These instructions are the final conclusion to the post

UPS/FedEx Brokerage Fees – avoid scam

- You ordered some goods from US into Canada by UPS and they are on the way

- Going to import some goods from US into Canada by UPS

- Already received your package and did not pay anything to the driver. It means that UPS will send you brokerage fees invoice several weeks/months later, or send information right to collection agency

- Driver showed you collect-on-delivery (C.O.D.) invoice which was ~half of the item’s price and you refused to pay at the door

There are two conditions necessary for the procedure of self clearance at Canada customs:

- Your shipment’s value for duty is less than $1600 CAD

- You have one of the local CBSA (Canada customs) offices nearby. You may find the list of offices across Canada here: Directory of CBSA Offices where Courier Low Value Shipments Program clearances are performed.

Here is the procedure of self clearing (confirmed by CBSA main office and proven many times in practice):

- Wait while your package comes to the local UPS warehouse (where you live). You will see status in the shipment’s tracking information on UPS website. If you don’t track, so just wait for the first delivery attempt and refuse to pay at the door

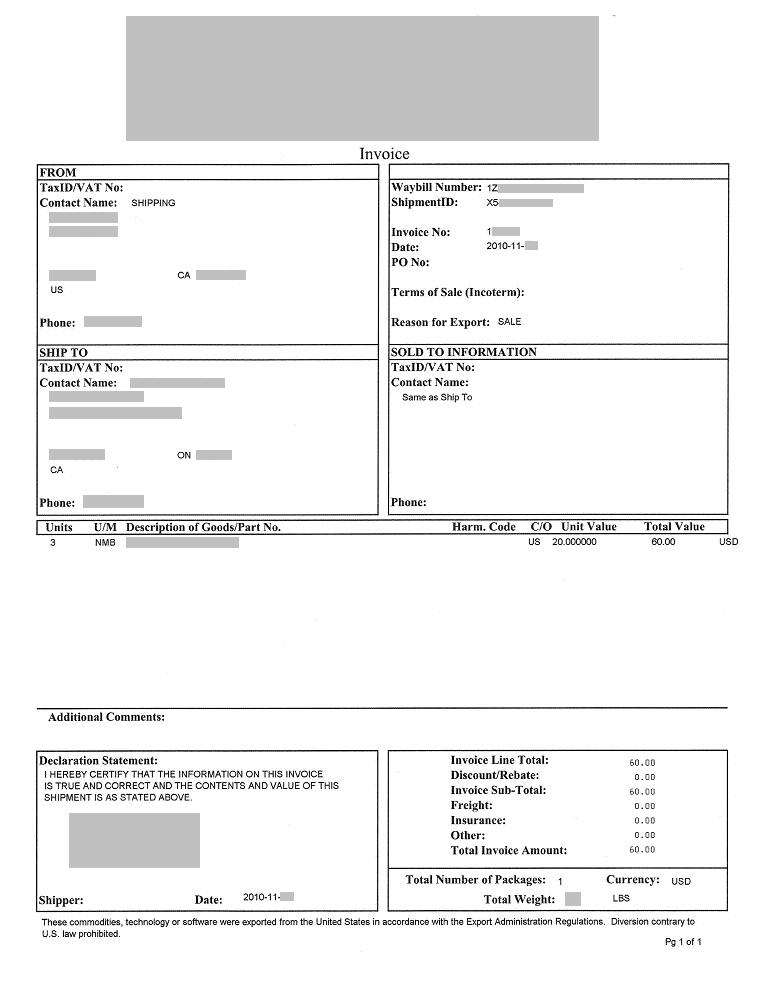

- Call UPS at toll free number 1-800-742-5877, press “3” to be connected to the billing department (or other prompt by the system), and ask customer service representative to send you shipment’s invoice. Some of the representatives call it commercial invoice. Just ask for “commercial invoice” associated with your tracking number. They can send it by e-mail or fax. Please make sure they got your address correctly – ask to spell it back. They will send it right away in .zip archive to your e-mail. Shipment’s invoice has the Unique Shipment Identifier Number needed by CBSA as well. This is how it looks like (click on image to enlarge):

- Find out what is the address of your local UPS warehouse where your package is being held. Call and ask UPS if you can’t figure out. CBSA may ask for this information during self clear. For GTA (if you see “Concord” in the tracking information) the address as of Nov. 2010 is:

UPS Center

2900 Steels ave. W,

Concord, ON, L4K 3S2

phone: 800-742-5877

- Take your shipment’s invoice, address of UPS warehouse, money to pay taxes and photo ID to the nearest CBSA office. Please take the reply from main CBSA office with instructions about self clear process for the case if officers in your local office are not aware with the proper procedure. You may find their reply at UPS/FedEx Brokerage Fees – avoid scam – section almost at the bottom of the post, just between solid grey lines. Last time I visited CBSA office in Brampton at the following address:

CBSA Brampton: office 480

197 Country Court Blvd.,

Brampton, ON, L6W 4P3

office hours: 8:30 – 16:30, Mon – Fri

!! – recently address has been changed to:

5425 Dixie Rd.

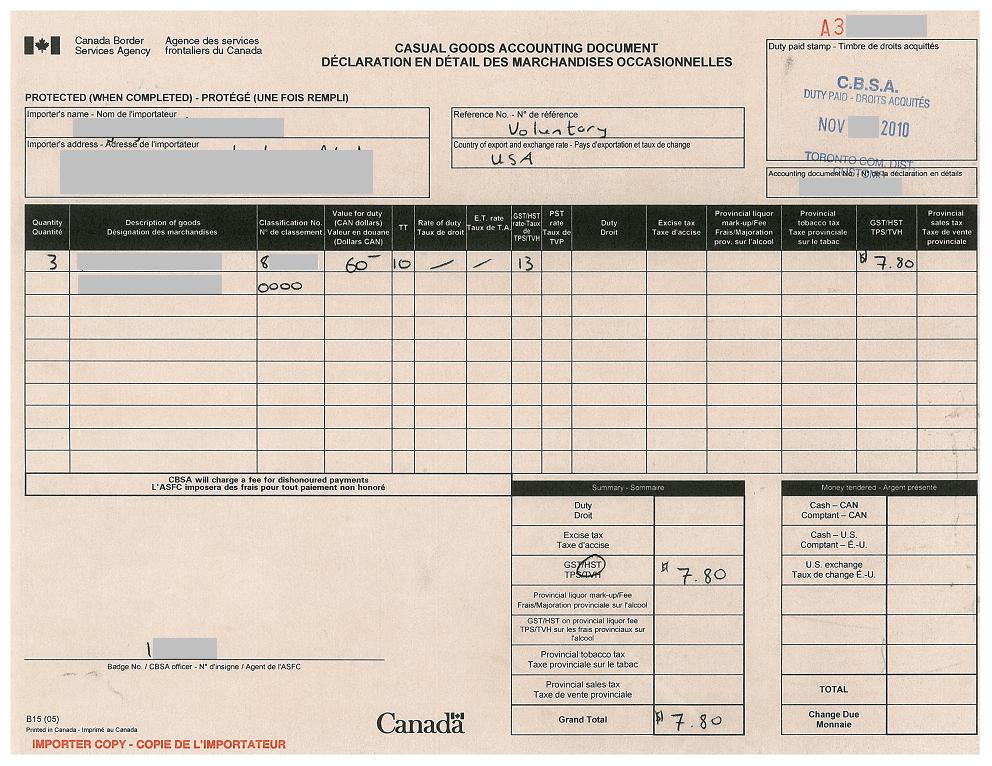

- Present your shipment’s invoice to customs officer and he will do clearance for you. After paying applicable taxes and duties to the cashier you will be provided with CBSA B15 form – Casual Goods Accounting Document, which confirms that you paid all the taxes to Canada customs. B15 form looks like this:

- Call UPS and ask how to provide them with B15 form (proof that you paid taxes) in order to waive brokerage fee invoice. They will give you fax number. Please make sure that you put your tracking number of the cover page. As of Nov 2010 CBSA B15 form should be sent here:

UPS Brokerage Department

fax number: 1-770-990-1724

- After that UPS Brokerage Department should process your B15 form and waive C.O.D. charges. It may take 1-5 days. You may also try to speed up the process by calling UPS and informing them that you already paid taxes to CBSA and sent receipt to the brokerage department. Ask UPS to schedule delivery.

You are done!

I have not done it with FedEx or other couriers, but procedure should be very similar.

I am uncertain about USPS, and if they charge brokerage fees? I wanted to order an item off of Etsy that’d be shipping from the US to Canada. The item is a ring (jewelry) and it is worth $20.02 CAD so that’s just TWO CENTS OVER twenty so would i still be charged for duties or taxes? and does USPS charge brokerage fees? i’m afraid to order the item because the shipping cost (according to Etsy, using USPS) would be $17.35!!! which is RIDICULOUS just 2 bucks and some change from being the price of the actual product i want to get.

If you could advise me on this, that’d be great, as i just started browsing the web to see how i could get around these outrageous fees, but i can’t seem to find anything regarding USPS , only UPS :(

Good Day,

I am looking how to use your method via UPS for an item sitting at Concord, Ontario UPS depot. I was sent the Commercial Invoice.

On your example above, the formatting from the UPS Commercial Invoice is a bit different than the one I have, but the numbers are available, located in different places.

I see on line that the Bill of Lading/Air Waybill No. on the UPS form is the same IZ number and the one now in the top right hand corner listed as Shipment ID. It is the exact same number for the Waybill No. and Shipment ID No.

I require the Unique Shipment Identification Number, but do I have it? On your example the Waybill and Shipment ID numbers look to be different. Will this cause a problem at CBSA? Am I missing a vital piece of information if the numbers are the same? Do you think UPS adjusted the numbers so I don’t have the one I need to pay at CBSA?

Thanks for your advice!

Rich

Thanks for this post! I paid $9 instead of $45on my last shipment, and the process was super easy. I posted a longer explanation on another site I found when googling how to avoid UPS’s brokerage fees

Hello, and thank you for all the information!!! So what I gathered ..I already purchased something online from the states and UPS is the delivery company for the store and the product I purchased is enroute (small package $50 US). I should wait until it is in Toronto once it has been delivered/or attempted delivery and go to the local CBSA office to self-delcare as long as UPS ask for COD? What if they deliver it without asking for payment should I assume that I may receive an ivoice in the mail and as of this point they don’t have my billing information item was purchased via paypal as well as shipping?

Thank you for this excellent instructional!

$211 was due on the UPS import for my business. I saved near $170 today by following these instructions and self-clearing at my local CBSA.

Will this process still work if you have accepted the package but received the bill after?

Thank-you for posting this information. I received a gift from a friend in California and UPS wanted me to pay C.O.D. $105.15. Yeah right!!! I found this website and followed what was suggested. I was able to clear my package myself and ended up paying CBSA $53.00. Huge difference in savings. I’ve been telling everyone about this site. Thank-you sooo much!

So what does a consumer do when UPS robocalls? Just not do anything and have UPS bring the package up to point of delivery? Will UPS default to doing their own brokerage if a customer does not answer their voice recording?

Seems like they are doing this robocalling to intercept customer self-clearing and upon realizing this, they strand the package as ransom at the point of entry so it doesn’t reach the customer’s final destination.

Thank you for this wonderful article. This was my first time getting stuff from US. I googled & found this article. Did everything exact – step by step as mentioned & it saved me from at least $100 brokerage fees from UPS.

As experienced by many – UPS told me

1) i cannot self clear

2) I have to go to border to clear

3) I cannot self clear as my package has been randomly chosen for inspection & has to be cleared by licensed broker

4) The tracking showed my package to be switched from Windsor to somewhere in Fredericton, NB for a day. Then came back to windsor again next day.

Please do not fall for any of the above.

One quick tip that worked for me – Try calling UPS call center more than one time if you feel the agent is not helpful or not providing correct information. Whenever I suspected incorrect information or unhelpful attitude – I told them that i’ll call back again later. Some of the agents did provide half- good info.

Their classic trick is to put you on spot to make decision over call. Remember you always have time to think & call back. I refused to give them a decision over holding my package or payment & insisted i need time to think & will call back.

Thanks again Trueler! Cheers!

Thank you Trueler for all of this, you were the first!

Unfortunately, as stated above, this is the final conclusion?

It is a shame if people are still trying to self-clear when nobody wants their shipment held at the border. You want to self-account after the shipment is happily sitting in a local bonded warehouse.

Let the courier do the job of clearing customs; this is supposed to be part of the shipping cost.

The points that Steve13 made from Memorandum D17-4-0 are also simplified at:

http://www.cbsa-asfc.gc.ca/import/courier/lvs-efv/prsn-eng.html#_s2

HI There

Thanks for the useful info. I live in Markham and checked for CBSA offices on their website. I see some offices near Buttonville airport and some offices in Pickering. Do all CBSA office can clear? Or I have to go to Brampton office. Also I paid yesterday $41 fees to Fedex (so victim of brokerage scam ): ) for $66 good. But I am not satisfied with the goods. In case I am returning the good- Will I get all the money back or not. Please advise.

Thanks in advance.

HI There – Thanks for this useful info.

I live in Markham and see some CBSA offices in Unionville (near airport) or in pickering (for boat club etc.) on CBSA website. Please advise if all office supports this or need to look for specific function.

Thanks in advance.

Thanks for the wonderful article. Unfortunately I failed! $90 fees on $900 item.

I had arranged shipping through the local UPS store so all the shipper would have to do is affix the label and drop it off at a USP location in Michigan. The package was marked self clear and when the item arrived at Windsor Port, I got a phone call asking for a credit card. I told they guy that I was going to clear it myself in Barrie ON and he provided me with my invoice number but would not provide me with an invoice. I was told I had to go to Windsor. I called back hoping someone else would answer and would comply. No luck.Then my local UPS store called and I made arrangements to get my invoice. I went to Barrie and the friendly CBSA people I spoke with told me that it was not in their jurisdiction until after it was admitted into Canada (inland) so they told me I either have to pay or go to Windsor. I called UPS and told them to go ahead and clear it themselves. I was told someone would call me for my credit card. The next day the item arrived at the UPS store and I went to pick it up and was told that they paid the fees so I should pay them. They are local business owners and not UPS employees so I paid because it was not their fault. If they declined the item, they risk upsetting the customer (me).

Today I called BIS (Border Information Services) and they told me that UPS has no obligation to clear a package. It is possible that marking it self clear caused them to hold my package hostage in Windsor prompting the original phone call.

Would UPS have removed my single item from their truck and left it in Windsor awaiting clearance? Surely they would not have held up an entire truckload.

update (Winnipeg):

Got a $90 package from US with $60 brokerage. I called them a few times, but it was taking time to get them back to me as package was with purolator. Anyway I had to go to UPS warehouse in person, pickup original paperwork,as they didn’t/couldn’t email it (invoice and yellow paper, maybe so called “manifest”). Print and bring actual receipt from your merchant just in case. With those went to CBSA office nearby, paid $15 taxes, they stamped both papers. Went back to warehouse, picked a package. Overall was worth it.

The best proof I have seen to back this up is Max T’s comments on this 2013 blog:

http://avoidbrokeragefee.blogspot.ca/2011/03/part-9-victory.html

Here is some VERY interesting information. Namely this post:

“After writing back to UPS that I needed the Cargo Control Document, I got an email reply from UPS within 30 minutes. I was pleasantly surprised again.

The e-mail said the following:

Hi Max,

I think there is some confusion here. It is my understanding that this only applies for shipments that are not released and are at the port of entry into Canada this is the procedure we use. In this case your goods have already cleared customs in Winnipeg and you are only “casual self accounting†for the goods and paying the taxes so we can remove the cod after you have the B15. In this case you should only need to bring your invoice to customs with your tracking#. We do not have a cargo control document to give you. For the first procedure you would have to be in Winnipeg and go to customs here.

I hope this helps you. Sorry for the confusion.

Also to add to that this is a Low value or “LVS†shipment they do not have manifests. Only High value “HVS†has a manifest and in the case of any high value we do not allow casual self accounting on those shipments it is only for LVS.â€

HIs next post about his experience at the CBSA office is also of interest:

“After finding the office, I had to wait approximately 15 min although I was the only one there. The officer was finishing some other procedures.

So I brought with me only one document – the Commercial Invoice sent to me by UPS.

Also The UPS tracking number is required. It starts with 1Z 404 XXX XX XXXX XXXX. In my case the UPS tracking number was printed on the Commercial invoice itself.

The officer explained to me that indeed, there is a difference between the 2 scenarios that I mentioned above – when the package is at the UPS warehouse and when it is in the port of entry. From what I understood, if the package is in the port of entry and you self-clear the package, then you also need to provide the manifest with the unique shipment ID, so it can be sent to the port of entry. In my case however, UPS has already provided that document at the port of entry when the package was being imported. So now, all I needed to do is pay taxes and GST and “report” to UPS that all was taken care of so they could remove the COD charge.â€

Also refer to the CBSA document on the steps required to account for your own shipment.

http://www.cbsa-asfc.gc.ca/import/courier/lvs-efv/prsn-eng.html

Hope this clears things up!

References:

CBSA Definitions: http://www.cbsa-asfc.gc.ca/sme-pme/glossary-glossaire-eng.html

Memorandum D17-4-0: http://www.cbsa-asfc.gc.ca/publications/dm-md/d17/d17-4-0-eng.html

I’m sure people still come to this thread and see the 400+ post looking for information. Let me summarize this process and get rid of some misunderstandings that seems to be floating around.

1. You are NOT “self clearing” your own package. It has already cleared customs which can be proven by your shipment ID number and the fact that it is sitting in a warehouse in Canada. If Customs had an issue, it would be stuck at the border. This is one reason to wait until the package is at your local warehouse.

2. There is no Cargo Control document for Low-Value Shipments (LVS), only High-Value Shipments (HVS). Low Value shipments are those bellow $2,500 ( as of 2015).

3. You ONLY need your Commercial Invoice and your Shipment ID # to go to a CBSA office. You should also print off some a receipt as proof of payment.

4. What you are doing is accounting for your own shipment. You are doing the “casual self accounting†for the goods by voluntarily paying your duties and taxes.

5. Once you have a B15-1 form, that is sufficient proof that you have payed all necessary fees and your package should be release by your courier.

Now some further explanations / proofs:

1. You carrier does NOT pay the duties and taxes in advance. You shipments goes to a bonded warehouse. What is that? Here is the definition from the CBSA website:

“Bonded warehouse: A facility licensed by the CBSA where non-duty paid goods may be placed for storage, essentially deferring duties (including the GST) until the goods are either exported or entered into the Canadian economy.”

Notice how duty has not been payed on those items yet? So when do the carriers pay the duties / taxes? Refer to Memorandum D17-4-0 section 24:

“Goods released under the Courier LVS Program must be accounted for on a monthly consolidated Form B3, Canada Customs Coding Form, or CADEX type “F” entry. Accounting for these goods is due by the 24th day of the month following the month in which the goods were released, with the payment of the duties and taxes due by the end of that month.”

If any courier says they have already payed your duties and taxes at the border prior to them delivering the shipment to you, they are lying. But get on it! If they do the accounting themselves and pay before you do, yes they can charge you a brokerage fee. This is why people get a bill in the mail two months later after paying no taxes.

2. Does your CBSA agent still insist on a cargo control document? He / She is confused. Memorandum D17-4-0 section 11:

“The cargo/release list for authorized participants of the Courier LVS Program is to be used in place of individual cargo control and release documents for goods valued under CAN$1,600 (now $2,500). The list must be presented to the CBSA by the courier before or as soon as the shipments arrive in Canada. It must contain a concise description of the LVS qualifying goods so that the border services officer can determine the admissibility of the goods.

There is only a cargo / release list and all the information necessary can be generated by the shipment identification number.

Here is the best solution to the problem;

Have a package coming? Call the customer service and ask what the charges are and will be, AFTER THEY HAVE CLEARED CUSTOMS (or so it says on tracking)

If they inform you of no charge, great!

Option #1;

Accept delivery at door.

Now, if a charge comes in the mail later on, guess what?

YOU USED A ‘PEN NAME’ or an ‘ALIAS’.

They cannot legally tarnish someones credit that does not exist. Even if the package is ‘signature required’ they have to accept the signature of anyone appearing over 18 at the address. Basically, anyone can sign, just someone has to sign upon receipt of package.

If the item was sent to your address, don’t stress, you don’t need ‘fake id’ or any such nonsense to pick up the item, anyone with govt issued ID from the same address can pick up the package. Legal, fun, and easy way to avoid the ‘ninja’ duty bills from UPS/FEDEX/DHL.

Option #2 is if on the phone the representative tells you some ludicrous fee for your package, simply inform them of your wish to self clear and follow the steps above. Be persistent, AND KNOW WHAT YOU ARE TALKING ABOUT! Have your forms ready and know their numbers. If the driver/rep is clueless make sure you inform them of your RIGHT to self clear your package.

But remember kids! Use a pseudonym when dealing with these fortune 500 scam artists. They are running a price fixing monopoly on service and only do this because THEY CAN. They can because WE LET THEM (sometimes *wink*)

I received my package back in December and just received an invoice from UPS With quite a hefty brokerage fee. What do I need to do not to pay this?

I found information on the CBSA website that tells you how to self clear (Accounting for your own shipment). http://www.cbsa-asfc.gc.ca/import/courier/lvs-efv/prsn-eng.html#_s2

CBSA tells you to refuse the shipment at the door and notify the courier that you will pay duties and/or taxes directly to the the CBSA. The problem is that when I receive a package they never tell you if duties or taxes were paid on your behalf and there is nothing on the box indicating taxes. I always get a notice in the mail about 2 weeks later that taxes were paid by the courier. So if I refuse the shipment I may have to go through all this trouble only to find out that nothing is owing. They sure make it difficult.

Dealing with this same bullshit right now,

UPS customer service has been so terrible that have asked me if I was crazy twice now.

I explained to them I wanted my invoice and manifest. Got the Invoice after 3 call and have yet to receive the manifest. Are they legally required to give it to you?

Hi, I’ve been trying for a couple of days to get a B15. It’s getting frustrating because I’ve made two trips down to the CBSA office on separate days. I have an invoice from UPS that’s very similar to the one you have. The customs officer filled out a B-15 for me but she wouldn’t give it to me nor let me pay for the duty because I provided her with the wrong documentation.

the only obvious difference to me from the from I have and the one you posted is that the waybill number and shipment ID is the same on mine rather than different. The officier said the form needed the tracking number as well (I provided the tracking number off my order)

she also mentioned something about 2 places to stamp on the back of the document that wasn’t there (she didn’t mention it when I called back on the phone)

Everything on the actual B15 is filled out. She even showed me. but with out the correct form, which supposedly gives proof that the package is actually in canada. She can’t issue the reciept or take my payment.

(it IS in canada, I already sent it back to the warehouse after reaching my door, and it’s at the warehouse currently as stated by the online tracking)

I’ve tried calling UPS many, many times, asking many representitives about the many different document names that people have stated on this thread and all i’ve ever gotten is, “leave me your phone number / email and the port will contact you” or, We don’t have permission to give you that document or are unable to give you that document for various reasons.

I have just combed through your thread and found so much valuable information!

We have a small business on Vancouver Island and import som products from the United States. We have used a broker to import product in the past but have been clearing items ourself for several years.

UPS is the only company that will not facilitate us doing our own clearing. They say we can clear it ourselves, but must make the 6 hour return trip/ferry ride to Vancouver to do it. The other choices they give us are to pay them or hire a broker. They manifest our shipment to Vancouver and are incredibly rude on the phone, stating that all businesses in Victoria can self-clear with no problem. However, both border agencies and the 800 # say they will not touch something manifested to Vacouver when we are in Victoria so we believe UPS is lying when they say this isn’t a problem for any other business.

I realize this site seems to be for personal clearing, but if anyone has resourses related to commercial clearing it would be greatly appreciated!

I complained to UPS about incorrect procedures, wrong coordination of their internal systems, rude customer service in concord location. Still they reply telling “not manifested” items can only be self cleared..This is after i emailed them what happened in CBSA where officers are specifically asking for document and in my case UPS gave me the manifest for LVS ! So looks like UPS system is totally broken and they themselves either dont want to follow procedures laid by CBSA or intentionally giving hassles so customers will be fed up and pay COD

—

Thank you for making us aware of this situation and allowing us to respond.

I have reviewed the situation that you have outlined in your e-mail below and I am truly sorry for the difficulties you have experienced with your request to self account for your shipment. I would also like to apologize for the negative experience that you had encountered while visiting your local UPS Customer Counter location.

This shipment was eligible for self-accounting and certainly be accounted for at your local Canada Border Services Agency (CBSA) office. The Canada Border Services Agency (CBSA) policy allows casual importers to account for their own goods directly with the CBSA. In order for the customer to self-account outside the port of arrival, certain conditions must be met:

-The shipment must be released from customs and currently available for delivery with a COD tag.

-The customer must be a casual importer (non-commercial).

-The shipment must be low value ($2500 CAD or less) and not manifested.

-The customer must be willing to go to a nearby Customs office where Courier Low Value Shipments Program clearance is performed.

By taking the time to bring your concerns to our attention, you enable us to strengthen our business and make improvements directly impacting the service that we provide to our customers moving forward.

—

Summary: After my experiences of processing 2 packages to almost be certain to self clear, these are required

(1) Wait until first delivery attempt is made

(2) Important that use Tracking contact ups by email option and open ticket with tracking number and ask for ..invoice + manifest (yes officers ask for manifest). you might get cleared with invoice + reference page with rectangular box for custom stamp but that is merely by luck and depending on which officer you meet

Manifest => Has ups logo, cargo control number, importer number

Invoice => this is something sender gives for item which has shipment id and waybill (nothing but tracking number)

(3) Be ready to make several calls to brokerage department or if cleared through pearson call them directly as they are helpful in emailing manifest fast and they understand officers ask for it

(4) If you are in toronto area , britannia road office should be choice as they are open 24 x 7 if your are busy in daytime.

(5) Take your passport, driving license or id, cash/credit card/debit card for taxes to pay, UPS website tracking details page as proof that item is already in warehouse, First delivery attempt notice, Manifest, invoice

(6) cbsa officer will ask if item is personal or business. in my case it was personal (not sure how business item might be cleared). and they ask to know what is item for like description etc. how much was paid..Then they verify docs ask to pay couple of dollars tax ..Then they give B15 with stamp and manifest with stamp. (If taxes are waived there is no B15) only manifest is given back with stamp

(7) Just take a photo of stamped docs with your phone and email back to brokerage department. When they are open for business make calls to ensure they received email and added note to remove COD

(8) If you want to pickup confirm item location and also confirm COD has been removed from central system 1800 number option 3 and then get the case# or auth# note down and go to pickup the item..you dont want to face issues like me where warehouse strictly follows blind rules and refuse to talk to brokerage department even if you dial and give the person on line or give them number to call..

(9) Even better ask them to redeliver the package..if you do this make sure absolutely it is updated in website or you really see that with message “rescheduled delivery” or “on vehicle for delivery”. Without this you will not get the package redelivered. you will receive calls saying we will deliver tommorrow but without website says “on vehicle for delivery” you will not get redelivered. it happened to me for 1st package where after self clearance promising redelivery package was still sitting in concord until i had to complain next day to redeliver. So for 2nd item i went for pickup and faced issued there as well as central system is totally disconnected with brokerage systems..

In the end be prepared to make several calls to get 2 documents manifest + invoice. If you get only invoice you may need to visit CBSA 2 times as officer can refuse clearance. Even the memo says shipment id enough looks like they are looking for cargo control document number in manifest. yes UPS has manifest and unless you insist they will not give. Also meanwhile be prepared to track your item in website. sometimes they put wrong message..example: item should be picked within 5 business days ! they dont mention item is for self clearance. sometimes they put second attempt will be made…so we have to tell them to have correct info in website…

Have your passport when you go to CBSA office.

Be prepared for calls again to brokerage department and calls to central system to get COD removed and get case# auth# and arrange for pickup / or redeliver. In case of redelivery make sure website shows really it is on vehicle for delivery..

Overall avoid UPS it is a big mess even now after process is established. They knowingly delay providing documents, very slow in updating central system and their website. Add conflicting messages in their system to confuse you like address corrected, second attempt etc. while you work on self clearance. Also CBSA process for personal items is confusing even though there is memo for LVS items it depends on officer..some clear with invoice + reference page given by ups which has rectangular box for customs. others dont accept and they insist to go back and get “cargo control document” and in UPS terms it is called manifest.

Now my case is for personal item and not sure how business/commercial items can be cleared. Also like someone said here wait for first delivery attempt and not sure how intercepting while on transit will work. If UPS knows you are refusing to use them as broker not sure what they will ask like who is your broker or come with different set of process !

Update to my november 6th post:

The nightmare continued for next 2 days. After getting manifest stamped i emailed the ups brokerage department morning 11 am. Called them again to remind around 3:30 pm to make sure COD is removed. They confirmed COD removal note already added to system and they can arrange to redeliver 7th friday or monday. also i was given concord location phone#. i called concord with plan to pick up item before 7:30 pm so that i dont want second delivery item and me running monday to get the package. I called concord got confirmed that item can be picked up before 7:30 . Reached there by 6:30 pm. They brought the package and before handing over they said sign here. i did sign then they said you have to pay $25 COD !. i explained the whole process i followed and also showed all email printouts how i got the manifest , invoice and CBSA manifest stamped with tax waived. They refused to give the package with my signature recorded as delivered!. then i called the brokerage dept using my cellphone and they confirmed system has been updated with no COD. While on phone i put on speaker and gave the phone to concord agent who refused to talk to the person on phone. I showed them the email which clearly has ups email id with ups emp designation “import operation mgmt specialist”. the concord agent refused to talk and claimed i cannot talk to someone on your phone ! Then this can be clearly hear by their own brokerage dept so other end they said give our number to them so they can call. I gave the number (direct line of import operations of UPS). They refused and said it is long distance call we cannot make ! (Now clearly i got that basically they want to not help to customers to get their package and they want to give hassle so they will pay COD). Then i walked back to car and called brokerage again then brokerage said call the manager at concord location show the cbsa manifest stamp and they may authorize to release the package. Also by this time brokerage was confused and they said it says package has been delivered and you signed it ! I then met the manager. She simply said “Without paying tax i cannot give you the package”. and reply was so rude. I asked are you ups or customs. Customs officer has specifically said they are waiving taxes despite me asking ups will be giving me troubles. I said i can go back to customs to ask to give you a call! and brokerage has already confirmed cod removed and you are refusing to talk to them where brokerage themselves are confused. Then manager said as far as cod is removed in central system i can pick up tommorrow ! (so they follow by their own process strictly and they dont work together with brokerage department even if brokerage department and willing to help but they dont follow the process laid by customs and drag the issue by not providing manifest). I wasted 2 hours and went back home called central system and complained what happened. Next day morning i called 8am central system they said they are sending note to concord location and gave me case# and give that to pick up package. Now i went to concord 9:30 am and after they checked central system they removed cod from package and handed over. Forgot to mention because they made mistake of signing me before providing the package i had to insist that they either give in writing i did not pick the package or update system that item is still in concord. That night in their it showed as Delivered + receiver agreed to pick package this evening ! Next day Delivered + In transit !

The scam is also strong with Canada DHL now as well.

Unfortunately Canada DHL is scamming harder that UPS by actually denying a commercial invoice unless, they say its your used personal goods or used clothing.

So I would advise that you avoid all shippers except united states parcel services (USPS).

Someone has to start complaining for this activity is killing commerce.

a $100 shipment is not costing $60 (40 + 20 broker fees) to ship.

its like we live in a 3rd world.

mine was different case altogether. UPS charged me $60 for $90 item. after 5 calls i got the invoice. my first visit to cbsa office was failure they asked manifest ! i called ups and surprisingly they gave manifest even though we know they may refuse to give. i went to cbsa office second time cbsa officer liked all docs and stamped the manifest and said taxes are waived ! i asked B15 and he said you dont need you get only if you have to pay taxes. send the stamped manifest to ups they should give the package ! then i emailed today and waiting for all cod to be cleared..like i said this is another case where officer insists manifest and ups provides manifest and no b15 issues with taxes waived !

ups agents and cbsa office is good. looks like they know the process well. problem is when we call ups or email each agent gives different answers. All we need is 2 docs the reference page and invoice which they will email as scanned copies which should be taken to cbsa office pay customs get it stamped and email back. Process works but not without atleast 10 calls to ups at every stage (1) call and open ticket to get the docs (2) keep checking the status in website as sometimes by mistake they try to second attempt (3) reply email with stamped docs (4) call again for redelivery

I have made atleast 5 calls as of today for steps 1 still waiting for document. will keep posted of happenings.

sorry this is one cbsa office found but they work mon-fri only

http://www.cbsa-asfc.gc.ca/do-rb/offices-bureaux/799-eng.html

i just the cod notice with delivery attempt ups friday. i called ups they said someone will call monday and email the invoice paperwork and i can self clear. i see in tracking that item is in concord location and receiver will pickup. can i go to this brampton location which doesnt show address or i need to go only britannia road? they are open 7 day 24×7. so can i go sunday to britannia with email i have just order details which has item details and amount from sender + ups tracking details + unique shipment number or i still need real invoice emailed from ups monday. Thanks

We currently have the package. The receiver requested clearance by a non-UPS broker. / As requested, the package was transferred to a Free Trade Zone or a non-UPS broker

does this mean im still gona be hit with there scam charge or did the sender already clear it ?

Would this method work if i were to order something from Sweden Via UPS?

After successfully clearing the package, I got the same invoice from UPS that Kango got. After talking on the phone with UPS and CBSA, there is a refund form that has to be filled out and will be some 6-8 weeks to get the refund from CBSA! In order to get this started, UPS needs to be paid and they will start the documentation. The UPS rep was very polite and clear in the steps. But obviously this is pretty frustrating. I think this issue arises when UPS is not informed prior to delivery that you are going to process the customs form yourself.

In retrospect, between the phone calls, time at the UPS and CBSA offices this is a large waste of time. Seems the best way of dealing with the brokerage fee is to simply avoid UPS and not deal with sellers that use them.

@Marc thanks i didn’t have to do that but heres an update.

So I got full refund and didn’t end up getting the items. Aramex sent my item back to the UK store.

So now I reordered my items only one of them so it’s under $20 so now no duty or taxes :)

@EricStern

Why is there brokerage fee your item is under $20 shouldn’t have any broker charges on it since theres no duties or taxes on it

Isn’t it about time that the government simplifies the process for small value packages and that it requires suppliers and shippers to warn customers upfront about potential excesses?

For a $17 object I just payed after placing the order $27 SH and $27 brokerage on something that was, to my surprise delivered as COD. It would cost me more in time and expenses to fight it.

Why is the government protecting companies that charge excessive brokerage fees? In fact why is there brokerage required on small value objects? Why are suppliers not required to warn customers of additional fees?

@Don they cannot DENY you the ability to self-clear. There is no such thing as “its part of the LVS” The whole point is to facilite self-brokering. Stick to your guns and keep calling back escalte sup’s sup if you have to. Tell them you will make a complaint to CRA

Anyone have experience with aramex.

So I bought item from online store from the UK, things were going smooth and tracking said it arrived in Canada. Next I get an email from aramex (shipping company I never heard of) telling me to email someone named Tiffany Klippel. So I emailed her she told me I have to pay custom duties fee totaled 32.52, ($12.52 for actual taxes, and $20.00 handling fee) before they release my item. Held in Customs – Awaiting Duty and Tax Payment. When I do pay duty it’s payed when my item is at my door not ever before I receive my item. I have never heard of paying customs before I received my item, and I don’t really want to give them my credit card information. So I contacted them about the “self clearance” they are taking forever to respond manager says I can’t “self clear” my item as my item has already been cleared through their custom clearance.

. I told them I never gave them my permission/authorization for them to go ahead to clear my item for me and I contacted CBSA directly said I can clear my item. They told me it’s part of the LVS program blah blah blah, honestly think they’re delaying it on purpose. Still waiting anyone have any knowledge or idea what I can do? Need help!!

CD

The same thing just happened to me. Did the forms and went to the UPS warehouse. They scanned my package and said I didnt have to pay anything. Month later I just received a bill from them for brokerage.

Hi, Truler!

Just used this procedure for Vancouver office. By the way, if someone is in Vancouver, they moved to Main Street in Apr 2014.

Jess

I used a b15 form picked up my package and faxed a copy 2 months later I received a collection letter from RMS for the same shipment not sure what to do

Ordered a package from the US, $100 value, $40 shipping (Heavy car parts) and $58 in brokerage/taxes. After reading this site i tried to get my Commercial Invoice. They tried repeatedly to email me the paperwork however it never came. After trying 5 different agents I found one who after trying many times to email me and no emails coming through i gave up and explained why i needed the paperwork. I offered to quit calling them if they dismissed the brokerage fees. Without hesitation he dropped the $58 fee to just $14 in taxes. I guess the moral is be persistent. Its not delivered yet but hopefully it all works out

Great article, thank you! Just went through this and thought I’d give a 2014 update for the Vancouver area.

My package arrived and there was a $64 COD charge. The UPS driver said I could self clear and I refused the package and it went to the UPS facility in Richmond.

I actually didn’t call UPS after this. I just drove down there the next day and the employees were familiar with my request and printed for me, the shipping invoice from the seller and then two copies of the UPS commercial invoice. One on blue paper and one on pink. The UPS staff said the Vancouver CBSA officer is a stickler about getting a pink copy. Probably a bureaucracy thing for uniformity.

Then drove the 5 minutes to the airport CBSA office at 5000 Miller Road. Handed the documents over and paid $24 cash in tax. Then went back to UPS and got the package. Great!

My advice is to make sure you go early as the CBSA office closes at 4:30 and budget at least an hour of wait time. I was very lucky and got there about 4:15 with very few people and it went fast, but I can see how it could get very busy there with just one officer on duty there.

Both the UPS and CBSA staff knew exactly what I wanted to do. And there was at least two other people going through the same process as me. We chatted briefly and they were doing business shipments and had more paperwork to file. Clearly this is not an uncommon request and everyone should feel optimistic they can do it themselves.

However, it is time consuming. I feel if it was a smaller UPS charge I’d not want to spend the time doing it.

My package is being ‘held in warehouse’ in louisville, kentucky. I don’t know if it will ever get to Canada, what option do I have now in terms of getting it cleared through the CBSA?

I looked up and saw that other people with a similar problem also had this message : THE SHIPMENT IS BEING HELD BY BROKERAGE FOR REASONS BEYOND UPS’ CONTROL

Sorry a few typo’s, on the last one.

UPS left us a recorded message advising us to notify them via email of the broker for the package. I called them and advised them that I would self broker and they said that I would receive a call tomorrow to pickup the paper work and instructions at the ups office.

I called back a half hour later to asked them to email me the information and was advised that I have to use a licensed broker since my package is being inspected.

My package status is listed as: Your package is at the clearing agency awaiting final release.

I have tried several times to email and voice request the commerical invoice but haven’t heard anything back.

Any suggestions, do you know if the package is stuck in customs based on the the status ? Anything I can do to help push it along, I’m concerned that UPS is just sitting on it now.

USP left us a recorded message advising us to notife them via email of the broker for the package. I called them and advised them that I would self broker and they said that I would receive a call tomorrow to pickup the paper work and instructions at the ups office.

I called back a half hour later to asked them to email me the information and was advised that I have to use a licensed broker since my package is being inspected.

My package is listed as: Your package is at the clearing agency awaiting final release.

I have tried several times to email and voice request the commerical invoice but haven’t heard anything back.

Any suggestions, do you know if the package is stuck in customs? Anything I can do to help push it along, I’m concerned that UPS is just sitting on it now.

Thank you so much for this blog post! I was able to save $90 on a $130 package!

I just received a package today (total cost of item was $24; Brokerage fee was $25), and I called 1-888-520-9090 and asked to speak with a supervisor/manager. Stand your ground and tell them that as a customer, you don’t need to pay for Brokerage fees and all you need to pay is the TAX (which is 13%)! Make sure you tell them to wave the brokerage fees!

All I paid was $3.12 instead of the $25 brokerage fees :)

What a ripoff

Update: Status is now “Out for Delivery”. I guess it worked! So happy to have saved money…even happier that I didn’t let UPSucks rip me off..

I did what Trueler said, except I didn’t wait for UPS to deliver my package. Instead, when I saw that the package had arrived in Windsor, I called and told the UPS agent to e-mail the invoice so that I could pay taxes and avoid the brokerage fee (50% of the value of my package!). The first agent tried to say that I couldn’t do that, but I insisted that UPS must send me the invoice. Finally got it. Package is still in Windsor at this point. I drive to the London airport where there is a CBSA office. Present them with the invoice and pay taxes. They give me the B15. I call back to UPS and ask for the e-mail address. The first guy I spoke to said they only have a fax number. I told him it’s 2014 and fax is not convenient. He refused to help. Called right back and got a different agent. Very nice guy. Gave me the e-mail address: can2sxk@ups.com. Sent the e-mail with the attached B15 and noted that I want a reply verifying they received my information. Got a reply within a few minutes. Called back again to schedule the delivery. Agent assured me that it will be out for delivery tomorrow.

Hopefully my package will arrive tomorrow! In the future I will never buy things in the US and have them shipped to Canada, at least not with UPS. I think it’s better to have a UPS box in the States and drive down to pick up packages. My dad has a UPS box and we have been able to get back into Canada without paying any duty or taxes…and we always declare!

Thanks to this blog I have saved a bit of money! Thanks, Trueler!!!

So I’ve got some packages coming from the states right now, and I’ve been trying to find my local CBSA office but there website is nothing but unhelpful. I’m currently under the impression that there ISN’T an office in all of Edmonton, Alberta, and am curious how I would go about doing this ‘self clearing’ if no office is around. There’s no phone numbers for any of these offices, and it’s looking like I’m just going to have to pay these really unreasonable brokerage fee’s, which I’m not too excited to do. Any help on the matter?

Thank you for posting this info. I’ve always known about UPS’s exorbitant brokerage fees and have always done everything to avoid it by asking for the shipper to use USPS. However, in a recent purchase, this was not possible. So I followed your instructions and here is my experience. I am writing from Calgary for what it is worth.

I had recently travelled to the USA for an extended holiday and had something I purchased while away shipped to me by an American business. When I landed at the Calgary Airport coming home, I made a declaration for “goods to follow” with CBSA. I was given a document by CBSA.

When my UPS package arrived in Canada, I emailed UPS to have them email me the “commercial invoice” for this shipment. I received the document within 12 hours. I took this commercial invoice along with a printout of the shipments latest tracking info (not sure if this was needed but what the heck) as well as my “goods to follow” documentation to the local CBSA office (near Calgary Airport in an area where all the couriers had their warehouses). The CBSA officer took a look at all the info and issued me the “B15” form.

As it happens, the day I obtained the B15 form at CBSA was also the day when the package was “on truck, out for delivery” according to the UPS tracking site. So I just waited at my door to take delivery of the package. The UPS driver told me there was brokerage but he accepted my B15 from CBSA without any hassle and did not ask me for any fee/tax payments after I gave him a copy of the B15 form.

It was actually quite easy.

Again, thanks!