with carriers. Document requests from FedEx, UPS and truck freight companies was part of my job on a daily basis.

FedEx and UPS email requests arrived maybe 70% of the time, and almost always on a time delay. Based on my experience with MULTIPLE agents across an entire year at that job, I get the feeling that when you don’t receive the email, it may be equal parts buggy delivery system and agent not filling out a form to issue the document properly.

Still, it’s better than most truck freight companies (with the exception of ABF, bless their souls) which have abysmal paperwork filing systems that are only 25% digital, at best. Imagine waiting 5-7 days for a scanned copy of a faxed document from one of their ancient depots.

Anyways, these instructions are a godsend. I’m gonna see what success I have using them with a DHL shipment and will be sure to post my successes and/or failures.

Regarding the case of emails not being sent. It seems their system has some strange rules regarding what a valid address is or is not. After getting the standard ‘wait 90 minutes’ line from two other reps yesterday, I tried again this morning. This time I had a patient rep (Sandra) who stayed on the line while we tried a few different tactics. Email to my custom domain was accepted by her system, but disappeared into the ether. We tried a shortened version (.ca – ie: abc.ca) of my employer address – which I use because it is much easier to type. UPS’ system rejected it as invalid. I then tried my full address (first.last@alphabravocharlie.com) – yes we have both a .ca and .com domain. The full address worked, and the invoice arrived in less than a minute.

Once I saw the email, I began to suspect why their system is so buggy. The email comes from , the subject was ‘Image Request’, and the file attachment is ‘6854868656519.zip’. Tell me that doesn’t look suspicious. I’m surprised our corporate antivirus / antispam didn’t trash the message.

So, as much as we collectively love to hate UPS, it appears the misdirected / lost emails might be a problem with UPS’ software and not some conspiracy to stall self-clearing.

I called UPS and they said I am unable to clear my own package unless I am at the port of arrival (talked to Denis #466). Then I called CBSA to ask how to go about clearing it myself and the guy was VERY rude and unhelpful… Im going to wait till it arrives and try it that way *fingers crossed*.

Thanks for the info!

Cheers

Hi Trueler,

Thank you for all your work investigating how to self-clear a shipment. Having read through all the blogs I was able to learn from everyone’s frustrating experiences and self-cleared my package from UPS without a problem.

I waited for UPS’s first attempt of delivery, took the sticker off my front door that they left and called UPS to tell them I will pick my item up at the warehouse myself.

Then I called UPS, selecting option 3, and asked for a copy of the commercial invoice (as instructed from one of your blogs). I DID NOT inform them that I want to self-clear the package. I ensured that they had recorded my email address correctly and received the commercial invoice within minutes.

I proceeded to my local CBSA office with the original sales receipt of item (picture of item was on there, which seemed helpful at CBSA office), the commercial invoice, UPS tracking summary (showing it was being held at UPS warehouse) as well as UPS sticker from my front door

and my ID. The customs officer asked for the “UPS manifest” which I didn’t have but I showed her the UPS tracking summary as well as the sticker from my door which was sufficient. Within 10 minutes she had all of the above papers stamped and dated and gave me the B15 form and

I proceeded to pay the GST at the CBSA office.

Then I faxed the commercial invoice, original sales receipt and B15 form to the “UPS Rating Department” (506)447-3706 in New Brunswick where they are to make rate adjustments to my package. Make sure to include your UPS tracking # on fax coversheet. Normally this takes 1-5 days to adjust, however, another blog I read said he went to collect his package the next day, so I thought I’d try that.

The next day I took all of the above paperwork to the UPS warehouse including the UPS sticker from my door. The fellow went to retrieve my package and when he was ready to collect the brokerage fees, I handed him all the paperwork. He took it to an international broker in the

back and a few minutes later said everything looked good. I did ask for all my paperwork back so that I have back-up incase I should have any issues with this at a later date, as I’ve read some of you had surprise bills months later. He scanned my package and sent me on my way.

I was ready for a big confrontation with CBSA as well as UPS and made sure to print off “how to self-clear” as well as some steps from some blogs of yours, but thanks to all the digging you’ve done and the shared experiences of others, I had everything I needed for a smooth transaction.

Doing this involved a fair bit of driving and researching but well worth saving approximately $47.00 in brokerage fees this time. Thanks again to you and everyone who has shared their experiences. I’m telling everyone about your website to help save others $$.

Linda

Wow, this has gotten very messed up since I self-cleared two months ago. Package released with apology after two weeks without COD. Thought I was in the clear. Received invoice a month after for $70+, dated 4 days AFTER B-15. Was told on phone that if I paid it they would be immediately reimburse my credit card. They could offer not proof of this so I basically laughed and hung up. Maria Greco (a manager, yes! – got last name through a unique source) called me out of the blue with some account number and said she would look into making the correct invoice. Was told a correct invoice could not be made without brokerage fee due to..well, whatever BS. She never called back despite saying she was ‘on it’. A week ago I got a form to claim taxes back from CRA. I have documented this with dates, names, and account numbers and will be mailing a complaint to both CBSA, CRA, and UPS. One thing is for sure, if I claim back my taxes, I admit I was wrong. I have been overtly lied to on at least 4 separate occasions and have probably cost them much more than 70$ in time :D

Hey,

Here is a information. If your parcel has some into Canada, you can’t clear the parcel at Windsor CBSA office. If anyone ask you to go to Windsor to clear the parcel yourself, don’t do it. I’m in Windsor and I wanted my parcel cleared. CBSA said you can’t do it here and has to be done at inland CBSA office and nearest one is in London or at your UPS store. People here at CBSA Windsor don’t know anything and are useless. I think I will have to pay 70$ custom to UPS now on 140$ parcel. What the hell.

So, Trueler, could you please include this information, that the item cannot be cleared once the item has entered Canada at Windsor location. UPS can tell you that they will have to send the package back, but that a lie as CBSA won’t take it back and wait for you to come. At least not here is Canada.

Thank you for your reply.

Even though UPS is a bonded carrier, we restrict in-bond movements to the first point of arrival, one of our UPS Canadian ports of entry. This means that you would need to physically go to the port of entry to complete the customs clearance in person. For ground shipments entering the province of Ontario, the port of entry would be Fort Erie or Windsor.

If you wish to self clear your future shipments, it is recommended that you contact UPS Customer Service once your order has been shipped so we can arrange to have the paperwork ready for you to pick up at the port.

Please contact us if you need any additional assistance.

gurrrr how do I deal with this

A group of us ordered 11 lbs of tobacco for $13 a lb, I have heard of issues regarding orders over 10 lbs must be proven to not be for resale, which is fine I can have my fiancee and his coworker sign a statement regarding splitting an order and customs fees to save on shipping. I called ups and the first rep couldn’t help me at all even after I pointed out there were plenty of people posting online their experiences and that I wouldn’t take no for an answer since I live on an island. So I called back and the next person was helpful, I just have to go into the cbsa office here in town and fill out the b15 then fax it to the dock that will be holding the package — no worries there. I suspect my order being over 10lbs might irk them, but 1lb from my last order went bad I think I even want to waive the fees considering I has partially spoiled product (not packaged properly went moldy).

We’ll see I am leaving in an hour or so to go deal with them.

I was gonna call in and do the same but the agent on the other line insisted that I must go to the windsor port of entry to clear it myself. However she said since I was not aware of the brokage fee, she will put a flag up and wavie the charge for me. So when I go pick it up I will only need to pay the duty tax.

Hope it helps

The third fax worked… UPS removed the COD charge from my shipment and I picked up the parcel today.

Thanks for all the information you provided Trueler!

The officers at the CBSA office near Trudeau Airport Montreal WILL NOT accept the commercial invoice only. I tried it two times with two different officers (showing the letter as well as the memorandum D17-4-0). With the manifest, it takes 5 minutes.

You can file every complaint you want, if you want your package you have to get the manifest (that UPS emailed to me easily).

This procedure works very well but I wish officers knew it is supposed to work with the commercial invoice only.

Thank you very much Trueler.

I am in the process of attempting this because I forgot to tell the seller that I only accept USPS shipments.

I contacted CBSA and received the EXACT same email that you did, so I followed option 2… emailed UPS for the invoice and received it, waited for delivery on Tuesday and refused it, went to CBSA and paid applicable duties and taxes, then faxed the B15 form into the fax number specified in your posting.

I contact UPS on Wednesday and they had no record of the fax being received, and they said I sent it to the wrong fax number… they gave me 1-506-447-3706 (same as others here). The person on the line said that when I faxed it I should include a note to refund the COD charge (sounds good, right?). I again faxed off my B15 off to UPS around 2pm that day.

Today I went at the end of the day to the UPS Pickup location in Ottawa (on Stevenage Drive) and again there is no record of my fax being received on their computer. The clerk at the counter even called their brokerage to check, and there is no evidence there that they received it. Furthermore, the brokerage person told the clerk that UPS had already paid the GST on the item on the 19th and since I had paid on the 22nd then it was my responsibility to deal with CBSA for a refund and I had to pay the brokerage fees. I got the clerk to confirm that I used the correct fax number, and I showed him the email from CBSA and my B15 form. He claimed there was nothing he could do so I left the store without my package.

I faxed everything again to that number, then followed up with a call to UPS. The person on the line said that the brokerage office was closed, but he would send a message to them to check for the fax.

That is where I currently am… I will be calling UPS again in the morning, and again in the afternoon if I don’t get any success. I will post back when all is done to let you know the outcome.

Thank you very much Trueler.

To all others: this does work but you have to stay within certain legal parameters, stay firm and learn the lingo (Low Value Program, bonded facility, duty, etc.), and be able to accept a week long game of chicken should they dig in and try to make you cave and pay to get your package. I can assume that once they have your money, a refund is impossible. Either way, on the final day them holding my shipment and my request being two days at “refunds” and spending two days at “brokerage” the problem was finally resolved with one phone call. Call numerous times, everytime you get an employee that knows the legalities of the situation, it moves a step closer to freedom. Reference your previous calls and outcomes, they have a record of when and how much you call so don’t lie. Once they start to admit they have made mistakes, you have won. Above all, be assertive and respectful at all times.

They also admitted to immediately paying the taxes in brokerage as being part of a policy and furthermore, that any refunds are their responsibility should the importer clear it themselves. So beware of this distraction that stopped me for a week.

Hi Trueler and thanks for this webpage!

I tried to do the described procedure to the office near Trudeau Airport in Montreal but was asked to show the manifest. I showed the CBSA letter pretending it was an answer I got but the officer refused to read the letter as “anybody could have written it”.

I didn’t take his name for some reason and I am trying to get the manifest from UPS. I wish CBSA offices in Ottawa would send this email to every other office so that they know how to proceed with only the commercial invoice…

I will update soon (hopefully).

@Nick and HateUPS:

Seems like you are mixing up commercial and personal shipments. For commercial shipments you have to present yourself at the port of entry. For personal shipments below $1600 CAD which fall under CLVS program you are allowed to pay taxes at a local CBSA office.

@Nick:

I’m not allowed to disclose names and phone numbers of CBSA employees. You may want to send their own reply with instructions (which I posted) to CBSA and ask them to confirm.

If you prefer regular mail instead of email, you may send your complaints to:

CBSA

Courier LVS Program

150 Isabella St., 4th Floor

Ottawa ON K1A 0L8

(address taken from http://www.cbsa-asfc.gc.ca)

Regards,

Trueler

After a few phonecalls, it is confirmed you must present yourself at the location goods are being housed to clear. This is in order for Customs officers to verify the goods. They have had all their phone agents review d-17-4 due to the number of calls regarding self clear they get.

If UPS has forwarded your package to a bonded warehouse which your local (inland) CBSA office is associated with you can clear it there. The package must stay in bond until tax and duty are paid.

Who did you speak to at CBSA Ottawa? Sure this person who called you had a name? It would have been a lot easier to denfend myself had I had the name and the position of the person telling you this information. All I had to go on was basically “this guy on the internet said CBSA Ottawa told him that you are wrong.” Which of course didn’t get me very far.

I’m not trying to be difficult but I’ve spent two days and I have spoken to people who do this for a living that say the information on your website is simply false. Beleive me I’d love nothing mroe than to go back and rub it in their faces but I’ve used up all my ammunition when I tried the first, second and third time.

@Nick,

I’m not proving you anything. This is a procedure confirmed by CBSA after a pretty long research and investigation.

Some comments for better understanding by everyone.

Unfortunately that paragraph 56 has been misinterpreted by you and 4 different people. The requirement to pay taxes by importer is that goods are already released by Canada Customs at the port of entry – that’s it, and this is exactly what officers at local CBSA offices ask people when they want to pay taxes. If importer calls UPS in advance and advice of the intention to pay taxes in a local CBSA office, according to paragraph 56 UPS should hold the shipment at the port of entry warehouse until importer provides B15 form to UPS. Then UPS should redirect shipment to the local warehouse and make a delivery. That’s simple. But when you inform UPS in advance they scare you and tell that it’s not possible and you must present yourself at the port of entry in order to do this. When I got a call from CBSA Ottawa, he told that it’s not true at all. Anyone can pay taxes at any local office.

When CBSA releases goods at the port of entry, it does not matter what UPS do with them: either keep in a bonded warehouse at the port of entry, or send to a local warehouse to save delivery time. The requirements are exactly met:

– Goods have been released by CBSA to the courier

– The courier does not release goods to the importer until taxes paid

Regards,

Trueler

Trueler,

With all due respect you are really not proving anything with that response. Paragraph 56 states that in order for the goods to be self-cleared they must be at the bonded warehouse, they can not have been released. Once the goods have arrived at the local depot they are no longer in bond and that means UPS has already submitted their entry and that’s why CBSA won’t touch it.

The superintendant I spoke with was very adamant. I could certainly clear the goods myself, but that it had to be done before the goods were cleared by the broker and at the office corresponding to that bonded warehouse. Once the goods were no longer in bond they won’t touch it. That’s how he explained it to me and honestly the 4 different people I’ve talked to at CBSA have all independently said the same thing. They all found it strange that people have found customs offices that have accepted such a thing, but they have assured me that they were sending notice to headquarters to make sure every office is aware that they shouldn’t.

Anyways… I don’t have time for this anymore. I thought I’d save myself a couple of buck and thanks to you I’ve wasted 2 days of my life.

Good luck to the rest of you.

@HateUPS:

CBSA did their own job – accepted taxes from you and issued B15. I think it’s better to complaint about UPS not to CBSA, but to CRA. Because asking a taxpayer to pay taxes the second time for the same item is a very serious violation, and CRA takes all these cases very seriously.

If you want to get it right by UPS, please refer to this comment about asking for receipt from UPS that they’ve paid taxes:

http://trueler.com/2010/11/24/self-clear-shipment-cbsa-avoid-ups-brokerage-fee/#comment-14940

That guy has similar case to yours.

Regards,

Trueler

So, after over a week of back and forth with UPS I’m still pissed.

I informed UPS I would like to self clear, their response “no problem, but you have to go to Windsor”. I told them this was not the case as a LVS I could clear at an inland office. To which they replied “well who is going to put it though customs at windsor then”…. After getting transferred to a supervisor who told me the same thing. I called the 800 number listed on the CBSA site, they told me to go to point of entry since it’s with UPS. <-oh really

Called my local CBSA office, they told me "no problem come on in and we'll do the paperwork".

Paid my tax and duty, faxed the form to UPS. UPS refuses to do anything with it because "we already brokered it". They finally waived the brokerage fees but require me to pay tax at the local warehouse for pickup. They said I could claim a refund after i picked up the package… Seriously not right.

Had a similar situation with fedex, which was resolved after a 5 minute phone call and a fax of proof of payment to CBSA..

Could you please forward some contact information for either a UPS agent who knows what they are doing, a CBSA officer who actually knows the importation process and a number to file a complaint with CBSA?

@Nick:

Release of goods by Canada Customs at the port of entry and payment of taxes are two things. For the first one broker is not needed at all. The second one can be done by a broker or importer.

I have not invented that response, it came from CBSA information center. I’ve found in the Internet some old response (maybe as of 2007) with the same idea of self-clearing at any local office and sent it to CBSA and also complained that Brampton CBSA office refused to follow it. Month later after investigation they confirmed the procedure in the response I quoted on this website. I also got a call back from CBSA and they confirmed that there is absolutely no need to go to the port of entry in order to self-clear as UPS and local CBSA offices ask you for.

Actually, D17-4-0 clearly confirms the procedure that importer can pay taxes. What is the “direct disagreement”? Well.. Let’s go through it:

17. Prior to or upon arrival of the shipment, the courier must present two copies of a cargo/release list to the CBSA.

18. The border services officer reviews the list and highlights any shipments that require examination. Goods that have not been selected for examination are considered released. The border services officer will release stamp one copy of the list and return it to the courier as proof of release by the CBSA. The second copy is retained by the CBSA.

=> Broker is not required in the procedure of release. It’s responsibility of the courier and CBSA.

21. Once goods are released, the courier is responsible for providing the importer or customs broker with all release information and supporting documentation for each shipment.

=> UPS must provide shipment’s invoice, unique shipment ID to the importer

52. Casual goods imported by authorized Courier LVS Program participants may be released before being accounted for and before payment of the applicable duties and taxes.

=> That’s what happens

56. If an importer wishes to account for the goods himself or herself, the courier does not release the shipment to the importer but holds the goods until the importer presents satisfactory proof that the appropriate duties and taxes have been paid directly to the CBSA. The importer must note the unique shipment identifier number and contact the courier to determine where the goods are held in a bonded warehouse until the release is effected.

That’s it. Taxes need to be paid directly to CBSA by importer. It does not have to be done at the port of entry. Any local CBSA office should be good.

If you want, you may file a complaint to the Ministry.

Thanks,

Trueler

Well it’s been a few days, and I’ve not made any progress with CBSA. I’ve spoken to the superintendant at the local office, I’ve spoken to several officers via the toll-free number (including senior officers) and they all confirm that your “official” response is not only in direct disagreement with paragraph 56 of D17-4-0 but they also find that response suspect on a few other grounds also. To them it makes no sense that anyone of any authority in CBSA would give a response that brings into question whether or not a broker can charge fees for their services especially considering that the brokers have already submitted their entry to customs regardless of whether LVS allows them to pay later.

They all wanted to know where that response came from because “CBSA Ottawa” seemed very ambiguous to them. I found out from the toll-free number that email responses are actually generated from a client services office in Winnipeg and not Ottawa, so no one was willing to accept the response you have provided from “CBSA Ottawa” over the procedures outlined in D17-4-0. They basically said if there are any ammendments to the d-memo headquarters would issue a notice of those ammendments. They say they have recieved no such notice so they are sticking to the the rules as they are written in the d-memo.

I was told though that there was going to be a formal inquiry to CBSA headquarters in Ottawa as to who submitted this response (if it was actually a reply from CBSA.)

I’m pretty upset now though, because on top of paying the brokerage fees (yes, I gave up.) I have also wasted a lot of my time… Next time I’m just going to use regular mail.

Thanks for the prompt reply,

I called again and got a woman who knew what I was talking about. She put it through again to brokerage marked as being part of the low-value shipment program (24-48hrs more) Funny, because I clearly wrote this on my original fax. Anyway, if the same error comes up, I will request the receipt. It seems the only way to work with these people is to call 8 times and hope you get a sympathetic employee who did their homework. They also fully insulate those who can make the invoice-altering decisions from the caller. If I was to create publicly traded rip-off company, I would study UPS.

Hi Ian,

It was really a B.S. from UPS… Well.. If they’ve already paid taxes to CBSA, they must provide you with a receipt from CBSA. You may try again calling UPS and ask to waive C.O.D. invoice from them with taxes and brokerage fee because you have B15. If they refuse and tell again that they’ve ALREADY paid taxes on your behalf to CBSA, ask them for receipt being sent to your e-mail or fax. No immediate receipt – so it’s 100% B.S. They may tell you that they will send you receipt in a month (I’ve heard this from one of the importers) – but it just means that they have not paid taxes to Canada Customs yet. Actually, different UPS representatives behave differently, so, I hope you will be lucky and they will just accept your B15 without long conversation and deliver the package without any fees.

Regards,

Trueler

Thanks Trueler,

UPS is doing the trick that I saw mentioned in this thread already. That is, they are claiming that they already paid the tax and say they will send a CRA form for me to claim a refund for the taxes I paid. I called the CBSA and the person said this was B.S., he also said that there is nothing that he can do as this was a private matter. I feel this is complete extortion on behalf of UPS and that CBSA will not lift a finger to help. Any advice? I feel like time is running out.