These common rules about taxes, tips/gratuity and delivery apply to most of the daily deals like Groupon, WagJag, DealFind, LivingSocial, TeamBuy, etc.

You may refer to the following article as well:

Complete List of Deal-of-the-Day Websites: Canada

Â

Tips/Gratuity

- Are expected to be paid on the full amount of the pre-discounted bill. If it is a spa deal “$400 for $100” (save 75%), that means that you will be required to pay at least $13 for HST in Ontario, $12 in BC, appropriate amount of tax for other provinces and $40 – $80 for tips (10% – 20%), so it may come up to $190.

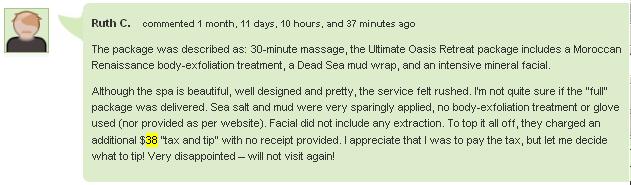

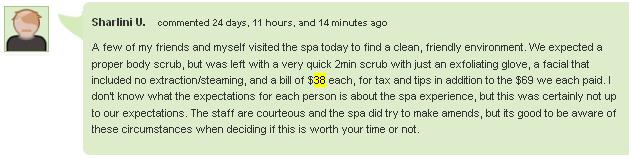

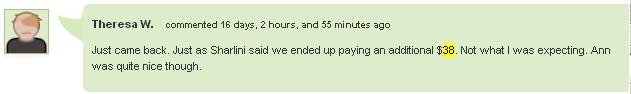

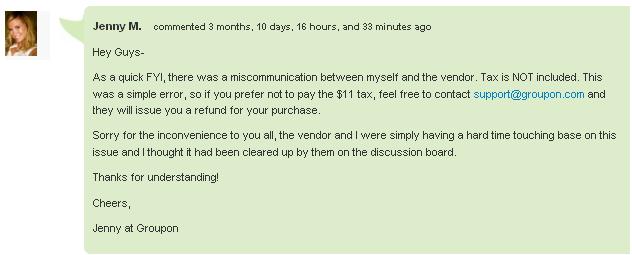

- Tips are usually absolutely voluntary, but some of the businesses require you to pay tips on your checkout bill. One of the examples was -417 Dead Sea Spa featured on Groupon in October 2010 with this deal: “$69 for an Ultimate Oasis Retreat Package and a 30-Minute Warming Mineral Massage at Minus -417 Dead Sea Spa ($292 Value)”. A lot of customers complained that on checkout they were required to pay 10% gratuity on the full $292 amount. If service is good customers will kindly pay good tips and come back, but service in -417 Dead Sea Spa was far from good, so customers did not want to pay gratuity, but had to. They charged additional $38: $9 HST on $69 + $29 tips on $292. Here are several complaints from Groupon discussion board related to this deal:

- If it is a good business, it will never require you to pay tips, they will just give your change back, so you can decide what amount you would like to tip. If it is a good business with good service, customers will tip generously.

- Sometimes (very rarely) there are deals “tax and gratuity included“. It means you will not pay anything as long as you do not exceed your coupon limit. On the excess amount you will be required to pay at least taxes, may be some other fees

Â

Taxes

- When you buy coupon, you do not pay taxes on it directly to Groupon. Your credit card is charged with the exact amount specified in the deal.

- “Tax not included” means that you will most likely be required to pay taxes on the full amount of pre-discounted bill. Only if it is clearly identified by Groupon Staff and business owner on the discussion board that taxes are paid on the discounted price, so you save more. Plus you will be required to pay taxes on the excess amount beyond you coupon value.

- “Tax included” means that you do not have to pay tax if you stay inside your coupon value.

- “Can not be used toward taxes”. When taxes are not included, usually it is impossible to cover taxes with your coupon. For example, if you have a coupon for $50 of merchandise, and you picked products worth $44 totaling almost $49.72 in Ontario (13% HST), you will be additionally charged by business with $5.72, and your $6 value from coupon will be lost.

- Sometimes Groupon staff make “simple mistakes“. It was a deal “$99 for a True Wellness Package at Sabai Thai Spa ($308 Value)” and they were telling for the entire day that deal included taxes, but actually it did not include tax. The following reply appeared on discussion board only a week after the deal:

- If it is a good business, usually they allow to cover taxes and delivery with your coupon.

Â

Delivery

- Delivery is usually can not be covered with coupon. So it will be additional charge by merchant. It is usually specified as “Coupon can/can not be used toward delivery purchase”.

�

Every time before purchase get answers to any uncertanties about taxes, tips, and delivery on Groupon (or other daily deal sites) with staff and business owner!

I have a question, so some have the tip added right on. So does that mean the tip should go to the employee doing the service or does the employer have the right to keep it?

I buy groupons and living social vouchers quite a lot (too often!) I’ve only once had a business try and collect tax on the alleged “actual value” of the service. I tried to take it up with her but in the end just paid it as it was only $7. I think she did genuinely misunderstand what she should be collecting tax on. I took it up with Groupon too, and they gave me a stupid canned response about how it’s different depending on what country/province you are in. Too lazy to find out what the regulations are in Canada I suppose – you’d think they should be able to guide businesses on this issue. It only makes sense to me that you would pay tax only on the amount you paid. It makes about as much sense as walking into a store that’s having a sale, and being made to pay tax on the “regular price” (which often is over-inflated).

Purchased Groupons two different restaurants for my husband and I to eat. Added to our bill automatically a 18 percent tip. I will not be purchasing anymore Groupns because one of the Restaurants we went to one of the waitress wasn’t worth it. Service wasn’t worth Eleven dollar tip. Customers will stop purchasing. First not much of a savings to try a new restaurant second if the waiter or waitress gives bad service that in itself wasn’t worth the groupon.

Lots of misinformation here!

Some got it right, along with the lawyer’s position.

Here’s an example to clarify the rules:

Certificate has a face value of $50

Customer pays Groupon $25

Groupon keeps $12.50 + HST

Restaurant received $12.50 – HST

A customer visits the restaurant and buys $50 worth of food and drink. The bill comes to $56.50, including HST.

The restaurant needs to apply a discount of $25 to reduce the taxable amount to $3.25. Then another discount of $25 is applied that does NOT affect taxes. The net cash payment by the customer should be $3.25.

Under CRA rules, the customer needs to be charged for the HST on the amount he/she PAID for the certificate.

Few restaurants or others get it right. If the restaurant bills $56.50 and deducts $50 for the certificate, making the customer pay $6.50 HST, the customer has been over-charged. Does the restaurant get to keep the extra $3.25? NO. The restaurant must remit the over-charged amount to the CRA.

Some thought that the restaurant or business only received $12.50 from the sale of a $50 certificate, because that is what Groupon remitted to them. In actual fact, the restaurant did receive $25 for each certificate, but it had to pay Groupon their fee (which Groupon withheld).

You can read more about this on my website, here: http://www.paulshewittca.ca

Hope this helps.

I’m not really sure how it works with retailers like Walmart or restaurants but i own a med spa and it’s very simple.

I decide on a selling point, let’s say $100, then the tax on top of that will be $13 and that’s it.

If i take a $200 product and give a discount on it so it ends up to be $100, the customer is still going to pay $13.

The same thing with those deal sites, you pay tax on exactly what you paid for.

Legally a business cannot charge tax GST, HST or otherwise on the stated value of the regular price of a product and or service offered. Why would they? In many cases the regular prices of deal offers are often inflated to make the discounted featured deal sound better. Businesses can only charge tax on the redeemed amount of the voucher. Example, if a Spa Deal is regular price $200 but the voucher deal is $100.00 then the tax can only be charged on the $100 amount. In the case of a $50.00 voucher towards a dinner valued at $100.00 the $50.00 voucher will be applied to the total value of the bill with taxes included and then $50.00 deducted. This is required by the HST police for accounting purposes as the business especially restaurants have different tax rates for food and liquor prices. For the most part people who purchase food vouchers may will always go over the voucher value and it would be a nightmare for most establishments to know how a customer might redeem the voucher or how much they would ultimatley spend. So it is easier for them to apply the voucher to the total bill with taxes and then deduct. That way there is a clear accounting for auditing purposes. In any case of an audit for any business period they would only be required to pay the business portion of the HST for TOTAL SALES and or revenue received. The Government cannot audit and collect taxes for sales and revenues not received. If a business does for an example $10,000 per month it is obligated to pay 13% HST on that amount (less business HST input rebates) they dont care what deals you did or what the regular prices were or what you sold the deals for.

Now keep in mind most of the deals done on the daily deal sites the vendor of the deal only gets a portion of the deal as the “deal sites” take a percentage. I have heard as high as 50%. So if a deal for a particular product or service is a $50.00 voucher then in many cases the actual vendor only gets $25.00 or a percentage (all sites and deals vary). The tricky part is the vendor will only recieve a cheque from the deal provider ( wagjag, groupon, etc) for the vendor portion of the deal. Example, total sales from all vouchers sold is $5000 less percentage to deal provider (might be 50%) vendor will receive $2500 from deal provider site ( wagjag, dealfinder, groupon etc) the vendor (business offering service or product) will only remit HST on revenue received. The HST auditors cannot possibly audit anything other then sales which means revenue recieved and their only means of proof is sales deposited to business bank accounts as a means of tracing and verification………

Hi Trueler,

I believe Mom is correct, although it would be best to check into the laws with a tax expert, which I am not…

For example, customer paid $100 for a spa package with a $200 value. The customer does not pay taxes on the $200 value, but the $100 that was tendered/paid. I suppose it would be treated as if it were a sale, and you paid for the spa package at 50% off.

However, the example you provided could be for something like a restaurant where the voucher may be treated like a coupon which would essentially take $50 off the total bill. However, and again I could be wrong, I believe that the restaurant still bills on the paid amount which in your example would be $75. Has anyone been in this situation lately that could shed some light on the rules?

Hi Mom,

Thanks for information! Could you please clarify one thing with a tax lawyer if you have a chance?

Usually it works in this way. Customer paid $25 for $50 coupon. Let’s take purchase amount equal to $100 (before taxes). Bill with HST before applying coupon is $113 (for Ontario, where HST = 13%). After coupon customer owes $63 to the merchant as a total bill.

Is this situation legal? I though it is the same as applying manufacturers coupon. First taxes are calculated, and then discount applies.

As far as I know businesses can claim HST back, so it was not actually fair to rise prices for at least by 8% as of July 1, 2011… Maybe I’m missing some details here…

Thanks!

Trueler

I spoke to a tax lawyer in Toronto who said these companies are NOT supposed to be charging tax on an amount above what is actually tendered/paid. Why would they? Is it true with the new HST laws that these places recoup more of the taxes back in compensation (hence making it to their benefit to charge over and above)?

Hi Kim,

I’m not familiar with US tax laws, so I can’t give a correct answer to your question. In Canada we don’t pay taxes later if we are not asked to pay them at the point of sale (if the sale happens in Canada). Is it different in US?

What is the reason that you are not charged at the time of service? Probably deal already includes taxes?

Thanks,

Trueler

If I’m not charged tax at time of service do I then have to declare it and pay tax later

Regardless, @Dealathons, it should clearly state and explain to the customer what the taxes are to be paid on full amount or discount prices.

also the tip issue, it should mention that the customer will be required to pay tips, wither they liked the service or not.

it does not seem the case with a lot of these deal sites.

When a person purchases a voucher from any daily deal site the taxes are technically not allowed to be charged. Only once the service is redeemed does the tax come into effect, otherwise the voucher is the same as cash. You must also remember that if a daily deal site charges tax it is like guaranteeing the voucher will be redeemed and we all know that not every voucher gets redeemed. So this is the reason the taxes are paid at time of redemption.

Hope it helps